This article dives into long-term investment strategies for the S&P 500. Following on from our initial guide on the S&P 500, we offer guidance for investors with a long-term outlook and how you could potentially enhance your outcome with this index.

The power of long-term: The key to S&P 500 investing?

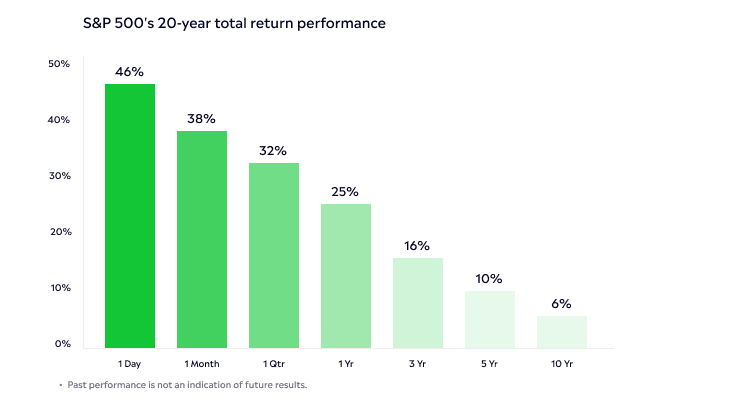

The S&P 500‘s historical performance showcases the power of long-term investing. By holding investments in this index over extended periods, investors could increase their chances of reaping the rewards of steady growth and compound interest. As demonstrated in our chart of the S&P 500’s 20-year total return performance, the index has averaged annual yields of 10.13%. This robust growth is a testament to the resilience and potential of the global economy over time.

Tips for long-term S&P 500 investing

- Patience could be profitable: Long-term investment requires patience. The S&P 500’s history shows that despite short-term fluctuations, staying invested over the long haul typically results in favourable returns.

- Consistency over timing: Regular contributions to your S&P 500 investments, rather than trying to time the market, can lead to significant gains over time due to dollar-cost averaging.

- Diversification within the index: While the S&P 500 itself offers diversification, consider varying your holdings within the index to mitigate sector-specific risks, for instance, by investing in different S&P 500 sector-focused funds such as technology, healthcare, and finance.

The Warren Buffett perspective

Echoing our previous guide, Warren Buffett’s philosophy on long-term index investing holds true. He famously said,

Understanding the long-term horizon

Long-term investing in the S&P 500 isn’t just about enduring the ups and downs; it’s about understanding and leveraging the cyclical nature of markets for enduring gains. This approach harmonises with the index’s design to reflect and capitalise on broad market trends over time.

The S&P 500’s role in a diversified portfolio

Incorporating the S&P 500 into a diversified portfolio offers strong potential for long-term growth, but it’s crucial to complement it with various other investment types to suit your risk preferences and financial objectives, ensuring a well-rounded investment strategy.

Final thoughts

The S&P 500 is worth considering for long-term investors, offering a blend of stability, diversity, and growth potential. Its track record over decades underscores the benefits of a patient, consistent investment strategy. As we’ve seen, the S&P 500 is more than just an index; it’s a pathway to potentially stable long-term investment goals.

Visit the eToro Academy to deepen your understanding of long-term investing strategies.

FAQs

- How do different economic cycles affect the performance of the S&P 500 over the long term?

-

Economic cycles, including periods of expansion and recession, and interest rates can significantly impact the S&P 500. Historically, the index has shown resilience, recovering from downturns to achieve growth over the long term, reflecting the overall strength of the diversified companies within it.

- How do inflation and interest rate changes impact long-term investments in the S&P 500?

-

Inflation, and interest rates can affect the S&P 500; typically, high inflation or rising interest rates can lead to short-term declines. However, over the long term, the index has shown the ability to adjust and continue its growth trajectory.

- Is there an optimal time or market condition for entering a long-term investment in the S&P 500?

-

While timing the market is challenging, long-term investing is less about finding the perfect entry point and more about consistent participation. Starting to invest and continuing regularly, irrespective of market conditions, often yields the best long-term results.

ASIC disclaimer:

eToro Service ARSN 637 489 466 promoted by eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. Capital at risk. Other fees apply. See PDS and TMD

This communication is general information and education purposes only and should not be taken as financial product advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial product. It has been prepared without taking your objectives, financial situation or needs into account. Any references to past performance and future indications are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

EU Disclaimer:

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.

UK disclaimer

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 51% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.