Ready-made portfolios offering exposure to diverse asset classes have gained popularity recently, and it’s easy to see why. These products simplify the investment process by reducing the time and effort needed for investment research and portfolio construction.

But how should investors approach selecting a ready-made portfolio? How do these products integrate with other assets such as tech stocks, commodities, and crypto?

Consider your investment goals

When thinking about selecting a ready-made portfolio (or any investment for that matter), a good first step is to clearly define what you’re looking to achieve. Whether you’re building retirement savings or aiming for a short-term goal such as a house deposit, your goals will guide your time horizon and target returns.

Think about your risk tolerance

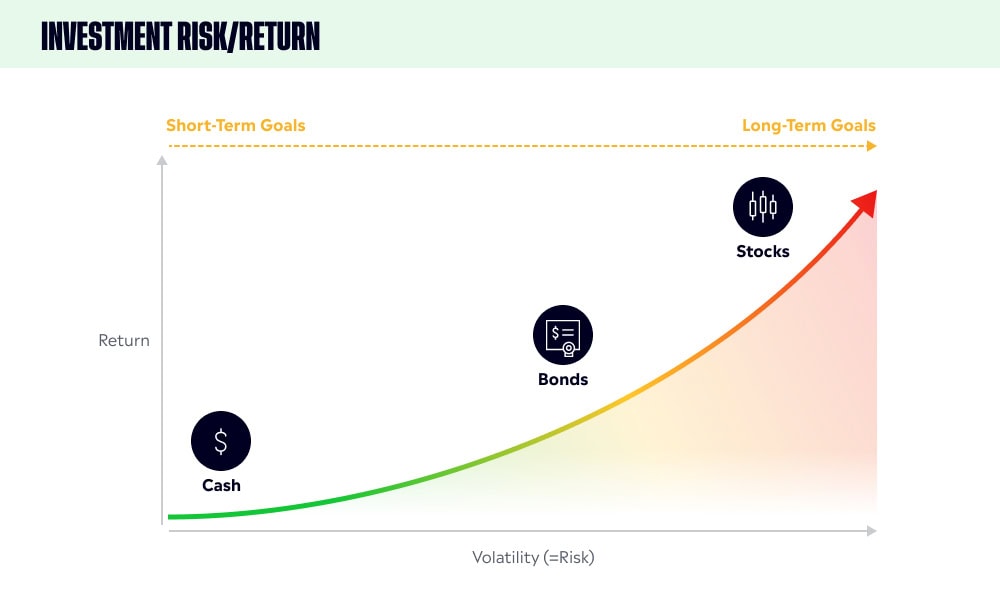

Assess how much risk you’re willing to accept to achieve your goals. This understanding will help to determine suitable assets. Are you comfortable with fluctuations, or is preserving capital a priority? Remember, risk and reward are intrinsically linked; higher long-term returns typically involve more risk.

Learn about stocks and bonds

After considering your goals and risk tolerance, evaluate which asset classes might be suitable. Many ready-made portfolios include a mix of equities (stocks or shares) and fixed-income securities (bonds). While equities offer higher potential returns, but with greater volatility, bonds provide stability and consistent income, making them suitable for different investment strategies.

Understanding how to match a ready-made portfolio to your profile

After assessing your goals, risk profile, and preferred assets, you’ll be better equipped to choose a suitable ready-made portfolio.

The eToro Core Smart Portfolio series (with asset allocation guidance provided by BlackRock) includes five distinct portfolios, each designed for different investor needs and risk profiles.

The five portfolios are:

- Core-Income — This portfolio is 100% fixed income, intended for conservative investors who prioritise stability and cash flow.

- Core-Stability — This portfolio is 20% equities and 80% fixed income, intended for those seeking a cautious, yet growth-oriented strategy.

- Core-Moderate — This portfolio is 40% equities and 60% fixed income, intended for moderate-risk investors who are aiming for steady growth.

- Core-Dynamic — This portfolio is 80% equities and 20% fixed income, intended for investors with a higher risk tolerance and a focus on long-term growth.

- Core-Equity — This portfolio is 100% equities, intended for investors with a high-risk tolerance who seek above-average returns.

Adapting to life changes

Always be ready to adjust your strategy as your life and financial circumstances evolve. Significant life or financial changes might necessitate a shift in goals and risk tolerance. eToro’s Core Portfolios are designed to be adaptable. For instance, if you feel that you are taking on too much risk, you have the option of switching to a lower-risk portfolio.

Combining ready-made portfolios with other investments

Ready-made portfolios can be a comprehensive investment solution, but they can also serve as a foundation for a diversified investment strategy.

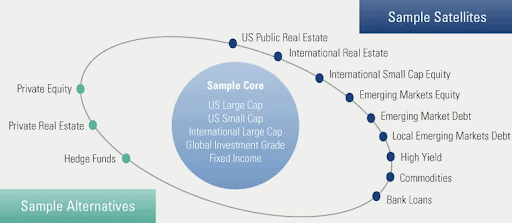

One effective strategy is using them as the foundation of your investment portfolio and then customising it with more niche investments aimed at capitalising on specific market trends, themes, or opportunities (e.g., artificial intelligence stocks).

This is known as a “core-satellite” strategy, balancing diversified passive investments with more targeted, potentially lucrative investments.

Source: Goldman Sachs

Source: Goldman Sachs

The advantage of this strategy is that it combines diversified passive investments with more tactical (and potentially more lucrative) investments to balance growth and risk. By combining broad market-based funds with thematic growth investments, you can potentially build a robust portfolio tailored to your interests and views.

Understanding your financial future

Whether you are a beginner or an experienced investor, understanding how to choose the right ready-made portfolio is important. This decision can influence the trajectory of your investments and, consequently, your financial future.

With eToro’s Core series, there are five ready-made portfolios available, each designed to suit different goals and risk profiles. You can build your long-term investment strategy around one of these portfolios, and if desired, incorporate other Smart Portfolios to explore compelling opportunities in the market.

This article is for informational purposes only and does not constitute investment advice. Always consult with a financial advisor before making any investment decisions.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk. Past performance is not an indication of future results.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.