Influenced by price trends, momentum trading involves buying rising stocks and selling falling assets in the hope of building your portfolio. Learn how it works, the risks involved and more.

There are many trading strategies for potentially expanding your portfolio on the stock market. Momentum trading is a strategy that is in tandem with this expression: “The trend is your friend.”

It seems like such a natural and logical idea — invest when the stock is popular, sell when it isn’t — but in reality, there is a lot more to it.

This guide will give you an overview of momentum trading, so you can consider the pros and cons, as well as different momentum strategies and how you can find momentum stocks to invest in.

Tip: Practise with a demo account before placing your own money at risk.

What is momentum trading?

Momentum trading involves traders trying to capitalise on price momentum by entering trends that they believe will continue in a particular direction for a set period of time. For example, buying a stock as the price starts to rise and selling it when the price looks to have peaked. The strategy generally ignores fundamental analysis and looks instead at technical analysis.

Momentum trading vs. momentum investing

These two strategies sound the same, and both look at price, trends, and exit points, but they depart from each other in some important ways.

| Momentum trading | Momentum investing |

|---|---|

| Focused solely on price signals | Looks at price, but also considers fundamentals such as sales and earnings |

| Ignores “the noise” of estimates and forecasts | Includes consideration of “future” factors: estimates and forecasts |

| Applies technical analysis only to identify price trends | Applies fundamental analysis to screen prospective stocks |

| Does not consider the value of a stock, only its popularity | Takes value into account as well as popularity |

How do you find momentum stocks?

Traders can find momentum stocks by using a stock scanner to produce an initial list of stocks for further exploration.

These four criteria have proven useful in identifying stocks with momentum. Stocks that are:

- Breaking their daily highs consistently

- Increasing and accelerating earnings per share quarterly over the last 12 months

- Beating their benchmark or index over the last 3, 6 and 12 months

- Reflecting a moving price average trending higher over 10 days, 50 days and 100 days

What are the momentum trading indicators?

There are several momentum indicators to choose from. These are among the most popular:

- Relative Strength Index (RSI) — measures whether momentum is speeding up or slowing down

- Moving averages — indicates price trends over shorter and longer time periods

- Stochastic oscillator — compares price to the previous trading range in a defined time period

- The momentum indicator — compares the last two closing prices

What are some momentum trading strategies?

There are a range of different strategies available to those interested in momentum trading. Two of the common approaches to momentum trading include “buy low, sell high” and “scalping”.

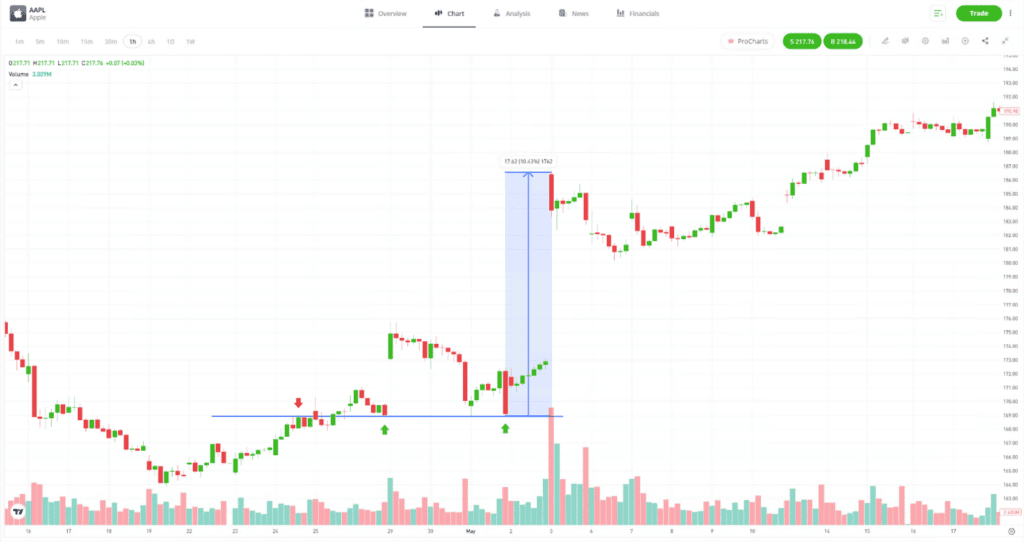

- Buy low, sell high — traders use technical analysis to identify the low and high price points, ideally buying an asset as (or just before) the momentum shifts. Traders will then aim to sell the asset once the price has risen. For example, in the below Apple chart, noticing the point at which the trend changed (as price bounced off the support level) would have allowed traders to capitalise on the positive upwards momentum.

Past performance is not an indication of future results

Source: eToro

- Scalping — traders make a series of trades with stop loss and limit orders, minimising both profit and loss to manage risk. Scalping usually involves small, quick trades, with traders trying to profit from small price changes.

What are the pros and cons of momentum trading and investing?

The pluses and minuses of momentum trading include:

- Can be profitable for expert traders

- Is more fast paced than long-term investing

- Does not require as deep an understanding of fundamental or value investing

- Trading on price volatility can be unpredictable and high risk.

- The shorter the trading period (day/hour/minutes), the higher the risk involved.

- Emotions can interfere with the detachment required for a successful momentum strategy.

Examples of momentum stocks

Bear in mind that momentum trading is easier in a bull market. Remember, too, that performance will change over time. Here are examples of three momentum stocks and their historical movements:

- Marathon Oil (NASDAQ: MRO) — the war in Ukraine, commencing in early 2022, saw oil prices increase. MRO had a low-cost structure, gaining 70% from mid-2021 to August 2022.

- GameStop Corp. (GME) — fuelled by a short squeeze, GameStop’s stock price rose from approximately $17 to more than $80 over the course of three weeks in early 2021.

- Apple (AAPL) — building hype around new release products and innovations, Apple stocks have continued to show strong momentum over much of the past decade, rising from around $17 in mid-2013 to more than $170 in mid-2023.

Visit the eToro Academy to learn more about trading.

FAQs

- What’s a stock scanner?

-

A stock scanner is a tool used to filter stocks by specific metrics or criteria, such as industry, price or liquidity. eToro allows you to filter stocks by industry, sort by price and discover some of the biggest market movers.

- Is momentum a good investment strategy?

-

Momentum could potentially be a good strategy for those with the right skills, expertise and mindset, but it is important to remember that, much like any investment or trading strategy, sufficient research and risk management are required.

- What is the difference between momentum trading and swing trading?

-

They are quite similar, but swing traders hold their positions longer, at least overnight, and sometimes for days or even weeks. Momentum day traders typically close out positions each day.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments.

This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Not all of the financial instruments and services referred to are offered by eToro and any references to past performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.