Your eToro Money GBP account works alongside your eToro USD account. Choose GBP or USD – whichever fits your investment strategy! Holding funds in both currencies gives you full flexibility. Buy GBP-based assets without any currency conversion, or when buying USD-based assets, convert only the funds needed for purchase.

What’s New

July 2023: Winner of ‘Best New Payments Brand’ at PayTech awards

June 2023: EU customer upgrades enabled

March 2023: Google Pay in UK launched

Feb 2023: New eToro Money app design launched

Jan 2023: eToro Money balance counts towards Club tier

2022: Direct Debits in UK launched

Deposit and hold in GBP

Deposit in the same currency as your bank account and avoid unnecessary conversion fees. Hold funds in GBP as well as USD, in order to manage currency exposure based on your investment strategy.

Fund trades of GBP-based assets with no FX fees

Avoid unnecessary conversion fees when trading GBP-based assets by using your GBP funds, or when buying non-GBP-based assets, convert only the amount you need.

Exclusive eToro debit card

Spend your money anywhere, anytime, including market leading exchange rates across the globe.

Make faster, safer payments with Google Pay and eToro Money – simply add your eToro card to your Google Wallet.

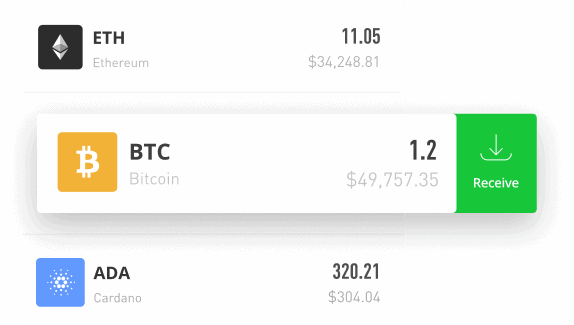

Manage your money & crypto in one place

As well as managing your fiat currency, you can also securely store, send and receive the world’s most popular crypto in the eToro Money app.

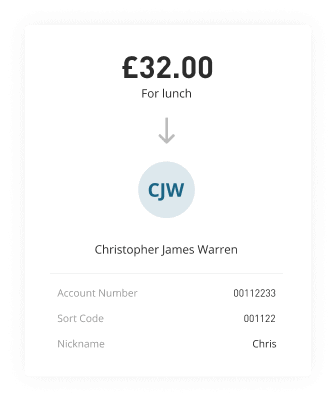

Easily send and receive money

Use your eToro Money GBP account to send and receive money to and from friends and family.

Legal bits: GBP account (eToro Money UK Ltd.) services only available to UK residents. eToro Money services are designed for the purpose of making payment transactions. Funds in your GBP account are safeguarded per regulatory standards but are not covered by the Depositor Protection Scheme (FSCS in UK) – please refer to the safe and secure page for further information. eToro Card is exclusive to eToro Club members, and can be used anywhere Visa is accepted. FX competitiveness based on research by eToro. UK bank transfers only. Currently only crypto-to-crypto conversion is available. Club members will continue to enjoy Club offers alongside the eToro Money benefits.

eToro Money Terms & Conditions

Terms & Conditions | Acceptable Use Policy | Fees and Limits | Privacy Policy | Complaints Policy

View our Open Banking guide and Open Banking API documentation. Only registered Third-Party Providers (TPP) can access production data

Essential Contact Information

Card activation and/or cancellation: UK (Toll free) +44 80813 48401 | International +44 20386 82903 | Banking indemnity claims: +44 20331 84618 | Compliance issues: etoromoney-compliance@etoro.com | Customer service queries

FAQ

- What is the eToro Money card and how can I use it?

-

The eToro card is tied directly to an eToro Money Account. You can use it as you would any Visa debit card. You can use it to pay and shop at home, online, and abroad, with market-leading exchange rates. You can review our Acceptable Use Policy if you wish to check which types of transactions can’t be made with an eToro Money Account.

The eToro card is only available in certain regions, see here for availability.

- Am I eligible for an eToro Money Account?

-

To be eligible for eToro Money, you must hold a verified eToro investment account.

Further eligibility requirements:

See list of countries where eToro Money is available here.

The eToro card is currently only available in the UK. Silver, Gold, and Platinum Club members in the UK are eligible for the Green Plan (which includes the Green eToro Card), and Platinum+ and Diamond Club members are eligible for the Black Plan (which includes a Black metal eToro card with enhanced benefits). Find out more in the Fees section.

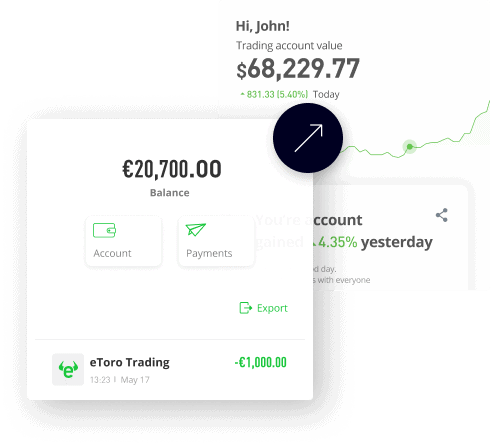

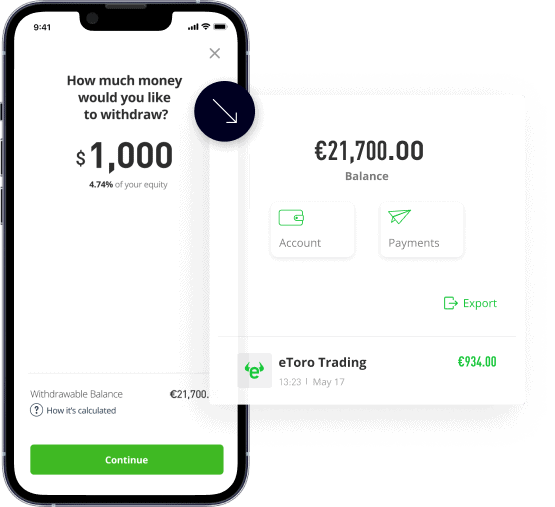

- What does ‘instant withdrawal’ to eToro Money mean?

-

“Instant withdrawal” means that you can transfer your available funds from the eToro investment platform instantly to your eToro Money account.

We offer instant withdrawals to most of our eToro Money customers. However, for various reasons including security requirements and procedures, some withdrawals may be only processed on the next business day.

- How are the funds in my eToro Money account protected?

-

Funds held in your eToro Money account are not protected by the banking depository compensation scheme (e.g FSCS in the UK and the depository compensation scheme in Malta). Your funds are held in a designated safeguarding account at an authorised credit institution in the UK and the EU respectively. Unlike banks, these safeguarded funds cannot be used by eToro Money for anything other than for facilitating your payment transactions. This means that your funds held by eToro Money are protected at all times and in the unlikely event of insolvency, your losses are restricted to the cost of repatriation of funds only.

- How will eToro keep my data protected?

-

eToro Money keeps your data safe in accordance with the General Data Protection Regulatations, and it’s implementation in localised laws. You can find out more within our Privacy Policy.

- What are my rights when making payments in the EU

-

See here for your rights when making payment in the EU.