The speed and scale of Bitcoin’s rise over the last decade caught many investors by surprise. The price climbed thousands of percentage points before they had a chance to buy.

Those with the foresight to recognize Bitcoin’s potential were able to make eye-popping gains by investing at the right time.

History doesn’t repeat itself. It rhymes. And those who missed the boat last time, may be getting another shot.

A second chance

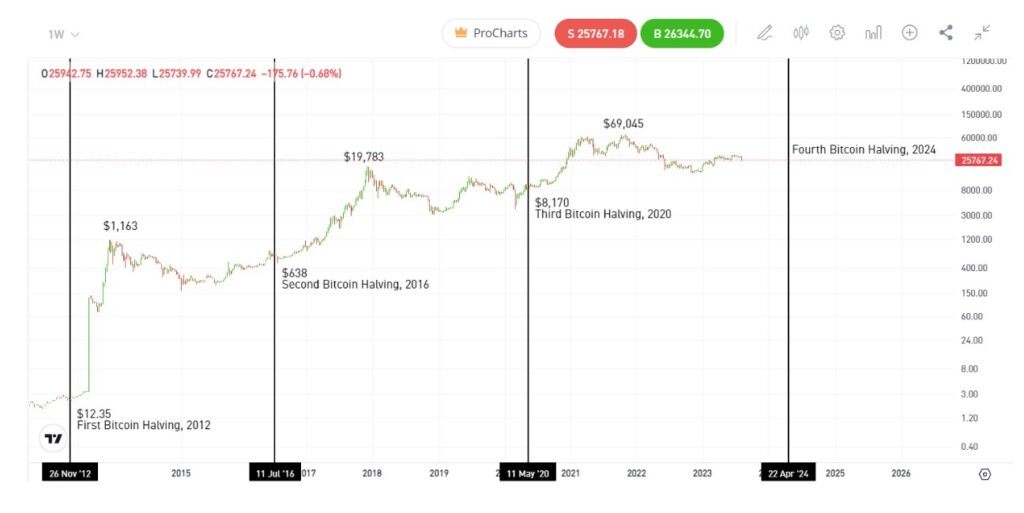

The next Bitcoin halving is predicted to occur in early 2024, and with it another buying opportunity. This event happens roughly every four years, and cuts the rate at which new bitcoin is created in half — creating the powerful characteristic of ever-increasing scarcity that makes the cryptoasset “digital gold”.

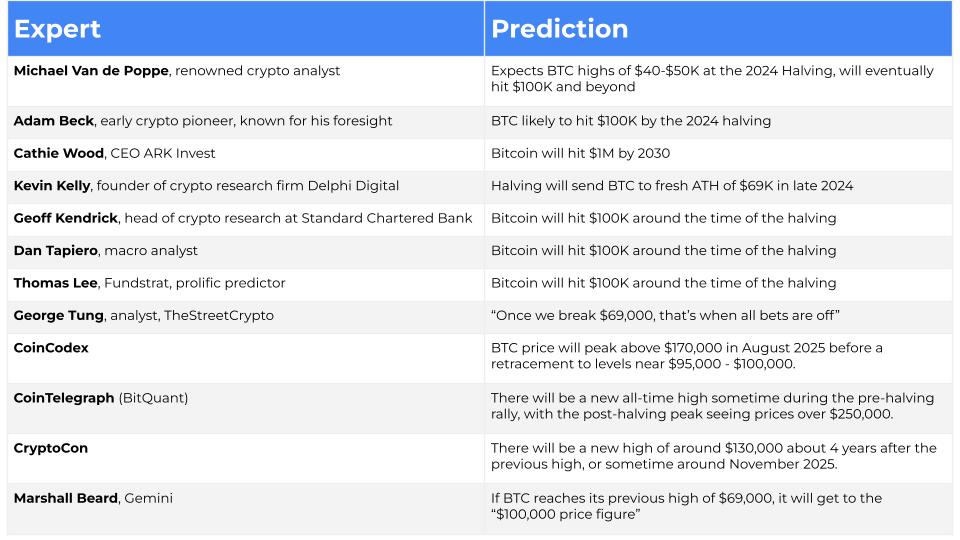

Many of the most seasoned and accurate analysts credit Bitcoin’s halving events with triggering enormous rallies, and are now setting sights on price targets above $100K.

Where will the next halving take bitcoin?

Past performance is not an indication of future results.

Crypto at $100K in 2024?

One of the most renowned price forecasters is crypto analyst Michael Van de Poppe. He predicted with almost laser-like accuracy that bitcoin would hit between $65 to $85K at the end of 2021, and has since said that he expects highs of around $40K – $50K at the 2024 halving, before the price eventually pushes beyond $100K.

Early crypto pioneer Adam Back puts Bitcoin at $100K even earlier. He thinks the cryptoasset will hit six figures around the date of the halving itself. Known for his foresight, Back said in 2019 that Bitcoin would hit $50K — a prediction that came true in early 2021.

Kevin Kelly, the founder of crypto research firm Delphi Digital, has drawn similar conclusions. His analysis concludes that the halving event will put Bitcoin en route to fresh all-time highs above $69K in late 2024. Kelly also has a solid track record, noting at the beginning of 2022 “that a sustained downtrend in global liquidity” was set to disrupt crypto prices.

Calls for $100K Bitcoin around the time of the halving have also been echoed by a chorus of voices from the traditional financial world. These include big names like Geoff Kendrick, the head of crypto research at Standard Chartered Bank, 25-year macro analyst Dan Tapiero, and Fundstrat’s prolific predictor Thomas Lee.

Cathie Wood: Bitcoin will hit $1M

Famed investor Cathie Wood maintains her view that Bitcoin will hit $1M by 2030. Her firm, ARK Invest, is known for making big bold predictions that are rooted in solid mathematical models. The Bitcoin halving is fundamental to her vision, creating steadily increasing scarcity that supports higher prices. As she said earlier this year: “Bitcoin is a store of value and an investment. Limited to 21 million units, so right now the inflation rate is 1.8% per year, that’s what is being mined. In a couple of years that will halve to less than 1% and keep halving until you get to that 21 million…”

Wood’s $1 million dollar Bitcoin vision is matched by countless other analysts, including mega bull Michael Saylor and ex chief manager at Goldman Sachs Raoul Pal. Time frames vary, but all are expecting bitcoin to move in this direction over the next five to ten years.

Doubt Bitcoin at your peril

Although sky-high Bitcoin price predictions are often sneered at, Bitcoin has done one thing repeatedly in its decade-long history: defied the doubters.

For example, while critics were writing obituaries during the Covid crash of March 2020, the few investors who were buying found themselves rewarded with staggering 1,000% gains just over a year later. Similar resurrections have followed each and every bear market thus far, including the collapse of Mt. Gox exchange (thought by many to be fatal) in 2014, and the cold crypto winter of 2018.

With another halving on the horizon, Bitcoin could now be on the cusp of another recovery. This network event marks an important technical change in the reduction of the inflation rate, but has also previously marked a turnaround in sentiment — and an opportunity to move past the falling prices of the bear market.

Be smart when investing in Bitcoin

Of course, what goes up must also come down. In the years immediately following each halving event (2014, 2018, 2022), Bitcoin typically experiences phases of downturn. After the soaring heights achieved in December 2017, it then took more than two years for the asset to get anywhere near that again.

It should also be taken into account that while many enthusiasts and analysts paint an optimistic picture of Bitcoin’s future, it is essential to acknowledge potential drawbacks. Bitcoin’s meteoric rise in price has been characterized by extreme volatility and speculation, which has left some investors wary. The cryptocurrency market is known to be volatile, is constantly subject to regulatory scrutiny, and its price can be influenced by a variety of factors. It is crucial for investors to conduct thorough research and consider the risks involved before making investment decisions in the cryptocurrency space.

However, for investors, the halving means another chance to climb aboard an asset class that has repeatedly outperformed every other financial market on earth.