Whilst most investors accept the benefits of building a well-balanced portfolio, achieving that aim can be challenging. The Portfolio Insights tool from eToro is designed to make the process a whole lot easier thanks to the way it compiles and presents key risk and performance data.

Rebalancing your portfolio is one way to try and make sure that the performance and prospects of the assets you hold match your investment aims. It doesn’t mean you will bypass the risks which are an inherent part of investing, but can help you navigate the challenges which come from changes to the macroeconomic environment, and keep you invested in the kind of assets which match your personal

But how does portfolio balancing work? And how often should you rebalance your portfolio? Help with answering these questions can be found in eToro’s Portfolio Insights dashboard, offering a suite of reports and analysis techniques designed to deliver valuable insights into the structure of your portfolio.

What is portfolio rebalancing?

Portfolio rebalancing involves buying and selling financial

The process considers which asset classes to invest in and incorporates the all-important investment practice of

How does portfolio balancing work?

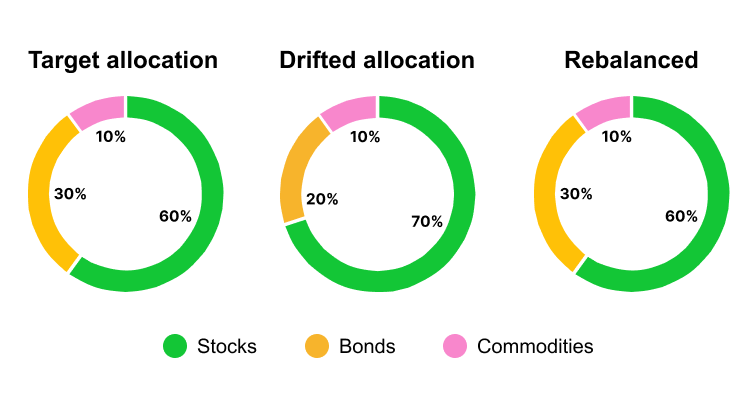

Portfolio rebalancing starts by establishing what proportion of your total portfolio is made up by different types of assets and how far that split deviates from the criteria specified in your long-term plan. Any discrepancies are then rectified by booking buy and sell trades in different instruments until balance is restored.

For illustration purposes only

The reports which illustrate the overall breakdown of your portfolio are complemented by the Risk Contribution section. That shows which stocks have historically been negatively correlated to a portfolio’s other assets and tend to go up when the portfolio goes down, and vice versa.

Tip: Develop a better understanding of the structure of your portfolio by using the information icon in your stats page.

It might be that you built a portfolio with the aim of allocating capital across assets with a 60/30/10 split between stocks, bonds, and commodities. Should stocks outperform bonds over a period of time and result in the relative values shifting to 70/20/10, then rebalancing would require you to sell stocks and buy bonds to return to the 60/30/10 level.

How to rebalance your investment portfolio?

Establishing whether your portfolio requires rebalancing involves measuring the value, risk-profile, and comparative performance of the assets within it. It’s a good idea to use tools which analyse your portfolio at a granular and a higher level. At eToro these include:

- Portfolio breakdown — A summary report showing how your investments are broken down by asset type, sector, geographical region, and exchange. Establishing which types of assets make up what percentage of your overall portfolio can help you pursue an approach where you diversify your investments to meet your long-term goals.

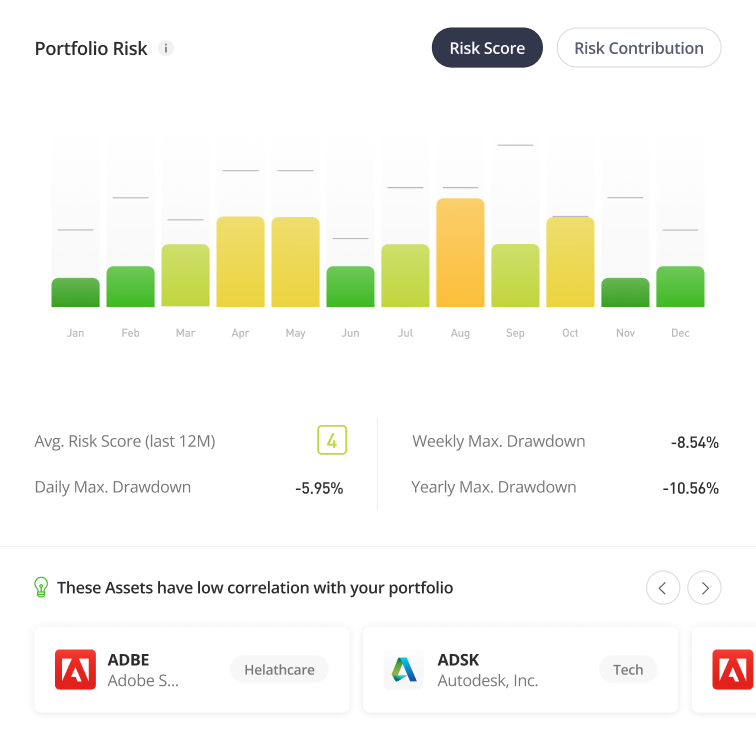

- Risk insights — Details how much each position in your portfolio contributes to your overall risk score. By measuring the levels of price volatility of your holdings over time you can establish if your portfolio is unintentionally shifting to be one with a risk-profile which doesn’t match your investment aims and make trades which adjust that balance.

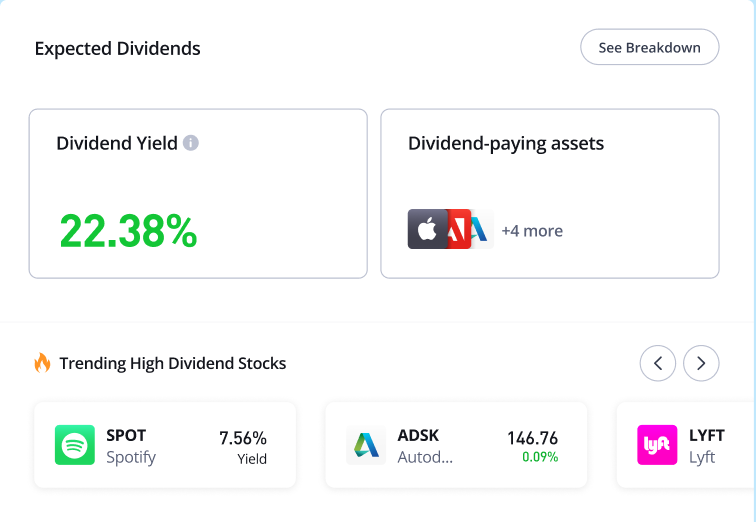

- Expected dividends — Provides details on how dividends paid to each stock you hold have contributed to your overall

P&L . It also forecasts what dividends might be expected over the coming 12 months and which high dividend stocks are trending, to help you determine whether to buy or sell a position. - Portfolio comparison — Measures the performance of your portfolio against an industry

benchmark . Establishing whether you are over or under-performing the wider market could help you establish if your portfolio needs rebalancing. - Performance card — Provides a month-by-month analysis ` For each time period, you can establish to a granular level which trades performed well, and which did not, and factor that information into your future decision making.

- Trading stats — A breakdown of the performance of your portfolio and trading activity over the previous 12 months. Including the percentage of winning trades, and information on the relative returns of different types of assets over time. This tool provides a clearer view of how different investments and strategies performed.

The question of when is the best time to step in and carry out a rebalancing will be answered by a variety of factors. These include how much time you can devote to managing your investments, how

Calendar based rebalancing

Investors who follow this approach review their portfolios on a predetermined date which could for example be monthly, quarterly, or annually. The simplicity of the approach is offset by the chance that considerable price moves might take place in the intervening period.

Trigger based rebalancing

This approach involves rebalancing whenever certain thresholds are met. These could include the relative weighting of assets deviating by a certain amount. Trigger based rebalancing can require you to be more hands on but initiates the rebalancing process as soon as anomalies are identified.

Combination based rebalancing

In practice, it can make sense to adopt an approach which combines both the calendar and trigger based methods of rebalancing. This ensures your portfolio will benefit from both regular adjustments, and ad hoc rebalancing should it be needed.

Tip: Keep in mind that selling a position and crystalising a gain can trigger a capital gains tax charge.

eToro does not provide tax advice and the information provided should not be interpreted as such. Customers should seek independent tax advice

What are the main reasons to rebalance your portfolio?

Rebalancing your portfolio is a way to keep it positioned to try to navigate the risks which might get in the way of you achieving your performance targets.

Manage risk

Reallocating capital across different asset groups influences the chances that a market shock could trigger a substantial fall in the overall value of your portfolio. Should you want to measure the risk element of individual holdings then the Risk Contribution tool in Portfolio Insights allows you to measure how much each one contributes to your overall risk levels.

For illustration purposes only

Improve performance

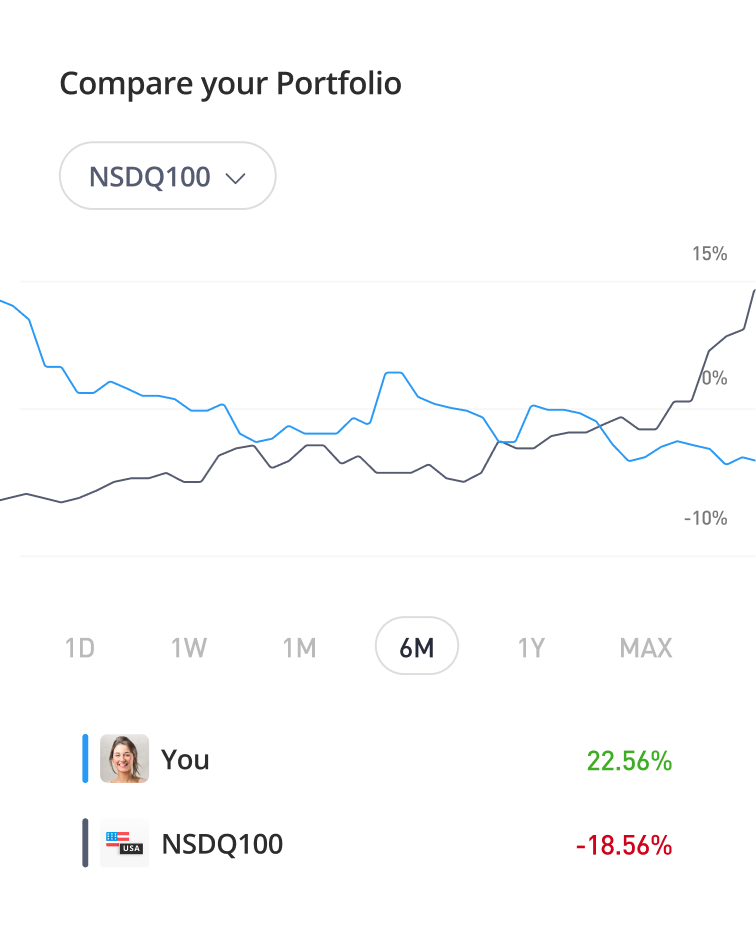

Performance can be measured in absolute or relative terms. The latter involves measuring your portfolio’s performance against that of an industry benchmark such as the S&P 500 Index which can be done using the Compare Portfolio tool in Portfolio Insights.

For illustration purposes only | Past performance is not an indication of future results

Improve passive income

With dividend investing and the compounding effect playing such an important role in investment returns there can be benefit gained from using the Expected Dividends monitor to forecast each stocks expected dividend returns over the next 12 months.

For illustration purposes only

Nearing maturity

As you near the end of your investment plan you may decide to rotate into different types of assets. Growth stocks and other long-term propositions might be a good idea if you have 5-10 years to allow them to realise their true value. But if you are six months from your strategy reaching maturity then you might increase the proportion of your portfolio made up by lower risk, highly liquid, assets.

How often should you rebalance a portfolio?

The time interval between each round of portfolio rebalancing will depend on what types of assets you are holding.

If you hold

If your portfolio holds stocks and bonds which are less volatile, then you may find rebalancing is best done less frequently, possibly on an annual basis.

Tip: Rebalancing may need to be done more frequently if levels of price volatility increase.

Final thoughts

Rebalancing is an important part of the investment process. It encourages you to assess two crucial factors, risk, and performance, and also helps you keep your long-term aims in mind.

The process starts with establishing the current state of your portfolio. When performing that task, taking full advantage of whatever support tools are available is never a bad idea.

Visit the eToro Academy to learn more about investment strategies and portfolio construction.

FAQs

- Should I rebalance my portfolio when stock markets are crashing?

-

This could be something you want to consider doing but it will depend on your overall investment aims and strategy. Some investors build tolerance into their strategies which allows them to rotate into and out of riskier assets when there are changes in market sentiment. Others with a longer term

investment time horizon may take a buy and hold approach and ride out the natural fluctuations of the market. - What is overtrading?

-

Overtrading is the booking of an excessive number of trades to the point where it becomes detrimental to the performance of a portfolio. This can be because frictional costs diminish returns or decision making becomes emotional and deviates from the criteria of the underlying strategy.

- Can I rebalance a portfolio without selling?

-

Yes. This can be done if you are an investor who makes regular payments into an investment account or follows a dollar cost averaging approach. Should your rebalancing analysis suggest you are slightly underweight a particular asset group, such as commodities, then you could use each new cash injection to buy commodities until your portfolio is realigned.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments.

This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Not all of the financial instruments and services referred to are offered by eToro and any references to past performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.