Major Developments for the Week

- BTC hits $106,489, achieving 142% year-to-date growth

- ETH adoption and wallet activity surge, analysts speculate $8,800 in Q1 2025

- XRP rebounds to $2.42 but remains below its seven-year peak

- DOGE gains 2%, supported by strong community backing and payment integrations

- French Hill proposes crypto legislation to clarify digital asset regulation

- Avalanche secures $250M to supercharge its blockchain ecosystem

- Altcoin market cap grows by 15%; Bitcoin dominance rises

- Fed expected to cut interest rates by 0.25%, boosting Bitcoin’s momentum

- Market Structure and Stablecoin bills aim to foster innovation and investment.

- Solana overtakes Ethereum as the top blockchain for new developers

- Sui partners with Ant Digital to launch tokenized ESG assets

- Microsoft shareholders show minimal interest in Bitcoin investments

- Italy may scale back its proposed tax hike on crypto gains

Bitcoin Surges to $106.5K, Achieving 142% YTD Growth

Bitcoin hit a new all-time high of $106,489 on December 16, marking a 142% year-to-date increase from its starting price of @ $44K at the beginning of 2024.

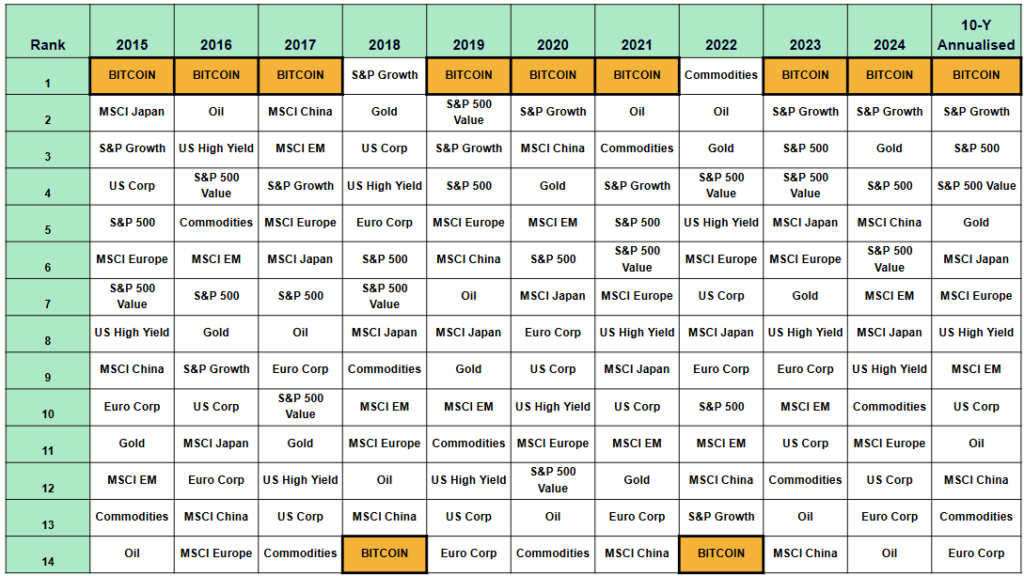

Image by Sam North, eToro analyst

Past performance is not an indication of future results.

As shown above, over the past 10 years Bitcoin has been the highest-ranked annual asset eight times out of ten.

Federal Reserve Rate Cuts on the Horizon

A 0.25% interest rate cut is expected this week, which would mark the second consecutive reduction. Historically, Bitcoin has thrived in low-rate environments as investors seek alternatives to traditional financial assets.

Institutional Support

New accounting rules by the Financial Accounting Standards Board allow institutions to record crypto holdings more realistically. Combined with spot ETF inflows, this has bolstered institutional confidence in Bitcoin. Bitcoin’s market sentiment remains highly bullish, with the Crypto Fear and Greed Index reaching 83/100 (Extreme Greed)—its highest level since Bitcoin broke through $100,000 earlier this month.

Analysts predict Bitcoin could reach $125,000 in early 2025. However, a potential 30% correction to around $87,500 is expected as the market digests current bullish news.

Ethereum: Poised for Growth

Ethereum’s price remains just under the $4,000 mark, but several factors suggest it may be preparing for a significant breakout. Analysts forecast Ethereum could reach $8,800 by Q1 2025, driven by reduced market leverage and increasing investor adoption. The daily average new wallet creation for ETH reached 130,000 in December, the highest since April, reflecting strong interest. Conservative estimates suggest Ethereum may peak closer to $6,000 in 2025, but the current trajectory signals strong growth potential.

Avalanche raises $250M to boost blockchain growth

Avalanche secured $250 million this week in a token sale led by major investors, including Galaxy Digital and Dragonfly, signaling strong institutional confidence. The funding supports the Avalanche9000 upgrade, which cuts deployment costs by 99% and enhances developer accessibility. Following the announcement, AVAX surged 9.6% and now ranks as the 10th-largest blockchain by total value locked (TVL) at $1.6 billion, according to DeFiLlama.

XRP: Steady recovery amid market volatility

XRP continues to show resilience despite a volatile month. After briefly dropping below $2, it has rebounded to $2.42, marking a notable recovery. While it remains below its seven-year high of $2.82, ongoing developments, including its expanding use in cross-border payment systems and growing institutional interest, could drive future performance. Analysts note that XRP’s position as a liquidity-focused cryptoasset puts it in a strong position should broader regulatory clarity emerge in 2025.

Dogecoin: Modest gains, strong potential

Dogecoin gained 2% this week, climbing to $0.403, though it remains 13% below its three-year high of $0.48. DOGE’s enduring appeal lies in its strong community-driven support and increasing integration into payment systems. As a meme coin turned utility asset, Dogecoin continues to spark interest for its potential role in mainstream financial ecosystems, especially as it remains a favorite among high-profile advocates and innovative fintech experiments.

French Hill Pushes for Clear Crypto Regulations

French Hill, the incoming Chair of the U.S. House Financial Services Committee, plans to introduce two major bills within the first 100 days of the Trump administration. The first, a Market Structure Bill for Digital Assets, aims to establish clear rules for how digital assets are classified, traded, and regulated, moving away from the SEC’s criticized “regulation by enforcement” approach. The second, a Stablecoin Bill, seeks to define the role of stablecoins in the financial system, balancing innovation with proper integration into traditional markets.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.