Wall Street giants follow BlackRock into crypto

Bitcoin is back with a bang!

The leading crypto has pushed 15% higher over the last week, briefly topping $31K after several Wall Street giants signaled their intentions to wade deeper into the market.

Most altcoins are following close behind, with Chainlink and Fetch.AI also flashing double-digit gains as the total crypto market cap nudges $1.2 trillion.

Read more after the jump.

This week’s focus

– Bitcoin leads bull charge on fresh institutional interest

– Fetch.ai adds 18% to lead AI rally — will crypto deepen its relationship with Artificial Intelligence?

– Chainlink makes 20% gains as DeFi sector outperforms

Bitcoin leads bull charge on fresh institutional interest

BTC is hovering above $30K, after smashing through this resistance level late last week

The price of Bitcoin jumped 15% last week, briefly touching highs above $31K for the first time since last year as several financial giants made moves on the crypto market.

Most of the positive news revolved around exchange-traded fund (ETFS),with a flurry of fresh institutional activity following news that TradFi giant BlackRock had filed a Bitcoin spot ETF application.

As the market was still digesting this, the US Securities and Exchange Commission (SEC) approved the launch of the first leveraged Bitcoin futures ETF in the US, and two other investment management companies, Invesco and WisdomTree, also submitted their own Bitcoin ETF applications.

Further fuelling the rally, last week also saw a new crypto exchange from Charles Schwab, Fidelity, and Citadel go public, as $1.4 trillion lender Deutsche Bank applied for a license to custody crypto assets.

As summarized by eToro’s Global Strategist Ben Laidler: the recent rally took Bitcoin’s “year-to-date gains to 80% and its asset class ‘dominance’ to a two-year high of 48%. The big twin drivers were the world’s largest asset manager Blackrock spot Bitcoin ETF application, and TradFi stalwarts Citadel, Fidelity, Schwab launching their EDX crypto exchange.”

Fetch.ai leads AI rally — will crypto deepen its relationship with Artificial Intelligence?

After jumping 18%, FET appears to be forming a classic bull flag pattern

The intersection of crypto and Artificial Intelligence (AI) continues to be one of the hottest areas of the market, with projects increasingly turning to AI to enhance their products.

Leading this trend, the tokens of Polygon and Avalanche both made double-digit gains last week as they introduced AI chatbot assistants.

The biggest gainer in the AI sector, however, was Fetch.ai, which added 18% to lead the broader market recovery. This AI platform is building smart agents that can learn, predict, and undertake meaningful tasks in web3 systems, putting it at the bleeding edge of both AI and crypto.

As Chris Lehane, chief strategy officer at crypto-focused firm Haun Ventures, remarked at an industry event last Thursday, the relationship between crypto and AI continues to deepen and create more opportunities for innovation: “Those two technologies are going to increasingly intertwine and intersect with each other” said Lehane. “It’s critical we think strategically about their relationship.”

Chainlink makes 20% gains as DeFi sector dominates

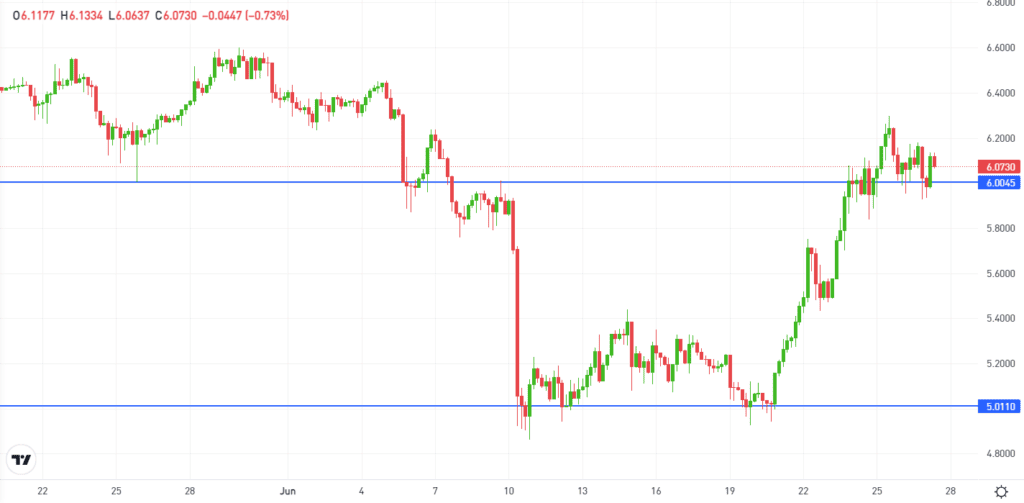

LINK has leapt from support at $5 to break above $6

Top DeFi tokens are outperforming the broader crypto market, with Uniswap, Aave, Compound and Synthetix all posting double-digit gains over the last week.

The price action could be supported by anticipation about upcoming product releases. These include Uniswap’s next iteration of its decentralized exchange, and Aave’s much-anticipated decentralized stablecoin.

Leading the way, oracle network Chainlink is up 20%.

This comes ahead of the launch of two new features, including the Cross-Chain Interoperability Protocol (CCIP), which promises to provide a single-messaging interface for all cross-chain communication, and a revised version of Chainlink staking.

The former release is expected to bring breakthroughs in blockchain interoperability, and according to Twitter analyst yourfriendSOMMI, could be Chainlink’s “secret bull market weapon”.