Could April’s upgrade help Ethereum catch up?

The crypto market has continued to creep higher over the last week, ending the first quarter of 2023 on a positive note.

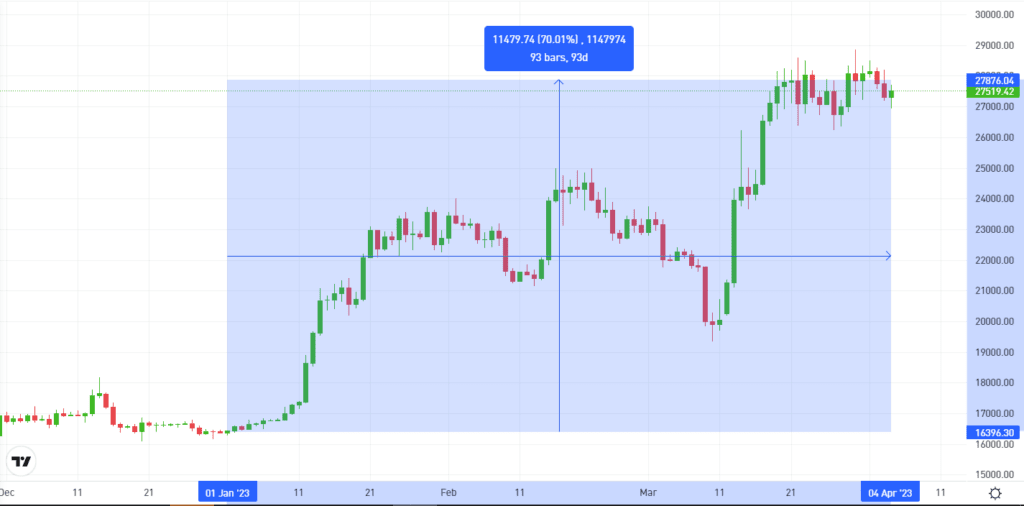

Since the start of the year, Bitcoin has led the crypto market; making 71% gains even amidst increasing regulatory pressure and the collapse of several crypto-friendly banks.

Yet in the last week, this trend has changed: Ethereum has pushed ahead to add 2%, as Bitcoin stayed flat. Other top performers include Stellar, which surged 17% to rival the gains of its closely related cousin XRP.

Read more after the jump.

This week’s focus

– Bitcoin closes best quarter in two years with 70% gains

– Ethereum shifts gears ahead of Shanghai — will the upgrade be bullish?

– XRP tops $0.50 on progress in long-running lawsuit

– Stellar surges 17% on MoneyGram award

Bitcoin closes best quarter in two years with 70% gains

BTC has rallied ~70% since starting the year at $16,200

The leading cryptoasset by market value has made its best quarterly gain in two years, adding around 70% to outperform gold‘s 7% and the S&P 500‘s 8%.

According to eToro Global Markets Strategist Ben Laidler, much of the upside has been driven by concerns around the centralized banking system. This has helped drive confidence in the decentralized crypto ecosystem, which was already benefiting from the broader resurgence of global markets on falling inflation.

This trend continued last week, with Bitcoin rallying towards $29K as an official White House statement lauded “progress in the fight against inflation”.

As Laidler commented, this improving macro environment is helping Bitcoin to overcome concerns around the bear market of last year, and could help make crypto “one of the positive wild cards of 2023.”

Ethereum shifts gears ahead of Shanghai — will the upgrade be bullish?

ETH is rising in an ascending triangle to tap against resistance at $1,800

Since the start of the year, Ethereum has struggled to match the pace of Bitcoin, gaining only 51% compared to Bitcoin’s 71% in the first quarter.

Yet in the last week, Ethereum has accelerated, adding almost 6% as Bitcoin finished relatively flat.

This change of pace comes ahead of Ethereum’s Shanghai upgrade, which is expected to go live in less than two weeks.

Shanghai represents the final stage of Ethereum’s transition to a proof of stake (PoS) mechanism, which is the way that transactions are verified and new ETH added to the network. This transition, otherwise known as The Merge, is an upgrade that aims to boost scalability of the Ethereum blockchain, cut energy usage by around 95%, and provide yield to stakers as a reward for participating in the protocol and staking their ETH.

When it goes live on April 12th, Shanghai will begin the process of unlocking staked ETH for the first time, reducing the risks of staking and marking the beginning of a new era of PoS Ethereum.

Many analysts expect this unlocking to be bullish, including Ethereum specialist Polynya, who tweeted that the event will be “the greatest derisking event in crypto history and will lead to an immense net increase in demand for staking.”

XRP tops $0.50 on progress in long-running lawsuit

Having briefly surpassed $0.50, XRP is now testing support at $0.49.

XRP has now risen 55% since the start of January, boosted by hopes that the token’s creators will win a legal battle against the US Securities and Exchange Commission (SEC).

This anticipation continued to build last week, following a lawsuit against a large exchange, in which the US Commodity Futures Trading Commission (CFTC) classified Bitcoin and Ether as commodities — sparking widespread speculation that XRP could also fit into this category.

Such a classification could help Ripple win its case against the US Securities and Exchange Commission (SEC), in which the agency claims that XRP tokens are securities.

If Ripple Labs does defeat the SEC, it could be a historic moment for the crypto industry and help establish legal clarity for the categorization of all cryptoassets.

Stellar surges 17% to hit yearly high

XLM has broken through resistance at $0.10, and is currently testing the same level as support

As XRP continues to rally beyond $0.50 in hopes of legal clarity, cousin Stellar is joining the fun.

This bullish price action follows a recent lawsuit against a large exchange, in which the US Commodity Futures Trading Commission (CFTC) classified Bitcoin and Ether as commodities — sparking widespread speculation that XRP could also fit into this category.

Such a classification could help Ripple win its case against the US Securities and Exchange Commission (SEC), in which the agency claims that XRP tokens are securities.

Not only that, but the resulting legal clarity could also be bullish for closely related tokens such as Stellar.

Often thought of as XRP’s closest cousin, Stellar has also raced higher in the last week, adding 17% after its partner MoneyGram was named winner of the “Best Use of Blockchain in FinTech” award for its integration with digital wallets on the Stellar blockchain.