Investor Name: Dale Doust

Location: South Africa

Username: @Trex8u247

Investment Focus: Stocks

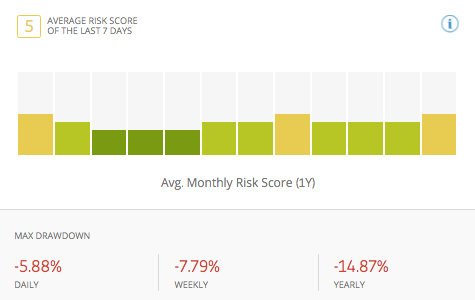

Average Risk Score: 5

Copiers: 85

Followers: 6041

Date Joined: December 2013

Dale Doust, who goes by the user name Trex8u247, is one of South Africa’s most interesting investors, with a proven track record of making money from stocks. Trex8u247 has been with eToro since December 2013, notching up an impressive 70% success rate on his investments. Like many investors, Trex8u247 occasionally has bad months, but his determination pays off because in both 2014 and 2015 he closed 9 out of 12 months in the green!

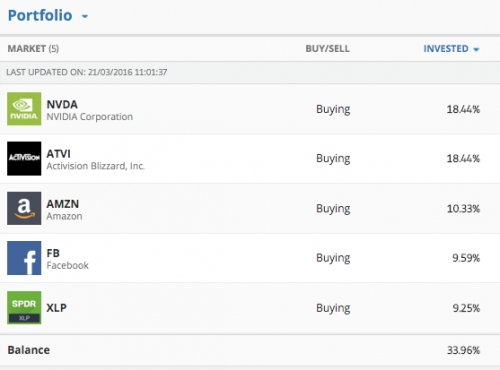

Trex8u247’s portfolio contains some very well-known stocks, including Amazon and Facebook and XLP, one of eToro’s ETFs. The stocks may be high profile but Trex8u247’s approach to investing is low key. It involves a lot of patience, persistence, plus time spent monitoring his investments and developing his investmentskills. Trex8u247 likes to keep his copiers and followers up to date with his portfolio management and investment decisions and it’s definitely worth checking out his News Feed.

Let’s take a look at Trex8u247’s current portfolio:

Part of the key to Trex8u247’s success could be the fact that he clearly enjoys investingand is happy to spend a lot of time on his portfolio and his investments. He also has a realistic attitude towards risk, accepting the need to take calculated risks in order to achieve good returns.

“How much monthly profit do you expect to make using a percentage of your account balance? Hard to say but 4% would be nice every month. What is your attitude towards risk? This is risky work. I know I can’t win them all but I can sure try :)”

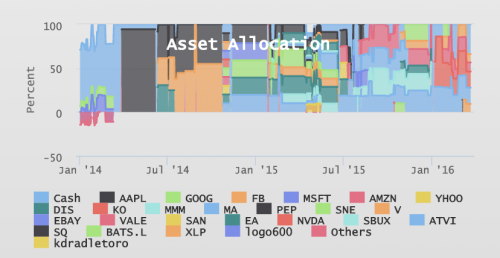

Asset Allocation over time:

Use our Discover People tool to find more Popular Investors.

March could be a very interesting month for stocks traders. The markets seem to be picking up after the difficult start to the year and trading feels bullish again. Commodity dependent companies are still seeing low share prices, and in some cases cutting dividends, but are still hoping for a turnaround. Troubled German car manufacturer VW is also looking for a better results this year after a disastrous performance in 2015. Wise investors will be keeping a close eye on the losers as well as the winners.

Past performance does not guarantee future results. You should not rely on any past performance as a guarantee of future investment performance. Unit values and investment returns will fluctuate. Investors are cautioned that data based on less than five years’ experience may not be sufficient to establish a track record on which investment decisions can be based. This post is not investment advice. CFD trading bears risk to your capital.