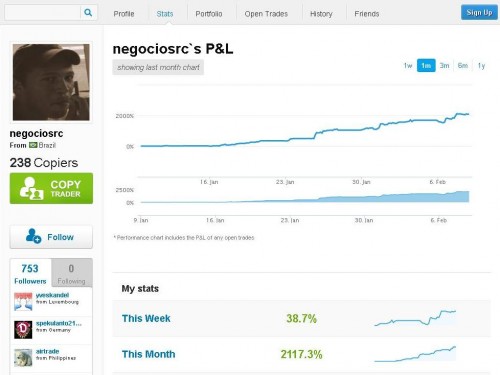

(eToro Blog) This week we decided to take a look at a trader who returned to OpenBook after a long hiatus. Brazilian trader negociosrc began trading again early this year and has posted a 43% profit for the week, and a one month profit of more than 2100%. With 604 followers and 202 copiers already, it is clear that he is destined to become an OpenBook favorite. Over the last month, this trader has traded exclusively in the Euro-Dollar, with 43 trades, nearly evenly split between longs and shorts, returning a profit of almost 27%. Since the trading week began, this trader has closed out 10 positions, eight of them shorts, with profits booked from a low of 1.33% all the way to 78.23%. In reviewing his trading history, this trader hasn’t had a trade go south in nearly three weeks, and it’s clear that he watches his trades carefully. Nearly all of his trades have been manually closed and given the uncertainty of the trading week with the Greek saga continuing to bewilder markets, a watchful eye would seem prudent. As of this writing, the trader has two open trades, one short and a long which is already showing an 92% return but is well off its target of 1.5056; as this trader manually closed out two trades earlier it is a near certainty that the trader is carefully watching this profitable open.

(eToro Blog) This week we decided to take a look at a trader who returned to OpenBook after a long hiatus. Brazilian trader negociosrc began trading again early this year and has posted a 43% profit for the week, and a one month profit of more than 2100%. With 604 followers and 202 copiers already, it is clear that he is destined to become an OpenBook favorite. Over the last month, this trader has traded exclusively in the Euro-Dollar, with 43 trades, nearly evenly split between longs and shorts, returning a profit of almost 27%. Since the trading week began, this trader has closed out 10 positions, eight of them shorts, with profits booked from a low of 1.33% all the way to 78.23%. In reviewing his trading history, this trader hasn’t had a trade go south in nearly three weeks, and it’s clear that he watches his trades carefully. Nearly all of his trades have been manually closed and given the uncertainty of the trading week with the Greek saga continuing to bewilder markets, a watchful eye would seem prudent. As of this writing, the trader has two open trades, one short and a long which is already showing an 92% return but is well off its target of 1.5056; as this trader manually closed out two trades earlier it is a near certainty that the trader is carefully watching this profitable open.

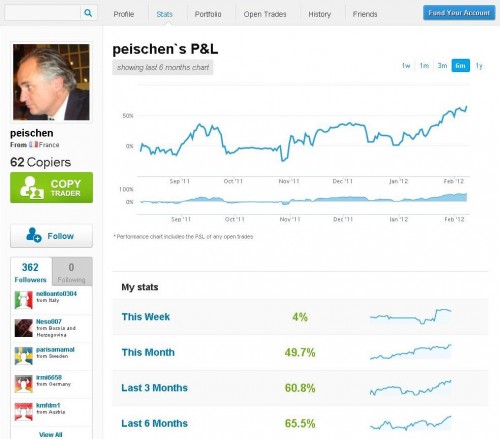

OpenBook trader peischen from France has shown steady improvement in his trading prowess; weekly profits are posted at 4%, monthly at 50%, quarterly at 61% and for the last six months, 65%. Over the past six months, this trader has allocated 53% of his portfolio to a diverse assortment of currency pairs, including USD/CHF, GBP/USD, AUD/USD, EUR/JPY, EUR/USD, USD/JPY, EUR/AUD and NZD/USD. Ironically, over the six month period, his smallest allocation, 0.1% in the USD/CHF pair, had provided the highest return of 9.7%. Conversely, the 49.5% allocation to the EUR/USD pair had provided this trader with a return of only 3.1%. Likewise, the 46.9% allocation in gold has resulted in a loss of 0.4%. In the past month, however, it would appear he has refined his gold trading strategy, as a reduced allocation to 27% has returned almost 2.3%. With 239 followers and 45 copiers, a conservative trader with a low-risk strategy such as his is also well worth a follow.

In economic news, in the Eurozone, the uncertainty took an odd turn on Monday when the Greek government was expected to meet a deadline but ignored it and then was given a new deadline of Wednesday, also ignored. The issue at hand was whether or not the Greek government, and all of the various coalition parties, agreed with the terms and conditions to the second €130 billion bailout loan. Pension reform was the sticking point but late today the Greek government announced an agreement among the parties. With a major debt payment coming due on March 20th, the Greeks were truly in no position to delay their intention much longer. In spite of the uncertainty, the Euro continued to rally with investors, who were at least certain that the Greeks would eventually concede that they are without time and options. Ahead of the ECB announcement, trader wkatsioulis, who follows quite a few gurus, had very nice returns on several of his own trades, posting a 177% and a 169% return.

In the U.S., last Friday’s unexpectedly good data from the Bureau of Labor Statistics showed that the improvement in the U.S. labor situation is not a fluke but an actual trend. The report showed 243,000 jobs created against a forecast of 150,000 and another drop in the unemployment rate to 8.3%. That improvement, however, has resulted in speculation that continued improvements may mean that the Federal Reserve’s recently reiterated commitment to ultra low and enduring interest rates may have to be reconsidered. In testimony to the U.S. Congress, on Tuesday Fed Chairman Ben Bernanke acknowledged that the U.S. economy could slow further, perhaps to 1.1% in 2014, should Bush-era tax cuts be permitted to expire. The bull rally in the U.S. equity markets has helped to give Spanish trader drangie several more opportunities to scalp the SPX500, and though primarily an indices trader a foray into the EUR/USD pair is giving this trader a positive return on the still-open short position.

The Japanese Finance Minister acknowledged that the government has surreptitiously been entering into the currency markets since the well-publicized intervention last year, in an effort to devalue the too-strong Yen. Japanese exporters have complained loudly that the safe-haven currency has made it difficult, if not nearly impossible, to compete in global markets. To that end, Japan reported a 43.9% decrease in the current account surplus, attributed to the decline in exports and an increase in energy imports needed to continue the restoration efforts following last year’s earthquake and tsunami. Trader sigavros continues to favor the JPY crosses and has been scalping gains for both the USD/JPY and the EUR/JPY regularly over the course of the week.

On Monday, the Reserve Bank of Australia surprised markets and analysts by not cutting interest rates any further. The governor of the RBA said that growth and inflation were both largely on target, thus another interest rate cut was unnecessary at this time. It was clear, though, that the RBA intends to keep a close watch on the Eurozone which could impact Australia both directly and indirectly. The Australian Dollar continues to rally against major rivals, rising earlier in the week to a 6-month peak against the U.S. Dollar following the RBA decision. Trader molla01 closed an incredible string of 16 long positions in the AUD/USD over the past day with the lowest return at 81.15%.

Copyright 2012 eToro Blog