We have teamed up with Investor-Ai to bring you a new type of smart portfolio

Artificial intelligence (AI) is not sci-fi, and it’s not cool tech for nerds. AI is playing a direct role in our lives — from accessing Alexa, to seeing Netflix suggestions. And now it is building your next investment portfolio.

Next-generation smart portfolio: InvestorAi-US

You are probably thinking this seems pretty revolutionary! Artificial intelligence completely built this portfolio? Not so much. The new GPTCHAT is writing computer programs, speeches for members of Congress and so much more.

That is why we have teamed up with InvestorAi to build a new AI-based smart portfolio. InvestorAi has been building its capabilities in AI and applying these to equity and crypto markets for the past three years. Since eToro was established 16 years ago, we have been at the cutting edge of technology to provide our members with the best, most advanced products. We think AI can provide added value to investors and support their decision-making processes when weighing how and where to invest.

Below, we will explain the rationale behind the portfolio and the process of building a portfolio through AI.

Knowledge is key

Knowledge is power. We have all felt this truth in our lives. It is certainly the case for investing. Those with an information advantage can use it to make better decisions about which stocks to invest in and which to avoid.

In the past, large investment institutions employing many analysts had more access to data and company insights than the average investor. This gave them a clear upper hand in the investment world. With the rise of the Internet, data has become readily available to all who seek it. Simultaneously, major banking institutions began to offer self-service investing, and new investment institutions were established whose primary goal was to provide a platform that educates and allows individual investors to make their own investing decisions, thus, reducing the need for money managers.

But there is a catch

Nevertheless, we still believe that active management has a place. The fact that so much information exists, doesn’t mean it will be utilised correctly. Data gathering, analytical capabilities (human or otherwise), the ability to control emotions and neutralise biases are all critical for making prudent investment decisions. In these cases, machines can often do a better job.

The advantage of computers

Computationally, a machine can process far more data, much more quickly than a human can, and will do this systematically and without regard for emotional / sentimental attachment. Where AI is at an advantage is the ability to recognise and identify patterns that may not form part of the dominant valuation frameworks previously used, but that given the cyclical nature of markets, can be identified and repeated.

The quality of these insights improves with more data. Therefore, as the data available on the markets and individual stocks grows exponentially, AI models should continue to generate even more accurate insights. The key to unlocking this is asking the right questions and then solving the right problem. InvestorAi does this by blending investment and financial expertise with machine learning and computer vision techniques.

Building a portfolio through AI

The starting points for InvestorAi’s portfolios are the insights generated from its equity models. These models utilise a combination of technical, fundamental, sentimental, and proprietary factors to generate insights daily. While they look to combine and allocate the strongest signals to their portfolios, they also run additional validation and constrain the portfolio with several rules. Typical constraints considered are the percentage of cyclicals vs. defensive sectors, market cap percentages, and sector concentration. This enables the construction of model portfolios that should deliver positive returns, while being sensitive to other key metrics.

The portfolios that are moved beyond the model stage and to implementation are then validated against, among other factors, information ratio, overall beta, max drawdown, total volatility, and return during stress periods.

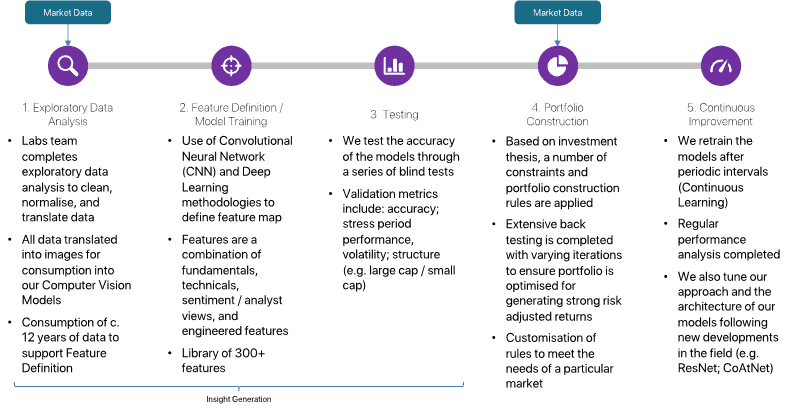

Process of building an AI portfolio

Technical aspects of an Ai portfolio

All of InvestorAi’s portfolios follow a consistent process that combines bottom-up stock selection, driven by the machine, with top-down constraints based on key theses or alignment to certain factors or themes. In the US equity portfolio for example, the initial investment universe is screened to filter out those companies with high leverage and significant sales decline.

Rather than taking an approach to define a particular price target or intrinsic value, the focus is on pattern recognition. Using deep learning and computer vision technology, the models are trained on c. 12 years of data to identify patterns that meet a particular problem statement, the output of which is a feature map or image that can be compared to daily data. This enables InvestorAi to process a large amount of data, c. 900 data points per stock, per day, which are then compared to the learnt pattern that matches the problem statement. In this way, the company moves the AI solution to focus on image classification rather than defining a particular stock price.

Stronger together: InvestorAi and eToro

We are excited that our first partnership with InvestorAi will be the launch of InvestorAi-US Portfolio at the end of January. This is a smart portfolio that rebalances monthly and takes the best insights on US stocks from the momentum model. It is easily accessible from the Smart Portfolios section on our website.

Copy Trading does not amount to investment advice. The value of your investments may go up or down. Your capital is at risk