Major developments for the week:

- Bitcoin ETF products see net inflow of $697 million

- El Salvador remains Bitcoin-friendly, with 87% of the vote going to re-elect President Nayib Bukele

- BTC Spot ETF ads coming to a site near you?

- Eigenlayer’s Puffer Finance project surpasses $400 million in TVL

- Genesis Global Capital has submitted a request to the U.S. Bankruptcy Court for the Southern District of New York for permission to sell approx. $1.6 billion in trust assets. This includes about $1.4 billion in Grayscale GBTC and roughly $165 million in Grayscale Ethereum Fund

- FTX has requested court approval to sell its ~8% share in the AI firm Anthropic, valued at $18 billion, equating to a stake worth around $1.4 billion

Bitcoin ETFs experience $697m net inflows last week

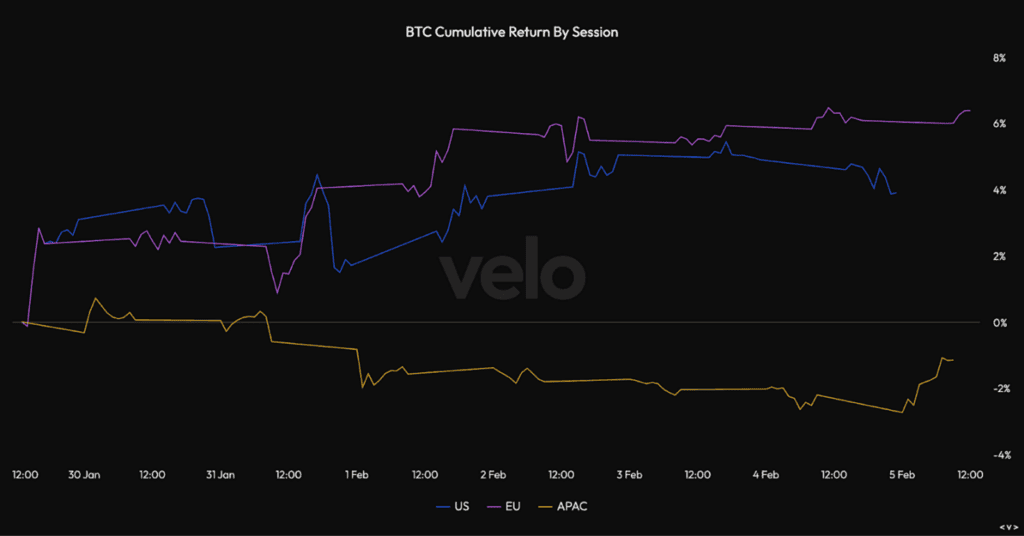

For the first time since the BTC ETF approvals, we are beginning to see the cumulative return by session turn consistently positive for US hours. This can be attributed to the reduction in outflows from Grayscale that dominated the initial weeks of trading post ETF approval.

Past performance is not an indication of future results

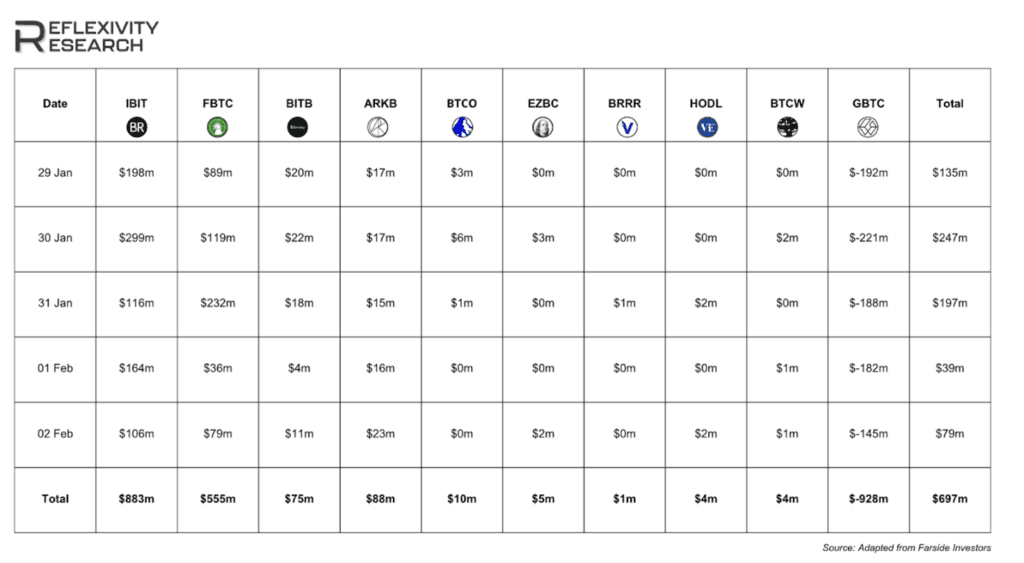

Last week marked a reduction in BTC outflows from Grayscale, following our previous report of $2.2 billion outflows from January 29th to February 2nd. The recent figures show a decrease of nearly $1.3 billion, bringing the total outflows to $928 million. Leading the inflows was Blackrock’s IBIT with $883 million, while Fidelity followed in second with $555 million.

The Bitcoin investment landscape is shifting positively post-SEC’s ETF approval, with eToro’s @BitcoinWorldWide Smart Portfolio poised to benefit amidst reduced Grayscale outflows and growing investor confidence.

Past performance is not an indication of future results

El Salvador remains Bitcoin-friendly

This week saw Bitcoin-friendly El Salvador President Nayib Bukele re-elected to the position, capturing a massive 87% of the vote.

Vice President Felix Ulloa confirmed that Bitcoin would remain legal tender during Bukele’s second term, with ongoing plans for Bitcoin bonds, cities and passports.

ETF ads coming to a site near you?

As reported last week, Google ads for ETFs are now permitted, further solidifying the institutional adoption of Bitcoin. This could well have a huge impact on the reach and prevalence of Bitcoin, as well as on the crypto industry as a whole.

This week, according to reports in the Financial Times, Blackrock, Fidelity, and Grayscale, as well as Invesco and Bitwise, are all advertising Bitcoin spot ETFs on Google, in line with its new policies permitting crypto exchange and wallet ads.

Puffer Finance accumulates more than $400 million in TVL

EigenLayer is set to increase the limits for its existing and newly issued Liquid Staking Tokens today at 12 PM PT. Within the EigenLayer ecosystem, Puffer Finance has emerged as a rapidly growing project.

Puffer Finance, which provides a decentralized, permissionless native liquid restaking protocol that merges Ethereum’s liquid staking with EigenLayer’s restaking, has exceeded a TVL of $400 million. Notable financial contributions to the project include a $120,000 grant from the Ethereum Foundation, a $650,000 pre-seed investment led by Jump Crypto and a $5.5 million seed funding round jointly spearheaded by Lemniscap and the collaboration between Lightspeed and Faction.

These developments not only underscore the vibrancy and potential for growth within the DeFi and Ethereum ecosystem but also align with eToro @DeFiPortfolio aim to leverage emerging opportunities in this space, offering investors a front-row seat to the unfolding innovations and financial growth in the DeFi market.