In the wake of an ongoing bull run, following a series of Bitcoin all-time highs, the cryptoassets beyond Bitcoin have taken center stage.

If you’ve noticed this – or even if you haven’t – and you’re interested in learning more about what altcoins are, and how they can be part of your investment strategy, keep reading. We’ll explore the altcoin surge, why it’s happening now, and how you can improve your knowledge to make better informed investment decisions.

What are you waiting for? Read on!

Understanding the Altcoin Surge

It’s crucial to recognize the significance of altcoins beyond being mere alternatives to Bitcoin. Altcoins such as Dogecoin (DOGE), Cronos (CRO), recently saw jumps of a staggering 92% and 85% respectively, plus there were several other big movers: Hedera Hashgraph (HBAR), SUI, Bonk Inu, Near Protocol, and Cardano (ADA). Even Ethereum got in on things, and passed $3.3K for the first time in several months. (Source: eToro)

These coins represent a variety of sectors within the crypto ecosystem, from meme-based communities to infrastructure (Layer 0, Layer 1 and Layer 2 blockchain), smart contract platforms and DeFi applications. This diversity in top performers emphasizes the need to understand the unique aspects of each altcoin and to consider a range of assets for balanced exposure.

Understanding Altcoin Volatility in the Bull Run

Just as Bitcoin experiences periodic corrections within a bull run, altcoins are also subject to sharp price fluctuations. During past bull markets, altcoins saw significant drawdowns even as they trended upwards over time.

Recognizing this pattern can help investors manage expectations and maintain composure during inevitable downturns. The cyclical nature of the crypto market—often linked to Bitcoin’s four-year halving cycle—suggests that while gains can be extraordinary, corrections are to be expected.

Understanding the DNA of Altcoins

Understanding altcoins means digging into where they come from. Each cryptoasset has its unique story that gives us key insights into what makes it tick. Whether it’s a native blockchain, a Web3 wonder, a utility token, or one of those trendy and experimental memecoins, such as Toncoin (TON), Pepe (PEPExM) or Bonk Inu (BONKxM) – their origins provide essential background on their purpose, development, and what sets them apart. Having a more comprehensive knowledge of this backstory helps us figure out each altcoin’s strengths, weaknesses, and potential trajectory of an altcoin, offering the ability to hazard an educated guess as to where they could be headed.

The Impact of the Halving and Four-Year Cycle on the Altcoin Market

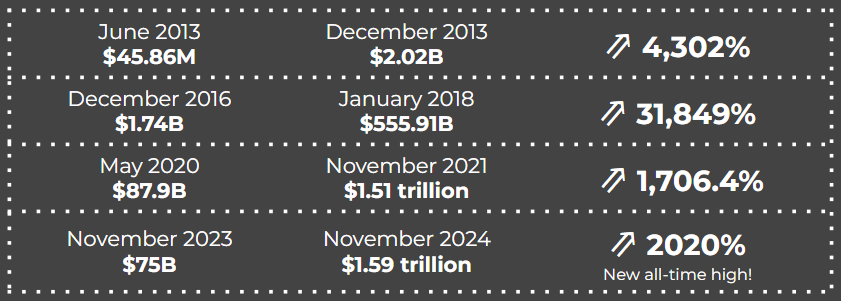

The altcoin surge was not a mere coincidence; it was actually a phenomenon linked to Bitcoin’s halving and the four-year cycle. Historical data shows that after each Bitcoin halving event, altcoins experience substantial growth.

The numbers don’t lie. See here how the altcoin market cap rose at various points following previous Halvings, as well as the most recent Halving event:

Source Messari.io and etoro.com

Past performance is not an indication of future results

As shown above, the figures following the most recent Halving look to be following a similar pattern. Check out the altcoin market cap breakout patterns observed back in 2020, and more recently in 2024 in the below table.

The patterns that emerge in both cases showcase many remarkable gains across various altcoins, further emphasizing the cyclical nature of the crypto market.

| Cryptoasset | Market cap 20/04/24 | Current market cap | Change market cap in % | Approx price May ‘20 | Approx price Nov ‘24 |

| Algorand | $1,558,930,875 | 2,252,673,638 | 44.5 | 0.19 | 0.27 |

| Chainlink | 8,786,478,940 | 11,049,055,422 | 25.75 | 3.59 | 17.59 |

| Decentraland | 897,763,879 | 1,217,672,128 | 35.63 | 0.034 | 0.63 |

| Dogecoin | 23,419,815,063 | 60,012,167,937 | 156.25 | 0.0024 | 0.41 |

| Enjin Coin | 488,057,174 | 507,233,601 | 3.93 | N/A | 0.29 |

| Ethereum | 379,076,411,241 | 413,727,187,984 | 9.14 | 186 | 3435.52 |

| Litecoin | 6,333,420,669 | 7,129,573,512 | 12.57 | 41.6 | 94.38 |

| Solana | 67,583,686,025 | 113,657,587,250 | 68.17 | 0.5154 | 239.06 |

| Stellar | 3,353,785,030 | 14,884,871,207 | 343.82 | 0.0625 | 0.4907 |

| XRP | 29,161,114,973 | 82,342,298,417 | 182.37 | 0.1928 | 1.4399 |

Source: Messari.io

Past performance is not an indication of future results

Information is Power

It cannot be overstressed that thorough research is crucial prior to investing in any altcoin, to be able make informed decisions in this dynamic market.

Empower yourself by leveling up your knowledge, with the help of eToro, till you have what you need to be an effective altcoin investor.

| What you can do | Where to do it | Resources available to you |

| School yourself | eToro Academy | Courses, Guides, Tutorials |

| Listen and learn | Digest and Invest | Podcasts (check out BTC etc), webinars |

| Utilize eToro | eToro | Individual altcoin bios, news feed, historical charts, analysis features |

It’s important to be careful

While the Altcoin surge presents lucrative opportunities, it comes with risks. The aggressive nature of the market cycle should not be underestimated, and you should carefully consider your investments. Risk mitigation is absolutely essential, and central to the process for smart investing.

The four year cycle of the Halving traditionally shows a trend of bearish crypto tendencies, to counterbalance the bullish highs. While the highs tend to be evident in the two years after the halving, what goes up must always come down, and lows inevitably follow, as shown below:

| Altcoins | No. of days to low, post-2020 Halving |

Drawdown percentage | Cycle High | Cycle Low |

| Ethereum | 768 | -81.4% | $4,846 | $902 |

| XRP | 962 | -96.8% | $258 | $8.27 |

| Dogecoin | 768 | -93.2% | $0.74 | $0.05 |

| Litecoin | 764 | -90.1% | $410 | $40 |

| Stellar | 951 | -89.0% | $0.71 | $0.08 |

| Dash | 1201 | -93.8% | $406 | $25 |

| Solana | 963 | -96.3% | $260 | $9.65 |

| Chainlink | 1125 | -90.5% | $52 | $4.98 |

| Polygon | 768 | -88.7% | $2.90 | $0.33 |

| Bitcoin Cash | 1129 | -93.7% | $1,606 | $100 |

| NEO | 959 | -95.7% | $140 | $5.96 |

| Decentraland | 1218 | -95.4% | $5.78 | $0.27 |

| Theta | 892 | -96.3% | $15.02 | $0.56 |

| Enjin | 890 | -96.8% | $4.75 | $0.15 |

| Loopring | 891 | -95.7% | $3.70 | $0.16 |

| Synthetix | 963 | -95.0% | $28.77 | $1.45 |

| Algorand | 1218 | -96.5% | $2.48 | $0.09 |

| Ankr | 963 | -92.9% | $0.21 | $0.01 |

Past performance is not an indication of future results.

We strongly encourage you to stay informed and make thoughtful decisions to navigate potential challenges effectively. Taking a proactive approach allows you to make informed choices, contributing to a more secure and successful financial journey without the need for excessive severity. Utilizing such tools as eToro’s Stop/Loss feature can help you anticipate and manage unexpected events.

Know when to cut your losses – and when to take your profits!

Knowing when to take profits and when to cut losses is crucial for long-term success. Utilizing the practical safeguard of eToro’s Stop/Loss feature is a wise move to ensure the safety of your funds and the effectiveness of your investment.

Stop/Loss is vital for risk management, and means that when you open a position, you establish precise points for potential gains and losses. The feature automatically sells a security when its price hits a set level to limit potential losses. Similarly, if the market moves in your favor, and the trade concludes with a profit, you secure your gains. This disciplined approach protects your capital, can improve your trading performance, and reduces any emotional biases. Think of this utilitarian tool as your personalized risk management system, allowing you to participate in the market while minimizing potential losses.

Diversifying the Altcoin Landscape

Safety in numbers is a key principle in navigating the Altcoin surge, which makes diversifying your investment across the Altcoins market cap a highly compelling option.

SmartPortfolios offer a way to invest in the market cap without needing to individually monitor each asset. Understanding the intricacies of your investment remains crucial, and with its diversified and curated Altcoin SmartPortfolios, eToro streamlines the process utilizing user-friendly features and comprehensive information on each portfolio.

For individuals who prefer a hands-off approach or harbor uncertainties about selecting specific Altcoins, investing in one of the eToro crypto SmartPortfolios, could well be a sensible choice. Specifically, look at the Scalable Crypto and Mid Cap Crypto portfolios, both of which comprise a number of different altcoins.

Furthermore, the blending of the stop-loss option with SmartPortfolios presents a strategic synergy, helping strengthen your risk management strategy as well as ensuring awareness of market shifts – while providing a protective cushion. In the realm of altcoin investments, the stop-loss feature emerges as a pragmatic ally, assisting you in maneuvering the twists and turns of crypto trading.

Conclusion

Navigating the Altcoin surge requires a strategic approach, deeply rooted in education and informed decision-making. From understanding the surge and the four-year cycle to exploring the diverse Altcoin landscape, this piece underscores the importance of caution and risk mitigation.

The vital significance of self-education and thorough research in the dynamic world of crypto cannot be overemphasized. We strongly encourage all our investors to do their own research, and use all the tools and information that eToro provides them in order to make safer and better informed investment decisions.