As we approach another pivotal moment in the crypto world, Bitcoin is again stealing the spotlight. After its most recent surge, where it smashed through its previous all-time highs, Bitcoin is sparking excitement among investors, while altcoins, including Ethereum (ETH), Sui (SUI), Dogecoin (DOGE), Cardano (ADA), Solana (SOL), and many others, imitate its trajectory.

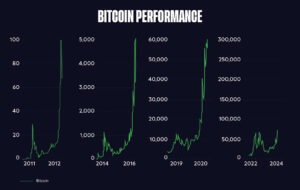

For anyone watching Bitcoin’s journey, this rally feels like déjà vu—and that’s no coincidence. Bitcoin’s price cycles tend to follow a pattern influenced by the “Halving” events, occurring every four years, where its supply tightens, often leading to impressive price gains. The question now: what lies ahead?

Why is Bitcoin Surging?

Bitcoin’s current rally has some powerful tailwinds driving it forward. Institutional adoption has hit new highs with the approval of Bitcoin ETFs, creating pathways for major players to enter the market. Regulatory developments have also lent stability, as the U.S. anticipates a more crypto-friendly administration and potential changes in SEC personnel, which could ease regulatory constraints.

Market experts are optimistic. Anthony Scaramucci from SkyBridge Capital predicts, “Bitcoin could surge over 200%, potentially hitting $200,000 within the next year as institutional demand and scarcity drive upward pressure.” Similarly, Mike Novogratz from Galaxy Digital foresees this Halving event, coupled with institutional interest, pushing Bitcoin past the $100,000 mark. And as Cathie Wood of ARK Invest notes, if institutions were to allocate just 5% of their portfolios to Bitcoin, it could propel Bitcoin significantly closer to a $1 million valuation.

Looking forward, projections vary, but the consensus is bullish. For instance, analysts from CryptoNewsZ forecast Bitcoin’s price could average around $119,454 by 2025, with potential highs near $250,000 by then. By 2030, some analysts foresee even more substantial gains, with targets ranging from $102,000 to $369,701. Further out, 2040 and 2050 price predictions are lofty, with estimates reaching up to $1 million, fueled by Bitcoin’s fixed supply and recognition as a store of value.

Past performance is not a reliable indicator of future results

What Can We Expect in the Coming Months?

In the short term, experts suggest that Bitcoin’s price could continue to fluctuate amid periods of volatility. According to Bitcoin analyst pseudonymously known as Titan of Crypto, Bitcoin has typically bounced 40-71% in past cycles following a rally. If history repeats, we could see a jump to around $92,000. While the journey may not be smooth, the trend points upward, likely benefiting other major cryptocurrencies that often follow Bitcoin’s lead.

Bitcoin’s long-term outlook also holds massive potential. Predictions as far ahead as 2030 and beyond paint a picture of Bitcoin solidifying its role as the alternative, digital gold, appealing to those in search of a secure, limited-supply asset.

Why Now is the Time to Invest

For potential investors, the timing couldn’t be better to consider Bitcoin as part of a diversified portfolio. The combination of scarcity, institutional interest, and a more favorable regulatory environment makes Bitcoin uniquely positioned to benefit from current and future trends. Acting now means getting in before potential gains, capturing the early wave of what many expect will be another high-reaching cycle.

If you’re ready to take advantage of this momentum, eToro is the ideal platform to start your crypto journey. With its award-winning reputation, user-friendly interface, and robust security measures, eToro provides a reliable way to invest in Bitcoin and other cryptocurrencies. Don’t miss the opportunity to be part of what could be the most exciting chapter in Bitcoin’s story yet.

As always, crypto investments come with risks, and past performance does not guarantee future results. But if you’re looking for a high-potential asset that aligns with today’s digital world, Bitcoin may be worth a closer look. Start exploring your options with eToro today and see where Bitcoin’s rally could take you.