Major developments for the week:

- January 10 marks final deadline for the SEC’s decision on ARK/21Shares’ spot Bitcoin ETF filing

- Bitcoin breaches $47,000 just 2 days away from ETF deadline

- APT to unlock 8.05% of the circulating supply on Friday Jan 12

- Ethereum L2 Arbitrum’s 24-hour decentralized exchange volume briefly flips that of the Ethereum base chain

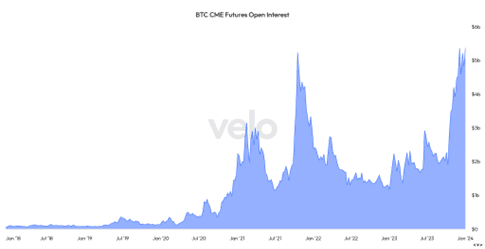

- BTC CME Futures Open Interest reaches new all-time high

- BTC ETF applicants have filed S-1 amendments outlining their fees

- CBOE to launch margined Bitcoin and Ethereum futures on Thursday the 11th of January

The day before the momentous Bitcoin ETF decision

Tomorrow is the day of the final deadline for the SEC to make a decision regarding the ARK/21Shares’ spot Bitcoin ETF filing. This means that this week is poised to be one of the most pivotal moments in the history of digital assets as the SEC’s conclusive decision for approval or rejection of the Bitcoin ETF rapidly approaches.

Watch this space…

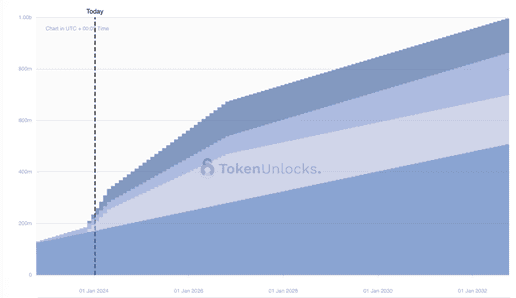

APT to unlock 8.05% of the circulating BTC supply on Friday January 12

APT is scheduled to release 8.05% of its circulating BTC supply three days from now. This is 2.4% of its total supply or $224.58 million USD equivalent. It is noteworthy that the above unlock schedule does not account for staking rewards that Aptos increases with every completed epoch by their validator.

Source: TokenUnlocks

Past performance is not an indication of future results.

Arbitrum’s decentralized exchange volume briefly surpasses Ethereum’s

Ethereum layer two Arbitrum’s fundamentals continue to improve alongside its price appreciation ahead of the future EIP-4844 upgrade; which is expected to reduce fees for L2s. Last week we witnessed Arbitrium’s total value locked surpass $10 billion with today’s total value locked sitting at $9.5 billion. Last Friday, Arbitrum’s 24 hour decentralized exchange volume hit $1.83 billion, almost $400 million more than the Ethereum base chain’s volume for that day.

Bitcoin CME futures open interest remains at all-time highs

Something that we have been paying close attention to over prior weeks and months has been Bitcoin’s CME futures open interest. At present we are sitting at a new yearly high with open interest having surpassed $5.38 billion, the highest level ever. This has been rising steadily as we approach the final decision for the Bitcoin ETF applications. There are two thoughts that could be drawn from this: On one hand, these positions may be closed around ETF approval as funds look to “sell the news”. On the other hand, if this was the case, why have these positions not begun to close out already?

Source: Velo Data

Past performance is not an indication of future results.

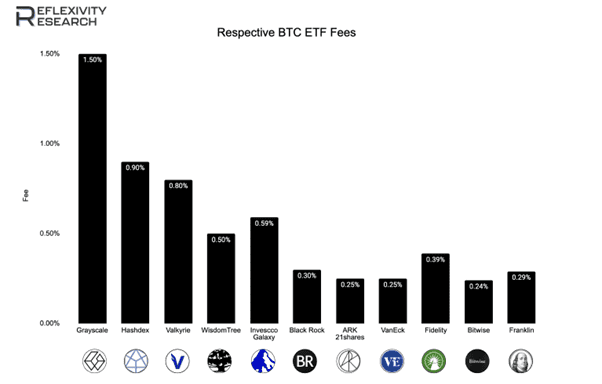

Bitcoin ETF applicants file S-1 amendments outlining their fee structures

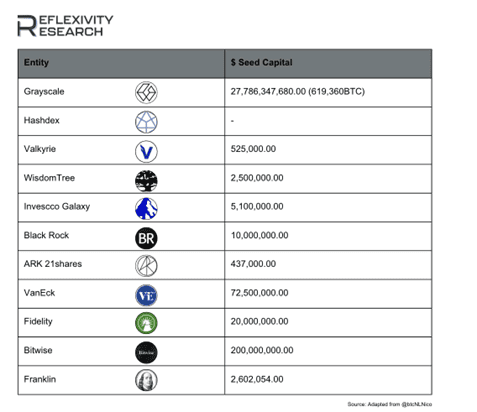

Yesterday we witnessed the spot Bitcoin ETF applicants file their amended S-1 forms and with these amendments, the fee structures for each respective filing.

- The title for the lowest long-term fee is held by Bitwise at 0.24%.

- Blackrock has suggested 0.20% for the first 12 months or until the $5 billion mark has been met and 0.30% thereafter.

- ARK and Bitwise have stipulated 0% for 6 months or until the $1 billion threshold has been passed.

Past performance is not an indication of future results.

With a race for AUM/volume/liquidity, it will be interesting to see how the ETF race plays out, should these filings all be approved by the SEC. It will also be interesting to monitor crypto native exchanges responses to these proposed fees by their traditional finance counterparts.

Past performance is not an indication of future results.

The initial capital provided to seed these ETFs is also shown above, with Grayscale leading the way, followed by Bitwise.

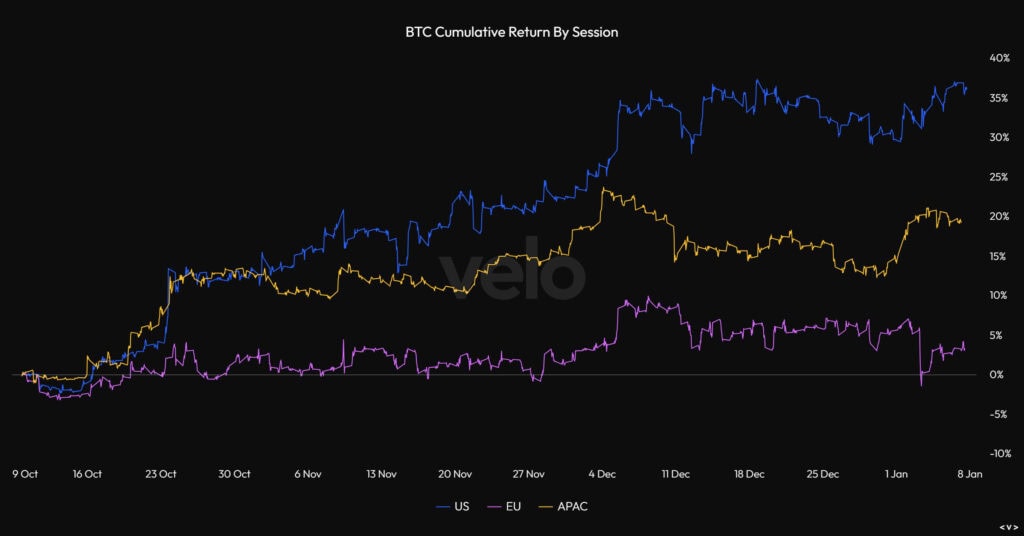

US continues to lead with cumulative return by session

US sessions have continued to lead the charge over the prior week in terms of cumulative return; with EU trading hours continuing to clearly fall behind.

Source: Velo Data

Past performance is not an indication of future results.

CBOE to launch margined Bitcoin and Ethereum futures

Starting January 11, CBOE Digital, an arm of the Chicago Board of Options Exchange, will initiate the trading of margined Bitcoin and Ether futures. This move, sanctioned by the Commodity Futures Trading Commission in June, positions CBOE Digital as the inaugural regulated U.S. platform to amalgamate spot and leveraged derivative trading on one platform.

The content in this post was created exclusively for eToro by Reflexivity Research.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.