Depositing funds into your account – FAQ

- How do I deposit?

-

Funding your account is quick and simple. While there are various payment methods at your disposal, using eToro Money allows you to get more for your money, as it means that you enjoy zero conversion fees on USD deposits. Setting up your eToro Money account takes seconds, and has no setup costs or hidden fees*.

To deposit to eToro, simply choose whichever method you prefer and follow the steps below to make a successful deposit:

- Log in to your account

- Click on “Deposit Funds”

- Enter the amount and select the currency

- Finally, select your preferred deposit method

* See “How do I fund eToro Money?”

Note: Click here to see if eToro Money is currently available in your region.

- Is depositing safe and secure?

-

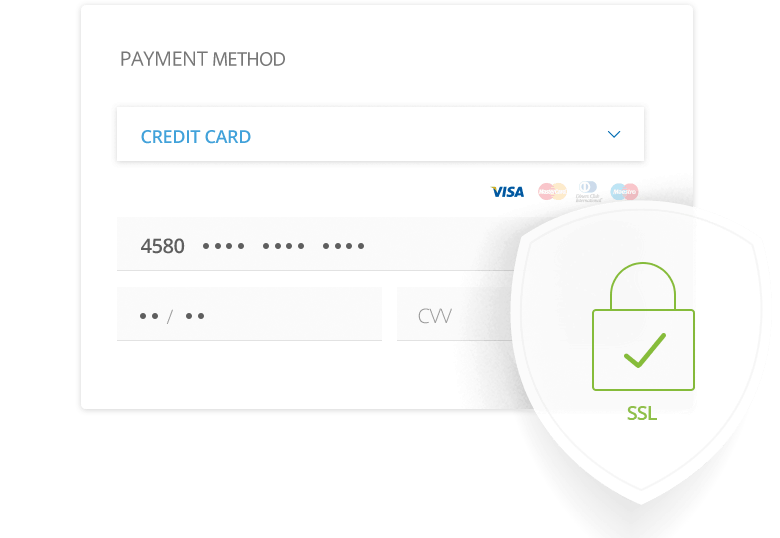

Yes, depositing money into your eToro investment account from any UK bank account or from any other method of payment is absolutely safe, private and secure. All transactions are communicated using Secure Socket Layer (SSL) technology, ensuring that your personal information is kept safe.

Depositing funds into your eToro investment account using eToro Money is secure and fast, with your cash funds safeguarded in a regulated bank account.

Furthermore, the eToro Money crypto wallet (found in the Crypto tab on your eToro Money app) is one of the safest crypto wallets available, with several high-level security features to protect against unauthorised access, including multi-signature facilities, DDoS protection, and standardisation protocols.

- Payment methods and limitations

-

For your convenience, we’ve provided a range of payment methods.

Below is a list of the available methods:Method Time Currencies Countries Max Single Deposit – See *a Withdraw Available? More info eToro Money Instant GBP,EUR See availability here 500,000$ Y (instant withdrawal) Must have funds available on your eToro Money account balance Credit/Debit Cards Instant Available in certain countries, click here for more information International $40,000 Y Supported cards: Visa, MasterCard, Visa Electron and Maestro. Transactions will appear on your statement as: Etoro or etoroprod.wpengine.com. Transactions in the EEA region may require authentication. See *b PAYPAL Instant USD, GBP, EUR and AUD International – See *c $10,000 Y Must have an active PayPal account with funds available on the account balance or a credit/debit card linked to it. NETELLER Instant USD, GBP, EUR International – See *d $10,000 Y If you don’t have a Neteller account you can create one on www.Neteller.com SKRILL Instant USD, GBP, EUR International – See *e $10,000 Y If you don’t have a Skrill account you can create one on www.Skrill.com iDEAL Instant EUR The Netherlands $55,500 Y There is no need to register with Ideal to make a deposit, but you will need to have access to your online banking system to complete the transaction. BANK TRANSFER 4-7 business days USD, GBP, EUR, AUD, AED, CHF, DKK, NOK, PLN, SEK, HUF, RON, CZK International Unlimited Y – See *g Please always quote the Transaction ID to prevent delays in crediting the funds.

When possible, please make sure you transfer funds to the bank account in the same currency as your own bank account (USD, EUR or GBP), to avoid unnecessary bank chargesOnline Banking – Trustly (EU region) – See *h Instant EUR, GBP SEK, NOK Sweden, Norway $40,000 N There is no additional registration process for this payment option. You will be required to access your online banking account to complete the transaction. Powered by Trustly. Przelewy 24 Instant PLN Poland $11,500 Y There is no additional registration process for this payment option. You will be required to access your online banking account to complete the transaction. *a – Unverified accounts are limited to a total deposit amount of $2,250.In order to upgrade your account to Verified status, please contact Customer Service.

eToro reserves the right to change any of the deposit limitations indicated at any time.*b – Worldpay is one of the providers that eToro uses for credit/debit card processing. For these credit card payments, Worldpay is the Data Controller of the information submitted. For more information and their privacy policy please visit Worldpay.

*c- PayPal is not currently supported for deposits for clients of eToro (UK) Ltd and eToro (Seychelles) Ltd, and in the following countries:Algeria, Antigua and Barbuda, Argentina, Aruba, Belgium, Belize, Bermuda, Bolivia, Brazil, Cayman Islands, China, Colombia, Costa Rica, Dominica, Dominican Republic, Ecuador, El Salvador, Falkland Islands, French Guiana, Honduras, India, Mayotte, Morocco, Netherlands Antilles, Paraguay, Peru, Reunion Island, Saint Lucia, Saudi Arabia, United Kingdom, Virgin Islands.PayPal is available only after the first deposit in the following countries:Bulgaria, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Gibraltar, Greece, Hungary, Iceland, Ireland, Israel, Jersey Island, Jordan, Kenya, Latvia, Lithuania, Malaysia, Malta, Netherlands, New Zealand, Norway, Oman, Poland, Singapore, Slovakia, Slovenia, South Africa, Spain, Sweden, Switzerland, Taiwan.PayPal is no longer available to users under the FCA regulation for deposit of funds to the eToro balance.

*d – eToro does not support Neteller in: UK, Germany, France, Italy, Spain, Netherlands, Czech Republic, Romania, Austria, Ireland, Portugal, Poland, Slovakia, Denmark, Bulgaria, Belgium, Finland, Sweden, Hungary, Greece, Slovenia, Luxembourg, Croatia, Lithuania, Malta, Cyprus, Latvia.For a list of countries not supported by Neteller, click here.

*e – eToro does not support Skrill in: Austria, Bahrain, Belgium, Bulgaria, Chile, Colombia, Croatia, Cyprus, Czech Republic, Denmark, Estonia, Finland, France, Germany, Greece, Hong Kong, Hungary, Indonesia, Ireland, Italy, Kuwait, Latvia, Lithuania, Luxembourg, Malaysia, Malta, Mexico, Netherlands, Peru, Philippines, Poland, Portugal, Qatar, Romania, Singapore, Slovakia, Slovenia, Spain, Sweden, Switzerland, Thailand, UK, United Arab Emirates.

*f – Funds deposited using Trustly become withdrawable within 7 business days of deposit.

*g – Transactions are completed instantly in most cases. However, at times completion may be delayed, as it is dependent on confirmation from your bank.

*h – The following UK banks restrict deposits made using Trustly to a daily limit of £5,000.Bank account owners can increase the amount to up to £20,000 per day by contacting their bank and asking about the special Payments Limit page.Affected banks:1. Natwest Bank2. Royal Bank of Scotland3. Ulster Bank (Northern Ireland)

- Payment service provider for eToro (Europe) Ltd

-

Payment Service Provider Authorising Body Worldpay Financial Conduct Authority (UK) Checkout Autorité de contrôle prudentiel et de resolution (France) Payabl Central Bank of Cyprus (CY) eToro Money Financial Conduct Authority (UK) Paypal Commission de Surveillance du Secteur Financier (Luxembourg) Skrill Financial Conduct Authority (UK) Neteller Financial Conduct Authority (UK) Zotapay Money Service Operator (HK) Nuvei Central Bank of Cyprus (CY) - Automatic Recurring Deposits

-

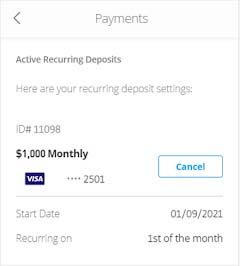

An automatic recurring deposit is when you schedule an amount of money to be automatically deposited from your credit/debit card into your eToro account on a time specific basis. You decide the amount of money, the type of currency and schedule for the deposit using a credit card that has already been connected to your eToro account.

How Can I Start Recurring Deposits?

- After making a successful credit card deposit with the card connected to your eToro account, a banner on the “deposit confirmation screen” will offer you the option to make a recurring deposit.

- Go to “Settings” and click on “Recurring Deposits” Then, click on the banner titled: “Recurring Deposits.”

How Do I Set My Recurring Deposits?

1.Select the amount and currency

2.Select one of your Credit/Debit Cards that is connected to your eToro account

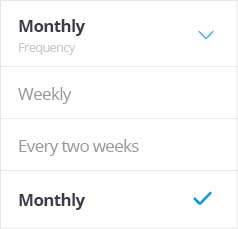

3.Select the frequency of your deposit [weekly, every two weeks, monthly]

Weekly: an automatic deposit is made once a week

Every two weeks: an automatic deposit occurs every two weeks.

Monthly: an automatic deposit occurs once a month.

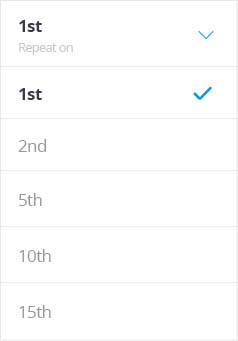

4.After selecting the frequency, you have the option to customise the date and/or day of the deposit, or accept the default option which is a monthly deposit occurring on the 1st of each month.

5.You can view your scheduled deposits or make changes here

- What is the minimum First Time Deposit?

-

Depending on your region and country regulations, the minimum first-time deposit to private accounts varies between $10 and $10,000.

For up-to-date minimum deposit amounts for each region, click here.

Please note the following:

– Unverified accounts are limited to a total deposit amount of $2,250.

– To upgrade your account to Verified status, please contact Customer Service.

– eToro reserves the right to change any of the deposit limitations indicated, at any time.

When registering a corporate account, different guidelines may apply. For more information, click here.

- Why can’t I deposit using a payment method under another person’s name (3rd party payment)?

-

eToro does not allow third-party payments. A third-party payment is a deposit made using a payment method that is not in the same name as the owner of the eToro account. As stated in our terms and conditions, the owner of the trading account should be the owner of the funds. Therefore, there is no option to make a deposit using someone else’s payment method.

- How do I deposit by credit/debit card?

-

To deposit using a credit/debit card, please click the “Credit Card” option from the drop-down menu, and enter the following details:

- Card number

- Expiration date

- CVV (3 digits on the reverse side of your credit/debit card)

Within minutes, your account should be credited with the funds. If your request is not approved for any reason, you will be notified via email.

The transaction will show as “eToro (Europe) Ltd.” on the financial statement of your payment provider.

- How do I deposit by bank transfer?

-

To deposit funds by bank transfer into your eToro investment account:

- Click on ‘Deposit Funds’ at the bottom left of your screen.

- Choose the currency and the amount. Different details will be given for different currencies, so make sure you have chosen the correct currency.

- Select Bank Transfer as the payment method and click ‘Continue’. The bank transfer details will appear on the screen and be sent to you by email.

- Log into your bank’s web service (or go to your bank) to transfer the funds.

- Enter the transaction ID and your username as the payment reference.

- Complete the transfer and open a new ticket in our Customer Service Center to send us a screenshot of the payment confirmation (or a scanned copy of the SWIFT document from the bank).

Here are some notes to keep in mind when depositing by bank transfer:

- Bank transfer deposits may take 4-7 business days to process.

- Your eToro investment account will be credited once the transfer has been confirmed by our bank.

- The exchange rate for converting to USD (if applicable) is calculated on the day eToro receives the deposit in our account.

- You may be charged by funding providers involved in the transfer (intermediary bank, receiving bank).

- How do I deposit using iDEAL?

-

iDEAL

- iDEAL enables you to make online payments in a reliable, secure and easy way. Payments are made using the online banking environment of your own bank.

iDEAL involves a direct online transfer from your bank account to the business bank account. - Available countries: The Netherlands

Available currencies: EUR - Supported banks: ABN AMRO, ASN Bank, Bunq, ING, Knab, Moneyou, Rabobank, RegioBank, SNS, Svenska Handelsbanken, Triodos Bank and Van Lanschot

- Maximum single deposit: $50K

How to deposit:

- Enter deposit amount

- Select iDEAL

- Select your bank and click ‘Submit’

- When redirected to your bank, enter your bank credentials

- Authorise the payment directly through your online bank account.

- iDEAL enables you to make online payments in a reliable, secure and easy way. Payments are made using the online banking environment of your own bank.

- How do I deposit using Online banking – Trustly?

-

- An online banking transfer via Trustly allows customers to carry out bank payments simply, quickly, and securely. No additional registration is required.

- Available in the following countries: Estonia, Finland, Latvia, Lithuania, Norway, Sweden

- Available for the following currencies: EUR and GBP

- Maximum single deposit: $40,000 USD

How to deposit:

- Enter the deposit amount

- Choose ‘Online Banking’ and click ‘Submit’

- Choose your bank

- Enter your bank credentials

- Authorise the payment directly through your online bank account

- Which currencies does eToro support?

-

eToro offers three account currency options: USD, GBP, and EUR.

For UK users

If you’re based in the UK, a GBP account allows you to:- Deposit and fund trades in GBP

- Trade GBP-based assets with no FX conversion fees

- Enjoy lower conversion fees when trading assets in other currencies

Learn more about the GBP account

For EU users

If you’re based in the EU, you can open a EUR account. This gives you the ability to:- Deposit and fund trades in EUR

- Trade EUR-based assets with no FX conversion fees

- Enjoy lower conversion fees when trading assets in other currencies

Learn more about the EUR account

For users in other regions

You can deposit to your USD account using your local currency, and it will be converted to USD when it reaches your account.

See conversion fees and supported deposit currencies

Check availability in your country - Can I deposit from a Business Account?

-

Please be advised that using any corporate method of payment to deposit into a personal eToro trading account is against our terms and conditions. We can, however, offer you the option to open a corporate trading account.

Depending on whether your business is a sole proprietorship, partnership or corporation, certain documentation will be requested to set up the Business trading account.

If your PayPal account is not linked to a real business, and you wish to continue to use this for depositing, please downgrade your account to a premium or personal account through PayPal. - Is there a minimum for deposits made after the First Time Deposit?

-

Yes. All deposits other than the First Time Deposit (which varies from country to country) are required to be at least $50. For deposits made by wire transfer, the minimum required is $500.

- How do I fund eToro Money? A step-by-step explanation of how to fund your account

-

There are two ways to fund your eToro Money account.

- Manual bank transfer

- Fast bank transfer

Manual bank transfer

1. Add eToro Money as a new payee to your bank account, if you have not yet done this.

- In the Cash screen, which is the opening screen in the eToro Money app, click the Account tab. Your eToro Money Account number and sort code are displayed here.

- Click Copy Details and then share them with your existing bank account.

2. You can now transfer your funds to your eToro Money account. Most payments happen instantly, but some can take up to 2 hours.

Fast Bank Transfer (currently available in the UK only)

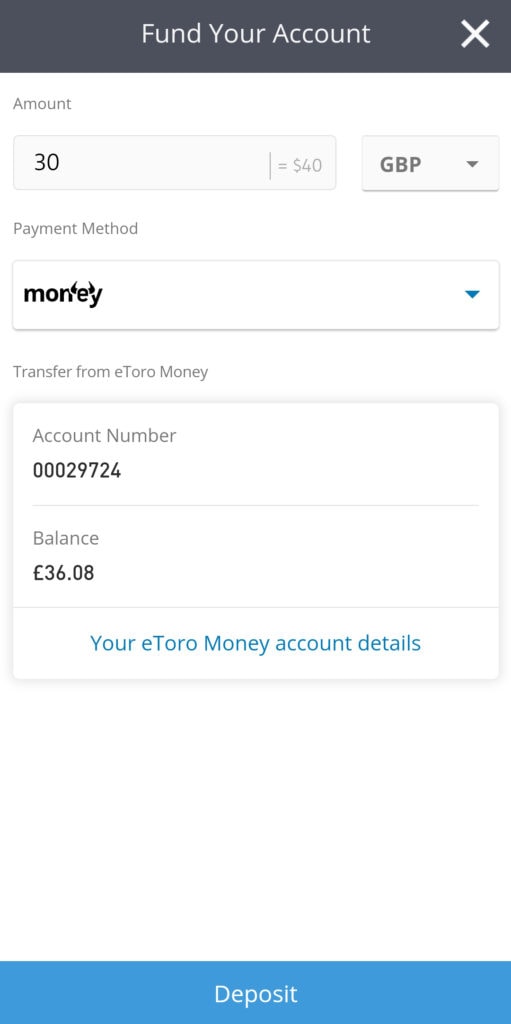

- Click Deposit Funds, from within your eToro account.

- In the Fund Your Account window, select eToro Money (it should already be the default option)

- Tap Top-up eToro Money balance at the bottom of the screen.

- Enter the amount you want to Top-up.

- Fast Bank Transfer is the default method selected, and is recommended. This means you’ll be able to make the payment from your bank account without leaving the platform or entering any bank details. The other option is Regular Bank Transfer, and will direct you to make a manual bank transfer.

- The Auto transfer option is set to ON by default. This will ensure the funds you transfer to your eToro Money account will automatically be transferred to your eToro investment account. If you deselect this option, the funds will remain in your eToro Money account.

- Tap Continue.

- Select your bank.

- Select Pay faster next time so the system remembers your details the next time you deposit.

- You’re redirected to your banking app where you can follow the instructions to approve the transaction.

- The funds are now transferred to your eToro Money account. If you selected the Auto transfer option, the funds will be transferred on to your eToro account to complete your deposit.

* Notes:

When making a payment into your eToro Money account, you may encounter an error. This could be one of two possible issues:

- Your bank could require 11 characters for the BIC (Bank Identification Code), and your BIC code is only 8 digits long. To resolve this, add uppercase XXX (3 X’s) to the end of your BIC code.

- If you’ve been asked to select a country along with your IBAN number, please ensure that you enter either Germany, France or Malta (depending on whether your IBAN number starts with DE, FR or MT), rather than the country you’re from. This is because we use French and Maltese IBAN numbers. Most banks automatically recognise the country of the IBAN number, but some still ask you to enter it manually.

- How do I deposit funds to my eToro investment account using eToro Money?

-

There are two ways to fund your eToro account, according to your residence country:

- Deposit to eToro using eToro Money (UK)

- Deposit to eToro using eToro Money (Europe)

In the UK

- Click Deposit Funds, from within your eToro account.

- In the Fund Your Account window, select eToro Money (it should already be the default option)

- Enter the amount you want to deposit.

- If you have enough funds in your eToro Money account, simply click Deposit and the deposit will be completed instantly.

- If you don’t have enough funds in your eToro Money balance, tap Top-up eToro Money balance.

- Enter the amount you want to Top-up.

- Fast Bank Transfer is the default method selected, and is recommended. This means you’ll be able to make the payment from your bank account without leaving the platform or entering any bank details. The other option is Regular Bank Transfer, and will direct you to make a manual bank transfer.

- The Auto transfer option is set to ON by default. This will ensure the funds you transfer to your eToro Money account will automatically be transferred to your eToro investment account. If you deselect this option, the funds will remain in your eToro Money account.

- Tap Continue.

- Select your bank.

- Select Pay faster next time so the system remembers your details the next time you deposit.

- You’re redirected to your banking app where you can follow the instructions to approve the transaction.

- The funds are now transferred to your eToro Money account. If you selected the Auto transfer option, the funds will be transferred on to your eToro account to complete your deposit.

Note: Most payments happen instantly, but some can take up to 2hrs, depending on your bank.

In Europe

Step 1. Fund your eToro Money account

- Add eToro Money as a new payee to your bank account, if you have not yet done this.

- In the Cash screen, which is the opening screen in the eToro Money app, click the Account tab. Your eToro Money Account number and sort code are displayed here.

- Click Copy Details and then share them with your existing bank account.

- You can now transfer your funds to your eToro Money account. Most payments happen instantly, but some can take up to 2hrs.

Step 2. Deposit to eToro using eToro Money

- From your eToro investment account, click Deposit Funds. Your eToro Money account should now display as the default option, so make sure that it is selected.

- Enter the amount you wish to deposit, and click Deposit. A confirmation screen will then be displayed.

Notes:

When making a payment into your eToro Money account, you may encounter an error. This could be one of two possible issues:

- Your bank could require 11 characters for the BIC (Bank Identification Code), and your BIC code is only 8 digits long. To resolve this, add uppercase XXX (3 X’s) to the end of your BIC code.

- If you’ve been asked to select a country along with your IBAN number, please ensure that you enter either Germany, France or Malta (depending on whether your IBAN number starts with DE, FR or MT), rather than the country you’re from. This is because we use French and Maltese IBAN numbers. Most banks automatically recognise the country of the IBAN number, but some still ask you to enter it manually.

- How do I deposit using Przelewy 24?

-

- Przelewy 24 is an online payment service in Poland that allows you to make a secure deposit from your Internet banking portal directly to eToro. You don’t have to register and no information is stored that can be used to access your bank account.

- Available in Poland

- Available for the following currency: PLN

- Maximum single deposit: $11,500

How to deposit:

- Enter the deposit amount

- Choose Przelewy 24 and click “continue”

- Select your bank

- Enter your bank credentials

- Authorise the payment directly through your online bank account