Major developments for the week:

- Bitcoin futures market heating up, open interest surpasses $6.7B

- Ethereum CME Futures reach $1B milestone

- Total net inflows of $2.27 billion streamed into Bitcoin ETF products last week

- Avalanche will undergo a $379.76 million unlock on February 22nd, 2024

- Apecoin‘s ‘ApeChain’ will be powered by Arbitrum, following a majority vote of 50.35% that favored it over other options including Polygon

- Solana Mobile has announced Snapshot 2, set for February 21st 7pm UTC

- Michael Saylor’s MicroStrategy has seen its Bitcoin investment exceed $4 billion in profits

- Injective launched what is described as the “first ever” omnichain domain name service, supporting both Injective and Solana

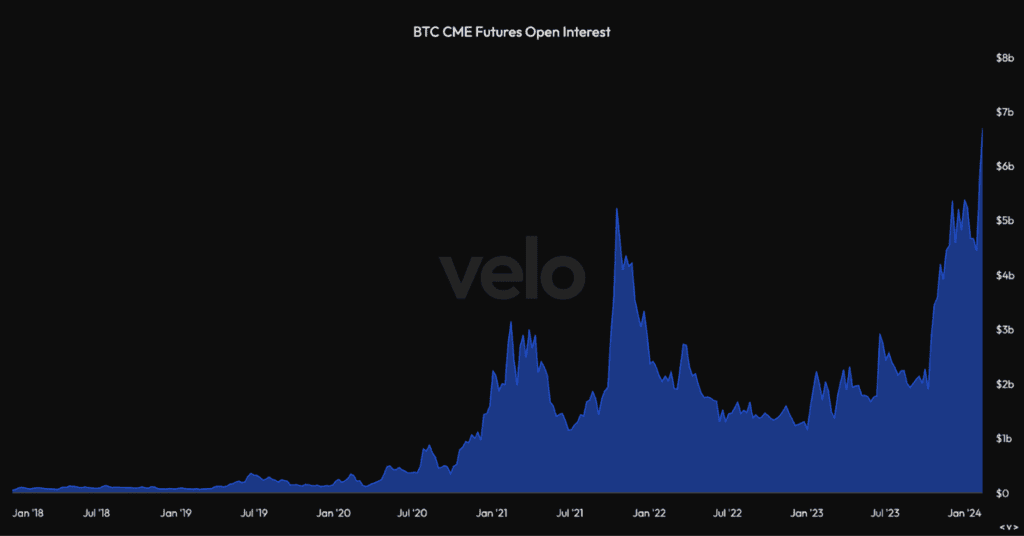

Bitcoin futures market starting to heat up

A subject that has been extensively covered in our previous roundups is BTC CME Futures Open Interest. As of February 16th, we’ve witnessed a significant milestone, as open interest surged to surpass $6.7 billion, depicted in the chart below

Past performance is not an indication of future results

It’s worth noting that while this represents a remarkable current high, it is still quite far from the peaks witnessed during the height of 2021.

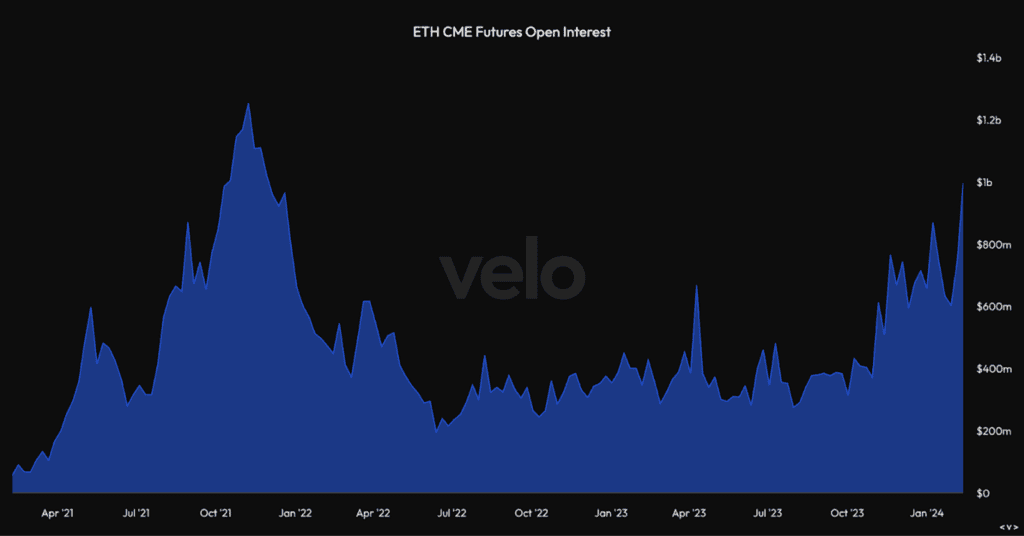

Ethereum CME Futures reach $1B milestone

Furthermore, Ethereum has achieved a milestone by reaching $1 billion in CME Futures Open Interest, a level not seen in more than two years. The surge in Open Interest for Ethereum CME Futures Open Interest occurred shortly after Franklin Templeton announced their application for a spot Ethereum ETF last Tuesday. This application places Franklin Templeton among other notable firms such as BlackRock, Fidelity, Ark 21Shares, Grayscale, VanEck, Invesco, Galaxy and Hashdex, all of whom have submitted similar applications in recent months.

Past performance is not an indication of future results

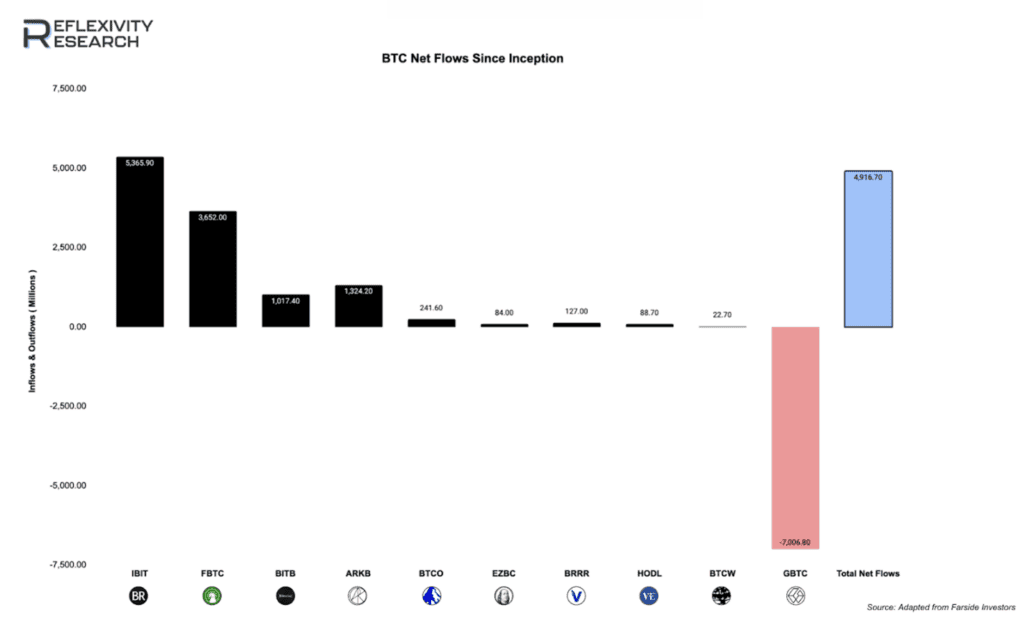

Bitcoin ETF products saw net inflows of $2.27 billion last week

Last week saw a significant surge in net Bitcoin ETF inflows, increasing by $1 billion compared to the previous week. A substantial portion of this increase was driven by BlackRock’s IBIT product, which attracted an impressive $1.6 billion, marking an approximately 170% increase from the week before.

Despite Grayscale experiencing $700 million in outflows since January 11th, Bitcoin ETF products have witnessed 16 consecutive days of net inflows. This has brought the total inflow figure to $4.9 billion.

Past performance is not an indication of future results

Amongst the largest contributors of net inflows are Blackrock’s IBIT, Fidelity’s FBTC and Ark 21 Share’s ARKB.

eToro’s @BitcoinWorldWide Smart Portfolio is uniquely positioned to leverage these market dynamics, offering investors an integrated platform to engage with the Bitcoin investment landscape. As the industry continues to mature and expand, the Smart Portfolio provides an opportunity for investors to navigate the complexities of the market with ease, ensuring they are at the forefront of the digital currency revolution.

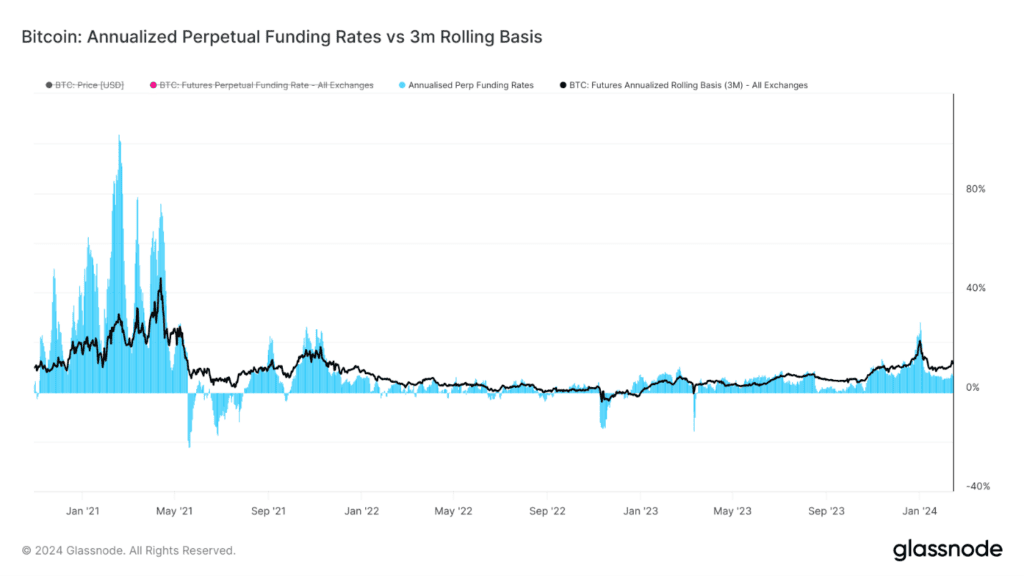

Bitcoin Derivatives Market Starting to Heat Up

One of the most important metrics to follow for the state of the Bitcoin market is the derivatives landscape, not only on CME but on crypto native venues as well. Following derivatives data can offer insight into the positioning of market participants and sentiment.

Below we can see the annualized calendar futures basis and the annualized perpetual futures funding rates. The calendar futures basis simply looks at the spread between the current Bitcoin spot price and where calendar futures are trading; the higher this spread is the stronger the demand is to be long.

Similarly, funding rates are the mechanism used to peg perpetual futures, the most liquid instruments in crypto, contracts to the underlying spot market. Every 8 hours this funding rate is paid out to the other side of the perpetual futures contracts based on demand to be long or short relative to activity in the spot market.

As we can see below, while these readings are of course no longer negative and starting to grind up, they are still far from levels reached during peak bull market euphoria in 2021. These will be two indicators to continue to keep an eye on.

Past performance is not an indication of future results

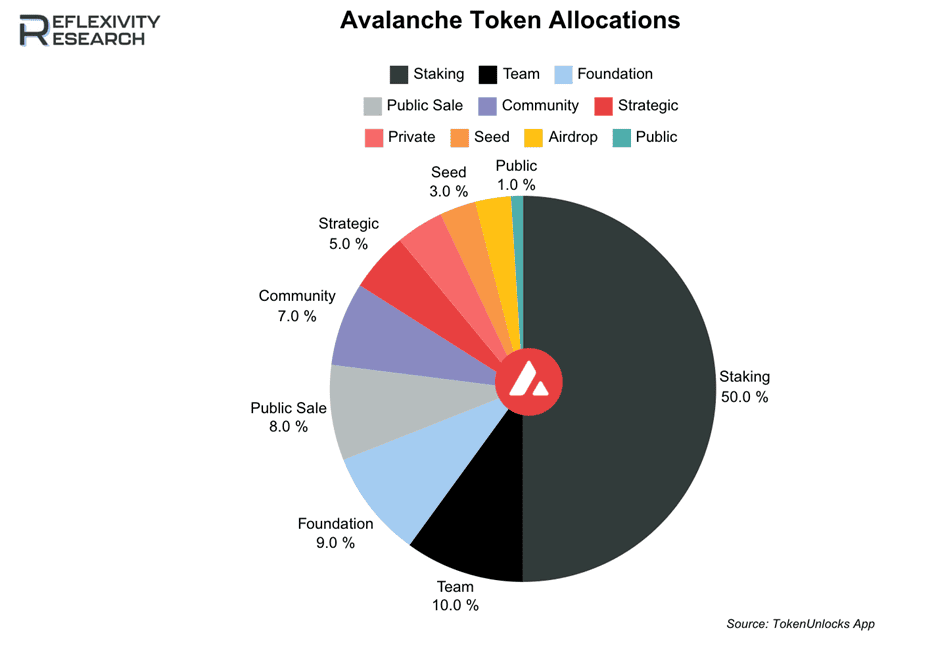

Avalanche will undergo a $379.76 million unlock on February 22nd, 2024

Scheduled for February 22nd, $AVAX plans to release 2.60% of its circulating supply. This comprises $182.25m million for Team, $91.13m million for Strategic Partners and $67.51m million for the Avalanche Foundation. $AVAX’s vesting schedule is estimated to reach completion by October 20th, 2030.

Past performance is not an indication of future results

As the crypto landscape evolves, @Scalable-Crypto Smart Portfolio stands as a pivotal tool for investors navigating market events. It effectively capitalizes scalable solutions from Layer 1 to Layer 2, enabling seamless strategy adjustments in response to shifts in the crypto landscape.

The content in this post was created exclusively for eToro by Reflexivity Research.