Could the crypto recovery be mirroring 2019?

As January’s crypto rebound maintains momentum, dYdX and Fantom are leading with more than 20% gains.

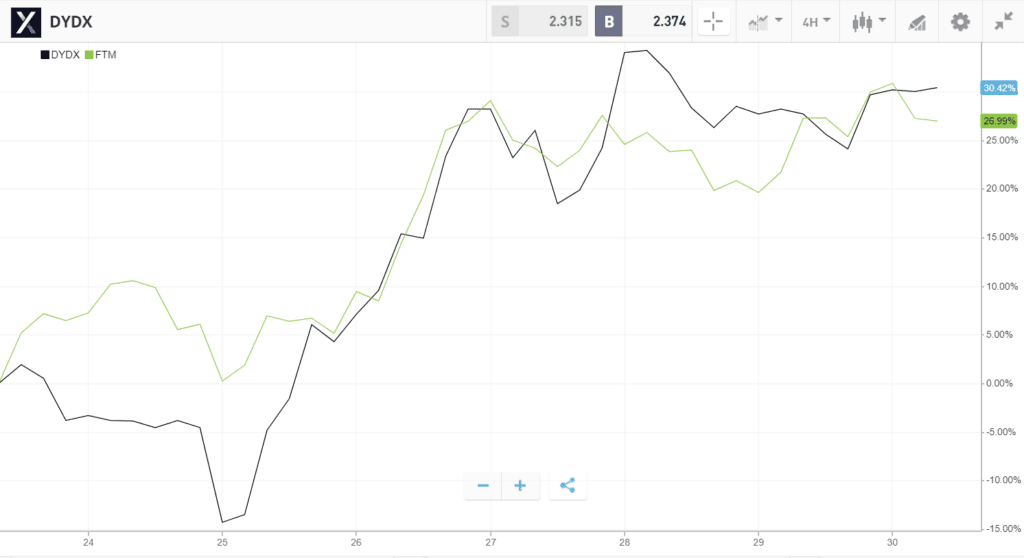

dYdX and Fantom race higher with 30% gains each

The rallies are being supported by macroeconomic tailwinds from cooling US inflation data, along with developments in each altcoin ecosystem: dYdX is benefiting from the delaying of a token unlock until December, while Fantom is rising in anticipation of a number of upcoming upgrades. Similarly, Polygon has popped 16% on reports of an enormous spike in transactions.

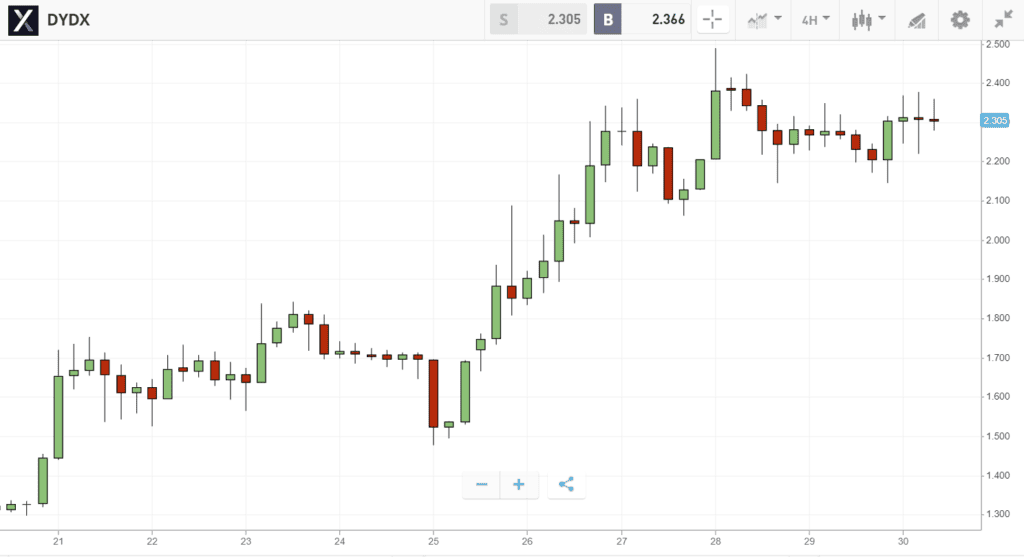

dYdX adds 30% to top $2.30

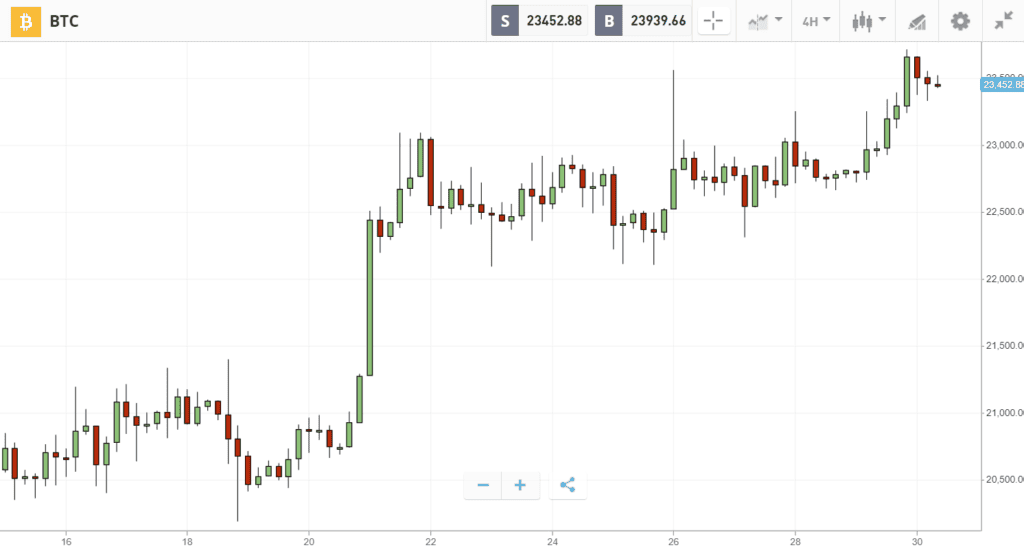

Meanwhile, Bitcoin has notched a third straight week of gains. The leading cryptoasset is now hitting a five-month high above $23K following a declaration from Goldman Sachs that the crypto is the best-performing asset of the year so far.

Bitcoin strengthens above $23K

This Week’s Highlights

– Dydx surges 30% on delayed token unlock

– Polygon pops 16% ahead of mainnet launch

Dydx surges 30% on delayed token unlock

Decentralized exchange dYdX has rallied 30% on news that a token unlock event worth $156 million will be delayed from February until December.

The announcement, published in a blog post on Thursday, postpones a move that would have doubled the circulating supply as tokens were distributed to “investors, employees, and consultants.”

Elsewhere in the decentralized exchange ecosystem, Uniswap finished the week flat, having failed to react to a poll that showed 80% support for deploying the protocol on BNB Chain.

Polygon pops 16% ahead of mainnet launch

One of the best-performing cryptoassets of 2022, Polygon, is extending its winning streak into 2023.

The Ethereum scaling network has surged 16% over the past week to become the tenth-most valuable cryptocurrency, supported by a spike in daily transactions that make it second only to BNB Chain.

Since New Year’s Day, the token is now up 48%, and some analysts suggest the party could just be getting started. Possible bullish catalysts in the coming weeks include the launch of the zkEVM mainnet, and the migration of top NFT projects DeGods and y00ts from Solana.

Week ahead

As the crypto market’s impressive runup continues and the sentiment index tips into Greed, many are wondering whether we could be witnessing the beginning of a sustained uptrend.

In the short-term, the market’s prospects could depend on the size of the next U.S. interest rate hike, which is set to be announced on Wednesday, February 1st.

If the Federal Reserve indicates that aggressive interest rate hikes will no longer be needed, then the bullish crypto trend could be strengthened. This would mirror the price action of 2019, when Bitcoin saw a bullish reversal as the Fed pivoted towards looser monetary conditions.