Global bank calls for $100K this year

Bitcoin has pushed 1% higher over the last week, making its way slowly back towards $30K as the dollar drifts sideways.

Meanwhile, major altcoins including Litecoin have fallen on regulatory tensions as one of the largest US exchanges pushes back against the Securities and Exchange Commission (SEC). Solana is a notable exception, having bucked the trend on excitement around a new NFT project.

Read more after the jump.

This week’s focus

– Bitcoin inches higher on improving macro conditions — could it hit $100K this year?

– Solana adds 2% on demand for Madlad NFTs — is the blockchain making a comeback?

– Litecoin sinks 2% with less than 100 days until the halving

Bitcoin inches higher on improving macro conditions — could it hit $100K this year?

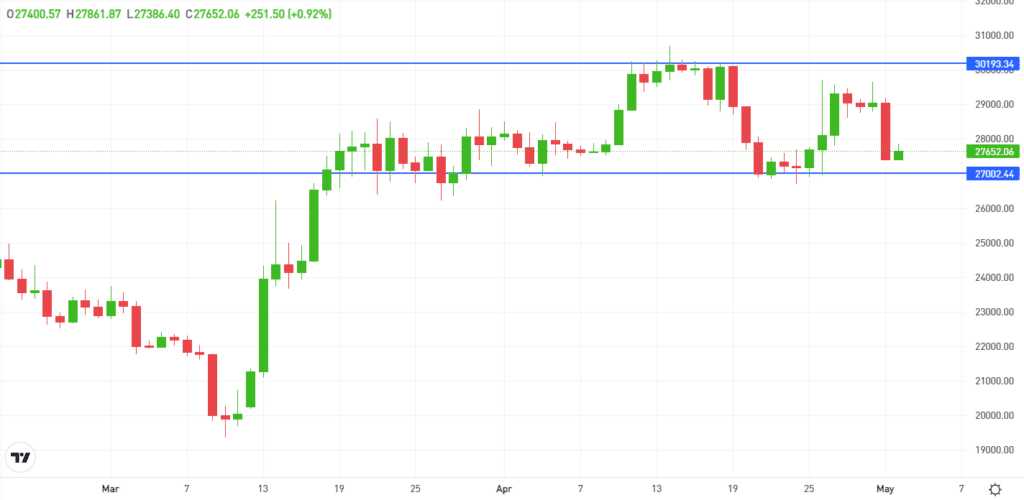

Despite upwards momentum, BTC remains range bound below $30K

Bitcoin inched slowly higher last week on improving macro conditions and a big prediction from a major bank.

As eToro Global Markets Strategist Ben Laidler commented, the rally was supported by a number of factors, including “a range bound US dollar and lower 10-year US bond yields.”

Yet according to Standard Chartered, this could be just the beginning. The global bank released research last week claiming that Bitcoin has the potential to reach $100K by year end, driven by banking sector turmoil, along with the stabilization of risk assets as the US Federal Reserve ends its cycle of interest rate hikes.

In addition, Standard Chartered’s head of digital assets research, Geoff Kendrick, pointed to Bitcoin’s upcoming halving as a potential catalyst. This event, due next year, is the process by which the rewards for mining a new block are halved, and is generally considered to be a positive driver for Bitcoin.

“As we approach the next halving,” wrote Kendrick in the research note, “we expect cyclical drivers to become more constructive, as they have in previous cycles.”

Solana adds 2% on demand for Madlad NFTs — is the blockchain making a comeback?

SOL has soared 125% since the start of the year

Solana has more than doubled in price this year, outperforming Bitcoin and Ethereum as it bounces back from a bearish 2022.

The blockchain was caught in controversy around the collapse of a large exchange in November last year, and suffered an additional setback in December when the creator of Solana-based NFTs DeGods and y00ts announced that both projects would move to Polygon.

Yet now, Solana appears to be making a comeback, boosted by the presence of one of this month’s most popular NFT projects.

Solana-based profile picture (PFP) project Mad Lads has generated over $15 million worth of trading volume since it was minted last week, and according to co-founder and CEO Armani Ferrante, it could usher in a new lease of life for Solana:

“I think that DeGods and y00ts kind of sucked the life out of the NFT space, but I think it’s totally back now,” Ferrante said. “And it’s not going anywhere. It’s honestly more exciting than ever.”

Litecoin sinks 2% with less than 100 days until the halving

LTC is trading in a tight range between $84 and $90

Over the last week, Litecoin sank 2% as the blockchain’s upcoming halving came into focus.

Litecoin’s third halving is now expected in less than 100 days, on August 2nd, 2023, at block number 2,520,000.

This event is a mechanism in which the rewards that crypto miners receive for validating transactions on a blockchain are cut in half, slowing down the inflation rate and potentially boosting the cryptoasset’s value according to the principles of supply and demand.

As Riyad Carey, research analyst at Kaiko, told Blockworks, the halving has historically been a bullish catalyst for both Bitcoin and Litecoin, and could represent an opportunity for the cryptoasset to grow:

“Litecoin was for many years a top-five token but has since lost that position to newer, primarily Layer 1, tokens. A pre-halving price rally could generate some excitement and potentially attract miners if they look for alternatives to Bitcoin.”