How eToro Money Keeps Your Money Safe

The safety and security of your money is our top priority at eToro Money.

We like to look at it in two ways:

The safety of your money

The security of your app and account

Protecting your money

Protecting the money we hold for you

We keep your funds in a designated safeguarding account with a fully regulated bank in the UK or the EU, depending on your country of residence. These funds cannot be used by eToro Money for anything other than facilitating your payment transactions, which means we can’t go and invest it in the markets, lend it to other clients, or use it otherwise.

We safeguard your funds

Safeguarding is a protective measure we take to ensure your funds are securely held in a separate account at a fully regulated bank in the UK, or with Qualified Money Market Funds (QMMFs). This approach ensures that your money remains safe and accessible, providing an extra layer of security for your assets. These funds cannot be used by eToro Money for anything other than facilitating your payment transactions, so, for example, we can’t go and invest it in the markets or lend it to other clients. This means that, in the unlikely event of insolvency, your funds held by eToro Money are covered in their entirety, other than the cost of returning the funds to you.

How are the funds in my eToro Money account protected?

Unlike banks, eToro is not allowed by law to use or re-invest client’s funds. Therefore, in the unlikely event of insolvency, your funds held by eToro Money are covered in their entirety, other than the cost of returning the funds to you. Since we safeguard all your funds, eToro Money is not required by the law to adhere to the banks’ Financial Service Compensation Scheme (FSCS) in the UK, or the Depositor Compensation Scheme (DCS) in Malta (for our European services). These effectively only protect a limited amount (£85,000 in the UK, and €100,000 in the EU) of your funds in case of default. In contrast, eToro Money is obliged to protect your funds in their entirety.

Where your funds are held

In addition to the safeguarding measures described above, your funds are held with a Financial Services Compensation Scheme (FSCS) protected bank or in Qualified Money Market Funds, as approved by the FCA.

The bank we hold your funds with is covered by the Financial Services Compensation Scheme (FSCS). This means any eligible funds we hold with them for you, are guaranteed up to £85,000 per person, in the unlikely event that they fail. If you have a separate account with that bank outside of eToro, that account will also contribute to the total amount of your cover. You can find out more on the FSCS website.

A portion of your funds are also held in Qualified Money Market Funds (QMMFs), which are highly secure funds made up of low-risk investments such as government bonds. The QMMFs we use are managed by leading fund managers such as Blackrock and JP Morgan Asset Management. These QMMFs are also segregated from corporate assets and are fully recoverable in the highly unlikely scenario that eToro has to wind down its business. You can learn more about QMMFs here.

We’ve got your back

We are legally obliged to continually monitor our financial health. To ensure your money remains safe, our regulators in the UK and Malta (for our European services) require us to:

- Have the way we manage and hold your money independently audited at least annually.

- Have plans and monitoring in place, ready to share with our regulators on request, to avoid insolvent wind-down.

- Ensure the banks at which eToro Money holds your funds remain of good repute and in good financial standing.

- Report to our regulators, at least annually, on matters related to our financial standing; including sharing eToro Money’s independently audited annual statement of accounts.

Account & App security

“Hardened” security

eToro takes a very proactive approach to app security. We are constantly developing and updating features to help identify security breaches, whether it be hacking or any other abnormal activity, to ensure we keep your money safe. Not only is our verification process extremely thorough, we also follow a security convention known as “hardening”, which means that from the moment you log into the app, your identity is carefully encrypted and any app activity is closely monitored.

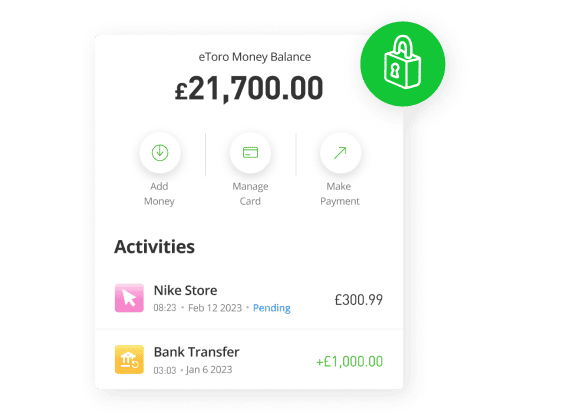

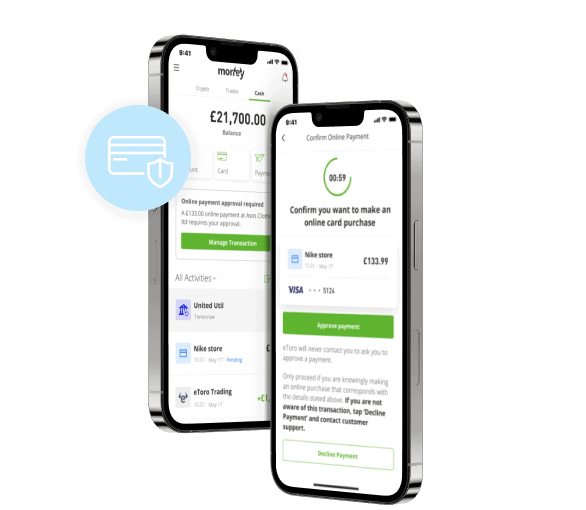

Your online payments are safe with us

When you make an online payment with your eToro card (available to UK Club members only) the store is required to ask us whether we believe it’s really you trying to make the payment, something also referred to as 3D Secure. Unfortunately not all merchants ask for these checks yet, so with us, if they don’t ask for these checks, we won’t let it through. Consider it an added layer of security for your money.

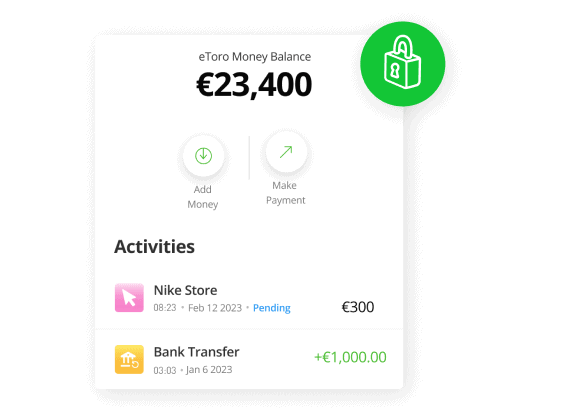

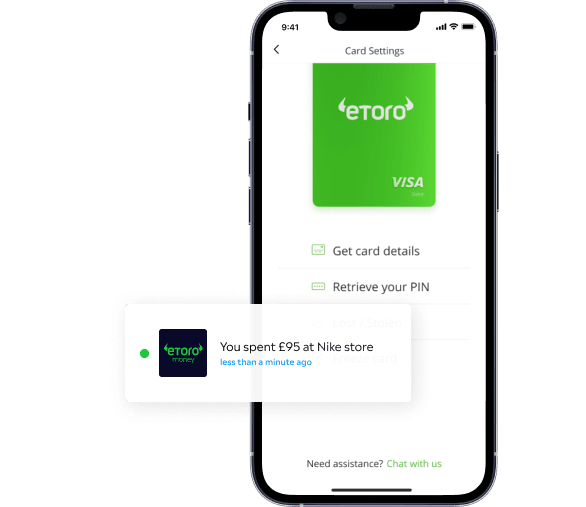

Helping you identify and prevent fraud

We will send you real-time push notifications everytime you pay for something, or transfer or withdraw your funds. This way, you can stay on top of what’s happening with your money, and spot any unusual activity early. If you have an eToro card, and something does not look right or you lose it you can always “freeze” it from the app, and “un-freeze” it once resolved.