Major crypto developments for the week:

- Bitcoin ETFs experience $1.8 billion in inflows

- Google to allow crypto trusts and ETF ads, further solidifying the institutional adoption of Bitcoin, which should have a massive impact on the reach and prevalence of Bitcoin and the industry as a whole

- Today (Tuesday January 30), Optimism will release 2.5 percent of the circulating supply, which is equivalent to $74.2M.

- DYDX v3.0 goes live

- Eigenlayer has rescheduled their upcoming restaking event for February 5th

- The United States government announced its intention to auction off $130 million worth of Bitcoin, which was confiscated from the Silk Road.

- Harvest Hong Kong applied for a Bitcoin spot ETF with the Hong Kong Securities and Futures Commission on January 26. This marks the first time a Hong Kong institution has sought approval for a Bitcoin spot ETF.

- The SEC has postponed the review of the spot Ethereum ETF applications from both Grayscale and Blackrock. Bloomberg’s James Seyffart remarked that “the next significant date is May 23” in relation to these applications.

Bitcoin ETFs experience $1.8 billion of inflows last week

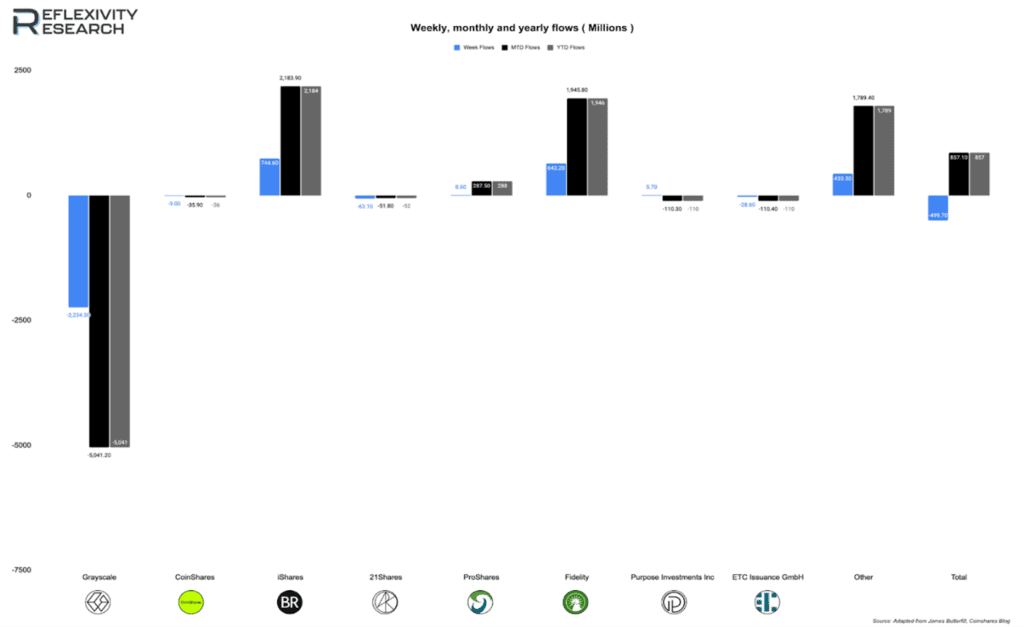

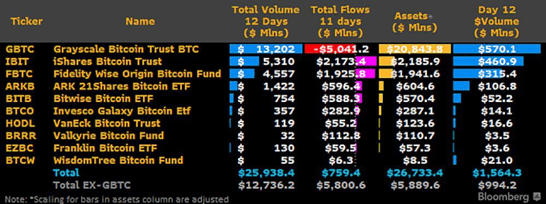

TL:DR Last week, digital asset investments faced $500 million in outflows, with Grayscale outflows reaching $2.2 billion. Bitcoin ETFs have attracted $5.94 billion since their launch in January, including $1.8 billion in the last week alone.

Our previous weekly reports have consistently focused on Bitcoin ETF inflows and outflows, particularly examining Grayscale. With the conclusion of another week, we’ve gathered more data regarding these specific flows. Since January 11 2024, Grayscale has seen significant outflows amounting to $5 billion in total. Just last week, the outflows reached $2.2 billion yet there was a noticeable trend of gradual reduction as the week advanced.

The newly launched US ETFs have been attracting significant interest, with $1.8 billion in inflows last week and a total of $5.94 billion since their inception. This brings the net inflow, including Grayscale’s figures since the launch, to $807 million.

Source: CoinShares

Past performance is not an indication of future results.

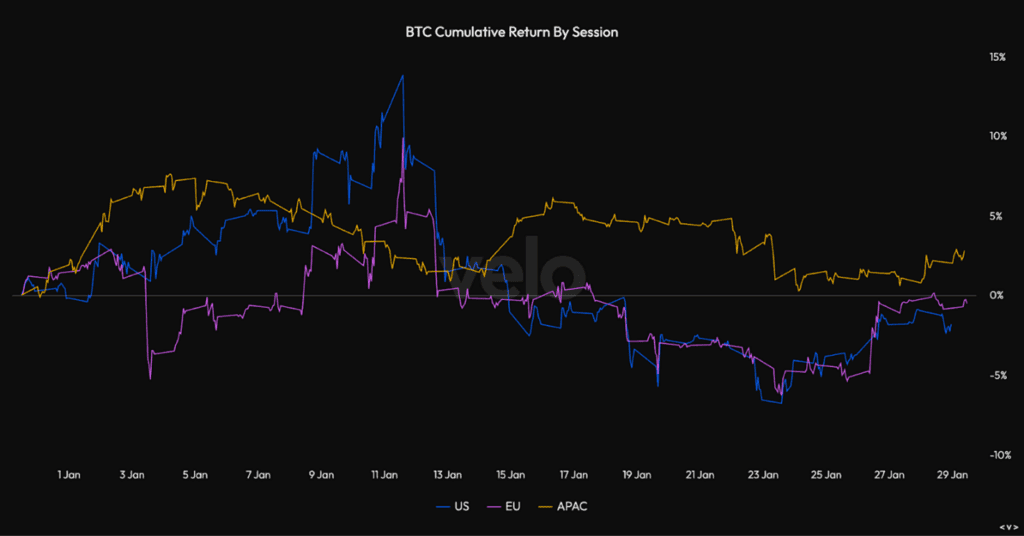

This tapering off of selling in the latter half of the week is reflected in the cumulative return by session, with US hours beginning to converge with its EU and APAC counterparts.

Past performance is not an indication of future results.

Data from Bloomberg’s James Seyffart reveals that although GBTC outflows have slowed, GBTC remains the #1 Bitcoin spot ETF by volume, $110 million more than Blackrock’s IBIT.

With the emergence of the Bitcoin ETFs, a transformative impact is expected throughout the Bitcoin value chain, positively affecting stakeholders ranging from miners to custodians. In this evolving landscape, eToro’s @BitcoinWorldWide Smart Portfolio stands out as an optimal investment choice, designed to capture the expanding opportunities across the entire Bitcoin ecosystem.

Source: Bloomberg

Past performance is not an indication of future results.

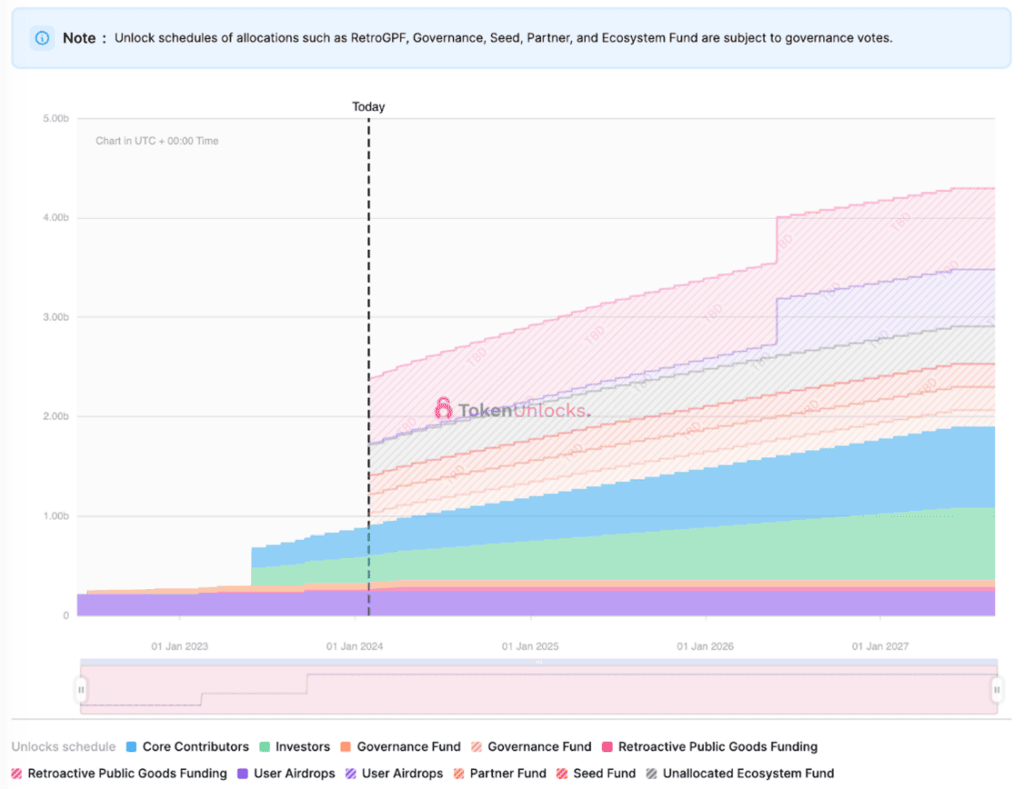

Optimism will undergo a $74.17 million unlock on January 30th, 2024

The primary unlock event this week features Optimism. Scheduled for January 30th, $OP plans to release 2.5% of its circulating supply. This comprises $39.27 million for Core Contributors and $35.14 million for Investors. As of time of writing, $OP is 21% vested, with the goal of this vesting schedule being completed by August 28 2027.