Major Developments for the Week

- More than 75% of Bitcoin HODLed for 6+ months

- JPMorgan: Bitcoin mining profits hit all-time low

- Analysts remain bullish on crypto outlook despite BTC price drop

- U.S. Treasury Secretary’s trillion-dollar plan could spark Bitcoin bull run

- Nasdaq, NYSE pull crypto ETF applications

- Dubai court sets precedent with crypto salary ruling

- Trump owns millions in Ethereum, earns $7M+ from NFTs

- Harris may extend Biden’s crypto crackdown

- Bitcoin Spot ETFs attract interest despite outflows, price could swing in 2024

- US Marshals may sell Silk Road Bitcoin stash

- Bitcoin dips as gold hits $2.5K milestone

- Tether’s Cantor Fitzgerald CEO joins Trump transition team

- Vitalik Buterin donates $500K from ‘Animal Coins’ to charity

Bitcoin

Long-Term Bitcoin Holders Stay Strong as Short-Termers Struggle

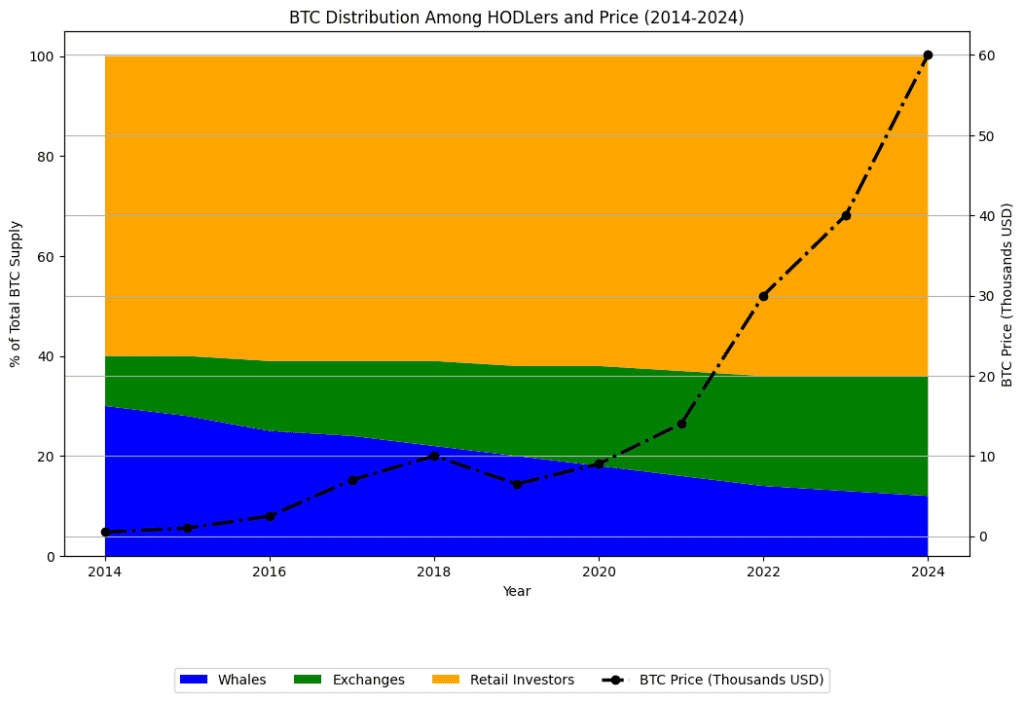

Despite a 21% drop from its all-time high, about 75% of all Bitcoin has remained untouched in wallets for over six months, indicating that long-term investors are holding onto their BTC, potentially anticipating future price gains. This reduced supply of Bitcoin available for trading could lead to price appreciation as demand rises and supply tightens.

Past performance is not an indication of future results.

However, short-term holders, who have held Bitcoin for fewer than 155 days, are facing significant losses, with over 80% currently underwater. This situation could trigger panic selling, as seen in previous market cycles, adding downward pressure to Bitcoin’s price.

Broader market sentiment remains bearish, with the Crypto Fear & Greed Index deep in the fear zone at 28. Although Bitcoin briefly topped $60K, it then fell to below $59K, reflecting ongoing uncertainty in the market.

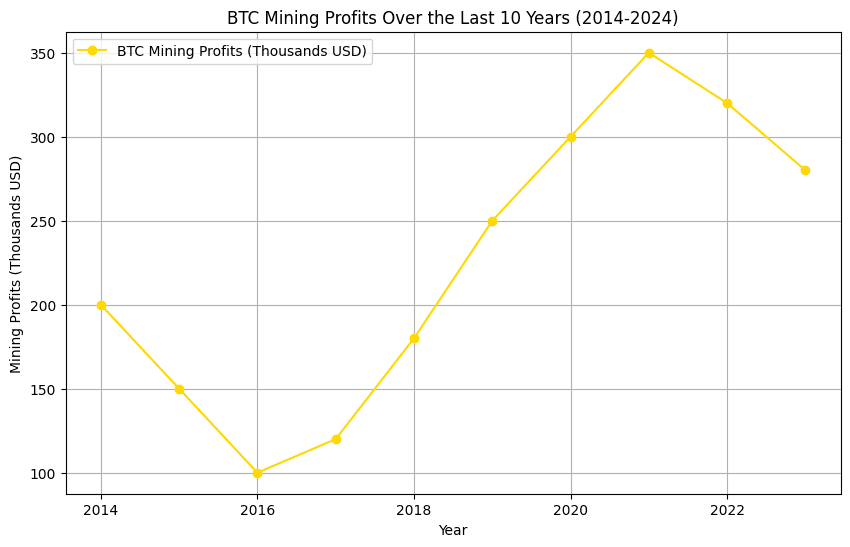

Bitcoin Mining Profits Hit Record Low as Hashrate Surges Post-Halving

Bitcoin mining profitability hit an all-time low in August 2024 due to a rising network hashrate and falling Bitcoin prices. The hashrate, which measures the computational power used to mine Bitcoin, surged by 1%, making mining more resource-intensive while rewards remain 40% lower than pre-halving levels. The April 2024 halving cut mining rewards by 50%, creating financial pressure on miners, and further straining profits as competition increases.

Despite these challenges, US-listed miners have captured 26% of the market, though mining companies saw their value drop 18% in August. While Bitcoin’s price has fallen 5% since the halving, it’s still up 35% year-to-date, and many miners are holding onto their Bitcoin, hoping for a price recovery to improve profitability.

Analysts remain bullish on crypto outlook despite Bitcoin’s price drop

Despite Bitcoin dipping below $59,000 after briefly surpassing $60,000, some analysts remain optimistic about crypto’s prospects for the remainder of 2024. The fall in BTC price has not dampened the overall bullish sentiment among investment desks, who highlight the market’s resilience to recent supply shocks affecting both Bitcoin and Ethereum.

Several factors continue to challenge the crypto market, including geopolitical tensions and uncertainty surrounding the upcoming U.S. presidential election. However, analysts suggest that Bitcoin’s indecision is driven more by concerns over the potential release of Mt. Gox’s significant Bitcoin holdings, which could lead to increased selling pressure.

The Mt. Gox estate, responsible for distributing Bitcoin from the defunct exchange’s hack victims, still holds roughly $2.7 billion in Bitcoin. Speculation around when and how these coins will be distributed has added to market uncertainty, contributing to Bitcoin’s recent price volatility.

Yellen’s Trillion-Dollar Plan Could Spark Bitcoin Bull Run

Bitcoin prices have fluctuated sharply between $70,000 and $50,000 amid concerns over potential U.S. crypto crackdowns and Apple’s announcement of a major update to its Wallet app. Former U.S. president Donald Trump’s suggestion to pay off the U.S. debt using Bitcoin has added fuel to the conversation, with one trader predicting that U.S. Treasury Secretary Janet Yellen’s liquidity injection of up to $1 trillion will trigger a bullish market in risk assets like crypto.

Adding to the speculation, the trader expects China to introduce a massive fiscal stimulus in 2024, which could further drive the crypto market. Economic issues in China have heightened expectations of intervention from the Chinese central bank, with some crypto entrepreneurs predicting a return of China to the digital currency market. As a result, some analysts, including Hayes, forecast Bitcoin prices soaring to $100,000 or even $1 million, sparking rallies in smaller cryptocurrencies as well.

Nasdaq, NYSE Pull Bitcoin ETF Applications, Refiling Expected Soon

Nasdaq and the NYSE recently withdrew their applications to list options for the Bitwise Bitcoin ETF and the Grayscale Bitcoin Trust, following CBOE’s earlier move. These withdrawals come after the SEC extended the review period for these proposals. However, Nasdaq and NYSE are expected to re-file updated applications soon.

Analysts view these actions as part of a trend to refine Bitcoin ETF proposals, with CBOE already submitting a more detailed re-filing. Meanwhile, investor interest in Bitcoin ETFs remains, as Grayscale Bitcoin Trust saw a slowdown in outflows and a rise in activity, signaling continued demand for these products.

eToro’s @BitcoinWorldWide Smart Portfolio offers investors exposure to a diversified range of assets within the Bitcoin ecosystem, aligning with the increased institutional trust and growth trajectory of Bitcoin’s market integration.

More Crypto Updates

Crypto Theft Surges to $1.6B in 2024, May Top $3 Billion by Year-End

Criminals are on track to steal over $3 billion in cryptocurrencies in 2024, with thefts so far reaching $1.6B – nearly double last year’s $857M for the same period. This increase is partly driven by rising crypto prices, which have almost doubled since August 2023. Despite this surge, overall illicit activity in the crypto space has decreased by a significant 20%.

Hackers are shifting from DeFi protocols to targeting centralized exchanges, reversing a four-year trend. One major victim was the WazirX exchange in India, which lost $235M in a July 2024 hack. These incidents highlight ongoing risks, though the value of stolen crypto is influenced by market fluctuations and large-scale hacks.

In other news

Donald Trump’s financial disclosure reveals he holds up to $5 million in Ethereum assets and has earned over $7 million from NFT collections. His holdings include $1.29 million in ether, $900,000 in WETH, and $400,000 in GUA tokens. Despite previously criticizing cryptocurrency, Trump has since embraced NFTs and aims to build a “crypto army.”