Major developments for the week:

- Wisconsin Investment Board buys $100m of Bitcoin ETFs

- Bitcoin ETFs saw net inflows of $948.3 million last week

- SEC to decide on VanEck’s spot Ethereum application by May 23rd

- Millennium Management reveals Bitcoin ETF holding worth approximately $2 billion in Q1

- Arbitrum DAO considers creating a mergers and acquisitions unit

- FantomFDN unveils Sonic Network and announced plans for a token migration

- AVAX will unlock 2.49% of its circulating supply on May 22nd

- Deutsche Bank joins Project Guardian to investigate applications of asset tokenization

- Lido co-founders finance restaking startup set to compete with EigenLayer

Wisconsin Pension Fund purchases ~$100m of Bitcoin ETFs

An interesting piece of BTC related news stemmed from Wisconsin last week. It was noted that in the first quarter of 2024, the State of Wisconsin Investment Board acquired 94,562 shares of BlackRock’s iShares Bitcoin Trust, valued at nearly $100 million, along with additional holdings in Grayscale’s Bitcoin Trust, bringing their total Bitcoin ETF investments to around $163 million.

This investment is significant as Wisconsin is the first U.S. state to make such a large-scale purchase of Bitcoin ETFs, indicating a growing institutional interest in digital assets. This move is part of a broader investment strategy that also includes holdings in other cryptocurrency-related assets.

Past performance is not an indication of future results

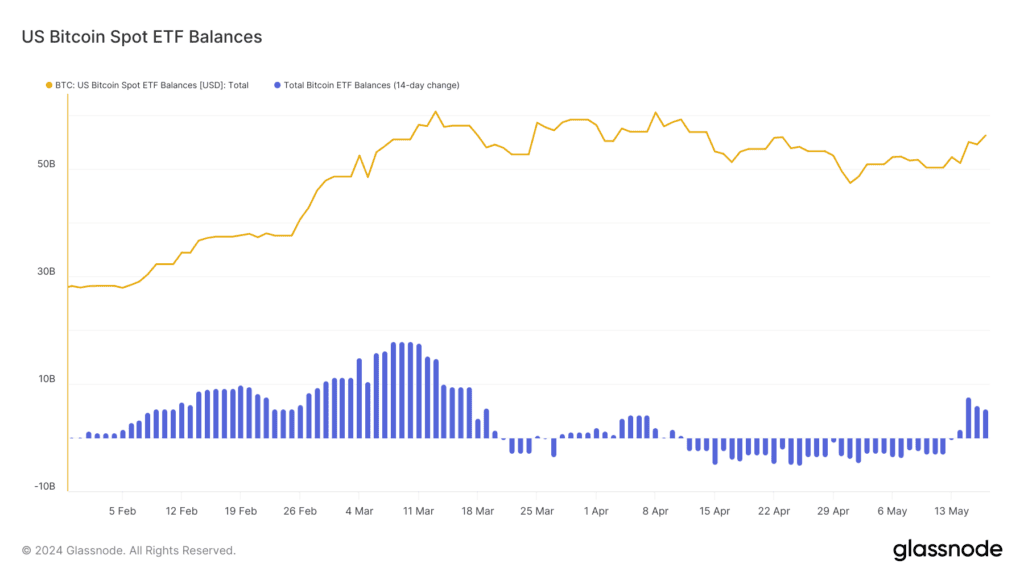

Bitcoin ETF saw net inflows of $948.3 million last week

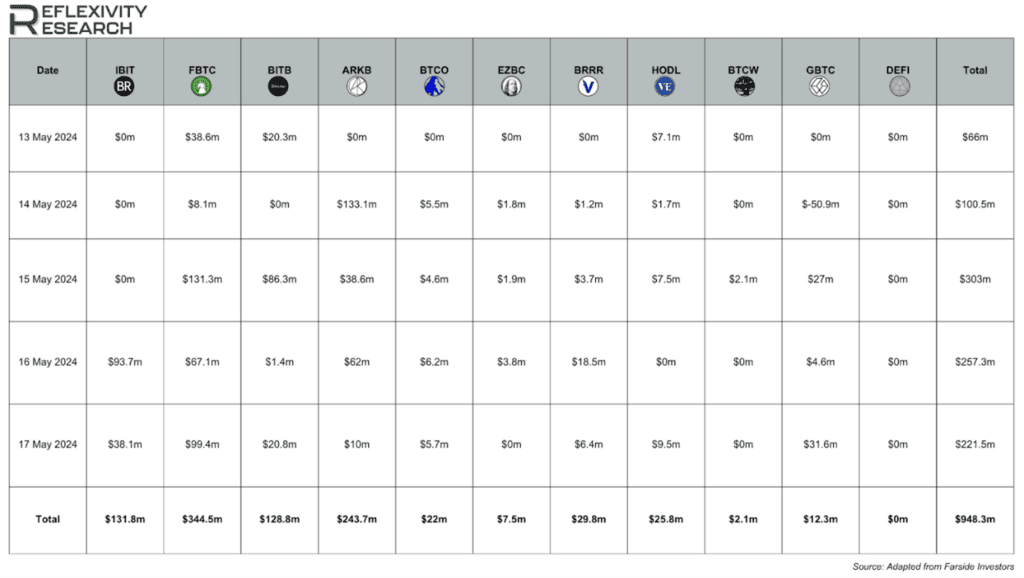

From May 13th to May 17th Bitcoin ETFs saw varied investment flows. FBTC led with $344.5 million in inflows, peaking at $131.3 million on May 15th. ARKB followed with $243.7 million, including $133.1 million on May 14th. BITB accumulated $128.8 million, with $86.3 million on May 15th.

IBIT received $131.8 million, mostly from $93.7 million on May 16th. BTCO, EZBC and BRRR saw inflows of $22 million, $7.5 million and $29.8 million, respectively. Overall, the total net inflow for the week was $948.3 million.

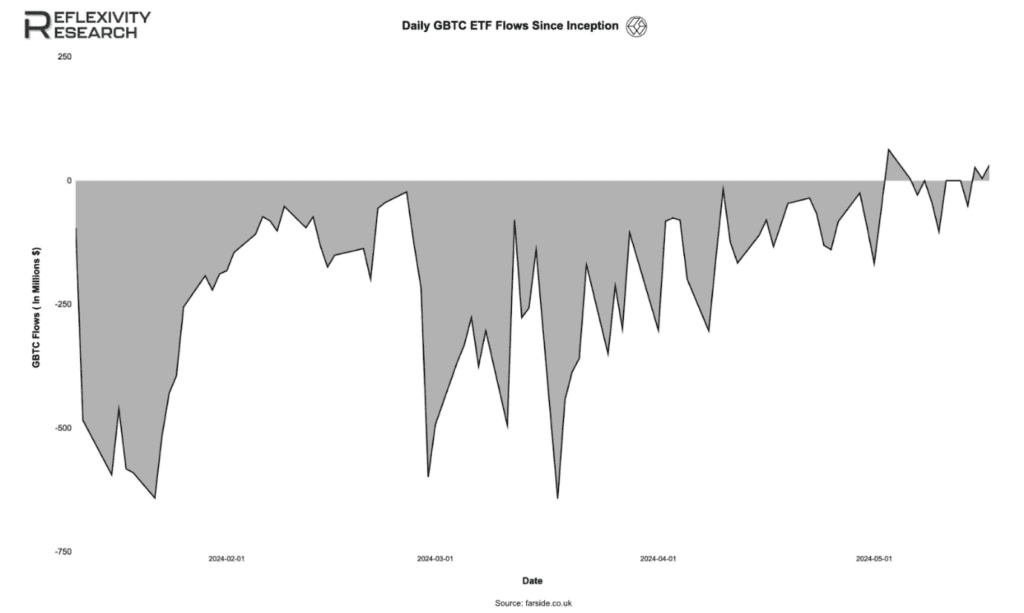

As discussed in our prior weekly report, we have been keeping an eye on the notable change of Grayscales flows, which now appear to be trending consecutively positive in recent days as detailed by the graph below:

Past performance is not an indication of future results

Ethereum ETF Deadline on May 23rd

The U.S. Securities and Exchange Commission is set to make a pivotal decision on several Ethereum exchange-traded fund applications by May 23rd. This deadline is crucial for applications from major firms such as VanEck and Ark Invest.

There is significant skepticism about the likelihood of approval. SEC Chair Gary Gensler has maintained a strict regulatory stance on cryptocurrencies and Ethereum’s classification remains ambiguous. Unlike Bitcoin, widely recognized as a commodity, Ethereum’s status is still debated, raising concerns about possible rejection. Prominent figures in the crypto industry have predicted that Ethereum and other leading cryptocurrencies may eventually be classified as securities, complicating their regulatory landscape and ETF prospects.

Historically, the SEC has been cautious, often delaying decisions on cryptocurrency-related applications to thoroughly assess market manipulation risks and ensure regulatory compliance. Nevertheless, some analysts draw parallels with the Bitcoin ETF approval process, suggesting that persistent legal challenges and strong market advocacy could eventually lead to a favorable outcome for Ethereum ETFs.

FantomFDN unveils the Sonic Network and announces plans for token migration

Last week the Fantom Foundation unveiled more details pertaining to Sonic Network. The launch of the Sonic Network marks a significant advancement, offering a new layer-1 chain with enhanced capabilities. With its native token ($S) and a sophisticated layer-2 bridge connected to Ethereum and other networks, Sonic Network aims to deliver improved performance and broader connectivity. Below is a detailed overview of the key features and initiatives associated with this project:

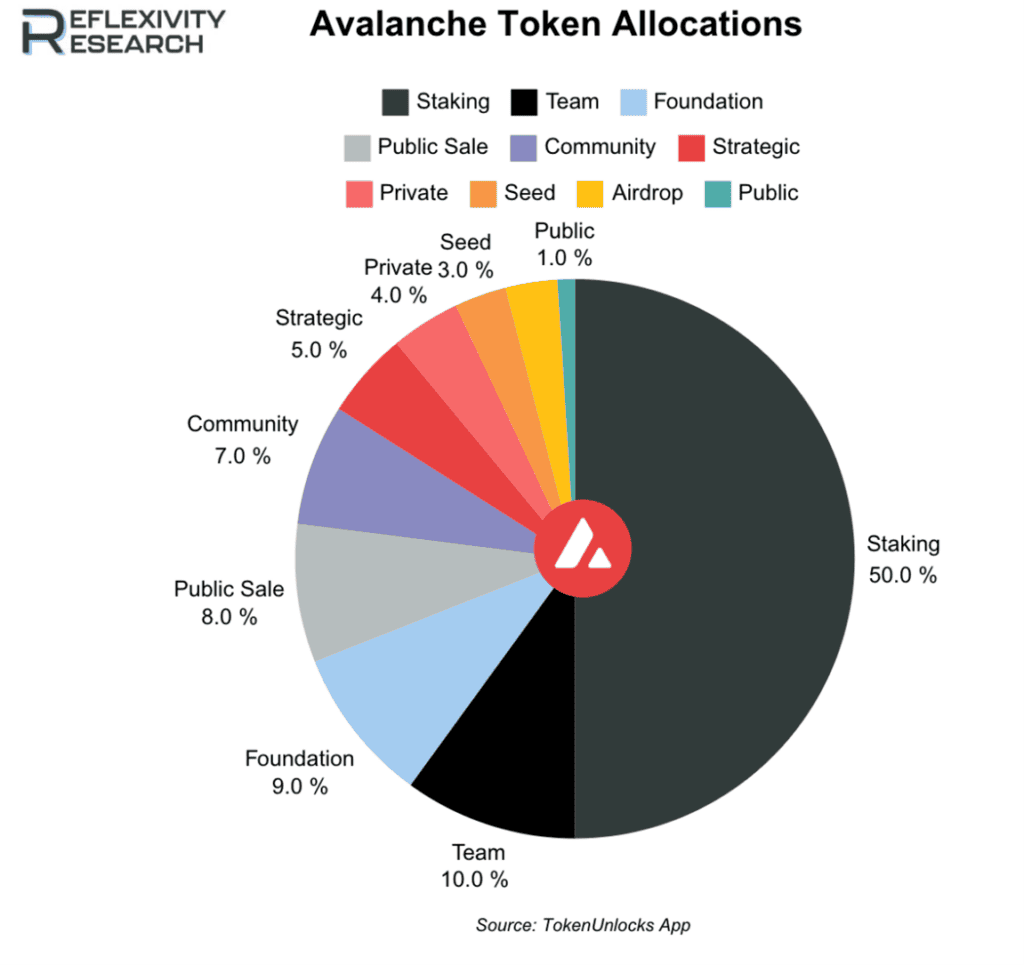

AVAX will unlock 2.49% of its circulating supply on May 22nd

Avalanche will release 2.49% of their circulating supply this week which consists of $83.63 million for Strategic Partners, $61.95 million for Foundation, $167.27 million for Team and $41.82 million for Airdrop.

The content in this post was created exclusively for eToro by Reflexivity Research.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment, and you should not expect to be protected if something goes wrong. Take 2 mins to learn more.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.