Major developments for the week

- Bitcoin potentially breaks out against M1 money supply

- $2 billion crypto fund inflows in May

- Australia launches its first spot Bitcoin ETF

- PayPal expands PYUSD and Solana payment use cases

- NEAR Protocol daily transactions surge to 6 million

- Uniswap vote delay highlights DeFi stakeholder divisions

- Mastercard unveils P2P crypto network with vanity address system

- Arta TechFin and Chainlink to tokenize real-world assets

- SingularityNET announces ASI token merger dates

- Ethereum Name Service (ENS) is considering migrating to a Layer 2 network

- Cristiano Ronaldo Launches Fourth NFT Collection with Binance

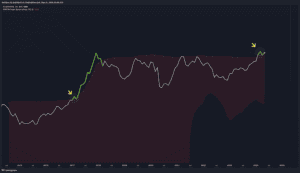

Bitcoin’s Potential Breakout Against M1 Money Supply

Bitcoin has been trading sideways following the euphoria from spot ETF approvals and post-halving. Analysts suggest a breakout compared to the M1 money supply (US money stock), indicating a bullish move similar to the 2017 parabolic rise. Despite the recent contraction in money supply, Bitcoin has appreciated over 50% YTD, driven by increased demand and decreasing liquidity. Long-term prospects remain bullish due to debasing currency and strong institutional inflows.

Past performance is not an indication of future results

M1 money supply and Bitcoin are often analyzed together because M1 indicates liquidity and inflation trends, impacting investment flows into Bitcoin. Bitcoin is seen as a hedge against inflation, and its performance relative to M1 can highlight its potential as a resilient and valuable asset.

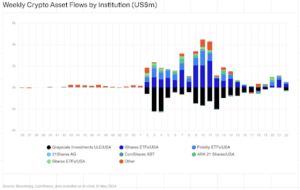

$2 Billion Crypto Fund Inflows in May

Crypto investment products saw $2 billion in inflows in May, the highest since 2021. Bitcoin-focused funds accounted for 90% of this inflow, driven by renewed institutional interest. This surge followed favorable regulatory developments and the growing appeal of Bitcoin as an inflation hedge. According to CoinShares, Ethereum ETPs saw $21.6 million in inflows, and Solana ETPs saw $5.8 million in inflows.

Past performance is not an indication of future results

Australia’s First Spot Bitcoin ETF Launched

Australia launched its first spot Bitcoin ETF by Monochrome, providing investors with direct exposure to Bitcoin. This regulatory approval signifies growing institutional acceptance and marks a milestone for Bitcoin adoption in the region. The ETF is expected to attract significant retail and institutional investments.

As Bitcoin continues to show strength amidst regulatory developments and institutional interest, the BitcoinWorldWide Smart Portfolio offers a comprehensive investment option aligned with Bitcoin’s growing potential.

PayPal Expands PYUSD and Solana Payment Use Cases

PayPal is expanding its use of PYUSD and Solana for payments, integrating these solutions into its broader financial services. This move aims to enhance transaction speed and efficiency while lowering costs, making it easier for users to transact in digital assets. This expansion is expected to drive greater adoption of both PYUSD and Solana within the PayPal ecosystem, highlighting the growing relevance of blockchain technology in mainstream finance.

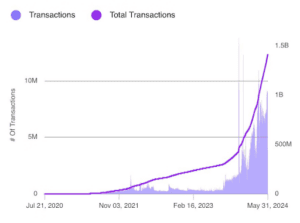

NEAR Protocol Daily Transactions Surge to 6 Million

NEAR Protocol‘s daily transactions surged to 6 million, driven by increased adoption of its blockchain applications and partnerships. This milestone underscores NEAR’s growing ecosystem and its potential to become a major player in the smart contract platform space.

Past performance is not an indication of future results

The Scalable-Crypto Smart Portfolio is designed to capitalize on the rapid advancements and adoption in smart contract platforms like Solana and NEAR, offering diversified exposure to this dynamic sector.

Uniswap Vote Delay Highlights DeFi Stakeholder Divisions

A recent delay in a Uniswap governance vote highlighted divisions among DeFi stakeholders. The vote, crucial for the protocol’s future development, revealed varying interests and priorities within the community, underscoring the challenges in achieving consensus in decentralized governance.

Mastercard Launches P2P Crypto Network with Vanity Address System

Mastercard has introduced a P2P crypto network featuring a vanity address system, aimed at simplifying crypto transactions. This innovation is expected to enhance user experience and drive mainstream adoption by making crypto payments more accessible and user-friendly.

The DeFiPortfolio Smart Portfolio aligns with the latest developments in DeFi and TradFi, providing investors with exposure to innovative projects driving the future of finance.

Arta TechFin and Chainlink Expand Partnership to Tokenize Real-World Assets

Arta TechFin has expanded its partnership with Chainlink to tokenize real-world assets, leveraging Chainlink’s decentralized oracles for secure and reliable data. This initiative bridges traditional finance and blockchain, enabling seamless integration and asset management.

SingularityNET Announces ASI Token Merger Dates

SingularityNET has announced the merger dates for its ASI token, aiming to enhance liquidity and utility within its ecosystem. This merger is part of a broader strategy to expand its decentralized AI marketplace and foster innovation in the Web3 space.

The Web3Applications Smart Portfolio offers diversified exposure to the rapidly evolving Web3 ecosystem, capitalizing on the transformative potential of projects like Chainlink and SingularityNET.