Occurring approximately every four years, this event is not just a technical procedure; it’s a transformative moment that shapes the future of Bitcoin.

Bitcoin halvings resonate with anticipation among investors. The next halving, due in 2024, is expected to have a profound impact on the crypto market.

Here, we delve into what Bitcoin halving is and the opportunities it can bring — plus five lesser-known facts which reveal Bitcoin halving’s impact on the digital currency landscape.

What is Bitcoin halving and why it matters

Approximately every four years, the reward for mining new blocks of Bitcoin is cut in half. This process was built in as part of Bitcoin’s design and works to reduce the rate at which new Bitcoins are created and released.

Halving is crucial for maintaining Bitcoin’s scarcity and value, ensuring that no more than 21 million bitcoins will ever exist, and preventing it from becoming a deflationary asset.

5 things you may not know about the Bitcoin halving

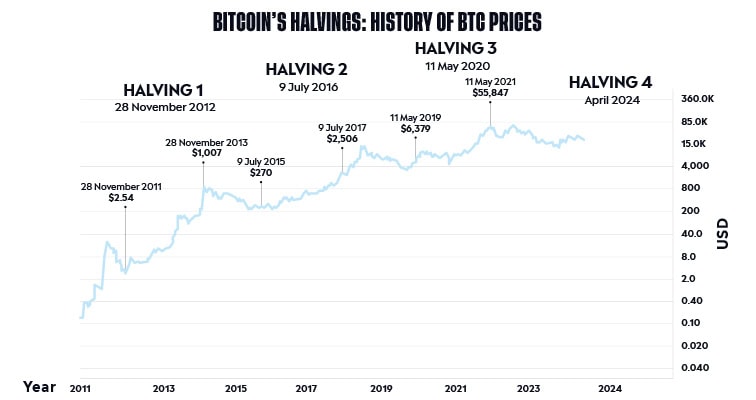

- Its historical significance: Each past halving event has been a critical evolutionary step in Bitcoin’s development (see “Past halvings and their impact,” below).

- Its effect on market value: Price spikes often follow halving events, fuelling speculation and market volatility around these times.

- Its effect on miners: Halving cuts miners’ rewards in half, forcing them to adopt more efficient methods and relocate for lower costs, reshaping the global Bitcoin mining landscape.

- Its social impact: Beyond economics, Bitcoin halving is a cultural event within the crypto community, sparking debates and building a shared sense of excitement and unity.

- Its influence on Bitcoin’s future: The halving is vital in controlling Bitcoin’s inflation and scarcity, enhancing its long-term value and securing its status as a digital equivalent of gold.

Past halvings and their impact

Historically, each Bitcoin halving has led to an increase in Bitcoin’s price. The anticipation and reduced supply have often created a bullish market sentiment and presented a unique opportunity for investors.

Here’s a summary of the last three Bitcoin halving events and their observed impacts on the cryptocurrency’s price:

First Halving: November 28, 2012

Pre-Halving Price: Approximately $12

Post-Halving Impact: The price began to rise significantly after the halving, leading to a peak of around $1,150 in December 2013 — an almost 100-fold increase.

Second Halving: July 9, 2016

Pre-Halving Price: Around $650

Post-Halving Impact: The following year saw a gradual, but consistent increase in Bitcoin’s price, culminating in a dramatic surge to nearly $20,000 by the end of 2017.

Third Halving: May 11, 2020

Pre-Halving Price: Approximately $8,600

Post-Halving Impact: Bitcoin experienced significant growth after this halving, reaching an all-time high of around $64,000 in April 2021.

What’s next for Bitcoin in 2024

2023 was a whirlwind year for Bitcoin. With market fluctuations and increasing mainstream adoption, the “king of crypto” continues to be a focal point of discussion in the investment world.

As we approach the 2024 Bitcoin halving, the context is significantly different from previous halving events. With a more mature market, increased institutional interest, and a growing awareness of digital assets, the impact of the next halving could be unprecedented.

The closer we get to the 2024 halving, the greater the anticipation and excitement will grow — with the entire crypto community and investors worldwide ready to witness the next chapter in Bitcoin’s ever-evolving story.