The S&P 500, the benchmark of the global stock market, frequently garners attention in index investment discussions. This article delves into its popularity, selection criteria, historical performance, and evaluates its pros and cons, offering in-depth insights into the world’s most significant index.

The allure of index investing

The trend toward index investing, with the spotlight on the S&P 500, reflects a shift in investment strategies. This method prioritises long-term average returns with minimal effort, often outperforming active stock selection.

The evolution and selection of the S&P 500

Since its inception in 1957, the S&P 500 has continually evolved to accurately represent the most prominent US publicly traded companies. A dedicated selection committee meticulously considers factors such as market capitalisation, liquidity, and trading volume to ensure the index’s relevancy and representativeness. The S&P 500 undergoes regular quarterly reviews, during which it is rebalanced.

This rebalancing process can have significant effects on companies entering or exiting the index. When a company is added to the S&P 500, it often experiences increased demand for its shares, as mutual funds and other investment vehicles that track the index buy shares to align with the index’s composition.

Conversely, companies that are removed from the index may see a decrease in demand for their shares, as they are sold off by funds tracking the index. This rebalancing ensures that the S&P 500 remains a current and dynamic reflection of the broader market, making it a vital tool for investors seeking exposure to the US economy and a benchmark for comparing the performance of actively managed portfolios.

A global market snapshot in one index

The S&P 500 is not just a reflection of the US market; it’s also renowned for its diverse and comprehensive coverage. This index includes significant international corporations and spans a multitude of industries, offering investors broad exposure to the global economy.

Its careful selection of companies and wide-ranging representation make it a preferred choice for investors and a benchmark against which the performance of many actively managed portfolios is measured. This solidifies the S&P 500’s position as a leading index in the financial world, widely used for evaluating investment performance across various sectors.

If it’s good enough for Buffett

Warren Buffett, the world-famous value investor, renowned for his investment acumen, has long advocated for consistent investing in index funds, particularly those tracking the S&P 500. He famously emphasised this approach in his advice to most investors. One of his notable quotes encapsulates this philosophy:

Consistently buy an S&P 500 low-cost index fund. I think it’s the thing that makes the most sense practically all of the time.

Warren Buffett

Buffett’s endorsement of this strategy stems from its simplicity, cost-effectiveness, and the historical performance of the S&P 500. He suggests that for most investors, especially those not seeking to become professional traders, this approach is likely to yield favourable long-term results compared to trying to beat the market through active stock picking.

As Warren Buffett also noted,

A low-cost index fund is the most sensible equity investment for the great majority of investors.

Warren Buffett

The rise of index investing

Index investing, particularly in the S&P 500, has become extremely popular for its efficiency and performance that usually surpass active stock selection. This strategy is simple, yet effective: aiming for long-term average returns with minimal effort and generally outperforming most active stock pickers including professional money managers. Notably, few investment managers can consistently outshine indices, bolstering the appeal of index investing, despite some inherent limitations.

Why the S&P 500 stands out

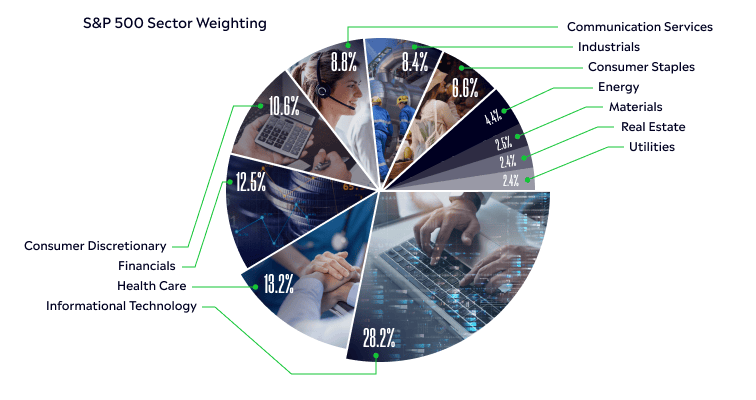

For index investors, the S&P 500 is often the prime choice. It’s not just a measure of the US economy, but a barometer of global economic trends, housing both American and significant international companies. Its diversified nature, across 11 different sectors encompassing tech, healthcare, financial services, and more, offers investors a comprehensive market snapshot.

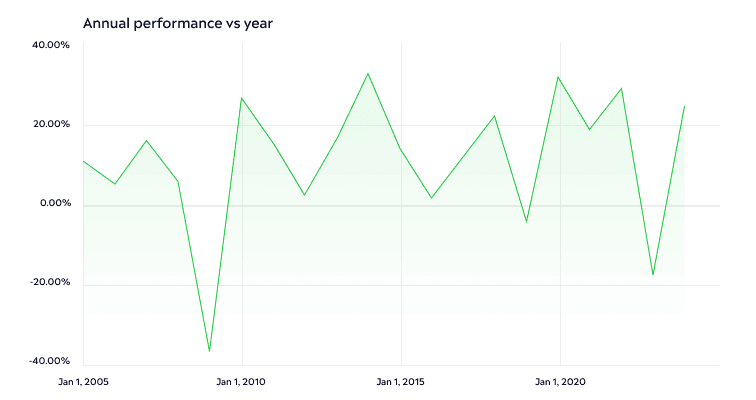

A journey through time — S&P 500’s performance

From its inception, the S&P 500 has been a beacon of steady growth, averaging annual yields of 10.13%. While certain years saw significant drops, the overall long-term trend showcases its reliability and robustness as an investment option which is a reflection of global economic growth.

UK & EU Disclaimer: Past performance is not an indication of future results.

Total return is a measure of the index performance, including dividends reinvestments.

Spotlight on major stocks

The S&P 500 is not an equally balanced index. Tech giants such as Apple and Microsoft dominate the S&P 500. Their substantial index weight is beneficial during tech sector rallies, but poses a diversification challenge.

This graph shows the S&P 500’s makeup.

For illustrative purposes only. Past performance is not an indication of future results.

Accessing the S&P 500: investment instruments

Diverse international ETFs such as SPY5.L, IUSA.L and CSP1.L offer straightforward, economical routes into the S&P 500. These tools provide a way to engage with the index’s performance without direct stock purchases.

Tip: Regularly review your S&P 500 investments to align with changing market trends.

Assessing valuation and risks

The S&P 500, often evaluated using the Price-to-Earnings (P/E) Ratio, historically fluctuates in valuation. While it has averaged around 15 times P/E over two decades, higher ratios suggest more expensive valuations. So, when the index trades below it, it is likely to be cheap, and when it trades above it, it is likely to be expensive.

Forward-looking P/E estimates may provide a different perspective. However, the index’s performance can notably be swayed by its tech-centric composition and a handful of influential stocks.

For those concerned about sector overexposure, equal-weighted index tracking offers a solution. Instruments such as Invesco’s equal weight S&P 500 ETF (RSP) provide an even investment spread across the index’s stocks, presenting an alternative to the traditional weighting methodology.

Tip: Diversify within the S&P 500 by exploring sector-specific funds for a balanced approach.

Final thoughts

In summary, the S&P 500 represents more than just an index; it’s a mirror reflecting the multifaceted nature of the global economy. Its journey from 1957 to the present day demonstrates not only its ability to adapt and evolve, but also its capacity to offer steady, long-term growth. Warren Buffett’s advocacy for the S&P 500 underscores its appeal as a wise investment choice, particularly for those seeking a simple, effective strategy that historically outperforms active trading.

The S&P 500 stands as a testament to the power of index investing, offering broad market exposure, sometimes consistent yields, and a panoramic view of economic trends. While mindful of its sector biases, valuation, and inherent risks, investors can approach this index as a cornerstone of a well-rounded, informed investment portfolio.

Visit the eToro Academy to learn more about index funds and other financial instruments.

FAQs

- What sets the S&P 500 apart from the Dow Jones Industrial Average (DJIA) and the Nasdaq?

-

The S&P 500’s distinction lies in its broader market coverage, featuring 500 of the largest US companies across various sectors, unlike the DJIA’s 30 and the Nasdaq’s tech-heavy composition. This diversity provides a more comprehensive snapshot of the US economy, making it a preferred index for many investors and analysts.

- How does the S&P 500’s performance typically compare to other investment options?

-

Historically, the S&P 500 has offered competitive returns compared to other investment avenues. Its diverse portfolio of large-cap stocks often yields stable growth, making it a benchmark for evaluating other investments’ performance. For specific comparisons and historical performance data, resources such as Investopedia offer detailed insights.

- Can individual stocks within the S&P 500 outperform the index as a whole?

-

Yes, individual stocks in the S&P 500 can and do outperform the index. However, this involves higher risks, as selecting individual winners requires in-depth research and market understanding. The performance of individual stocks can be significantly influenced by company-specific factors and industry trends.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments.

This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Not all of the financial instruments and services referred to are offered by eToro and any references to past performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.

eToro AUS Capital Limited ACN 612 791 803 AFSL 491139. OTC Derivatives are leveraged financial products and considered speculative. OTC Derivatives may not be suitable for all investors. You don’t own the underlying assets. You risk losing all of your investment. This information is general only and has been prepared without taking your objectives, financial situation or needs into account. Consider our Product Disclosure Statement (PDS and TMD). See full disclaimer.

EU disclaimer: CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 76% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.