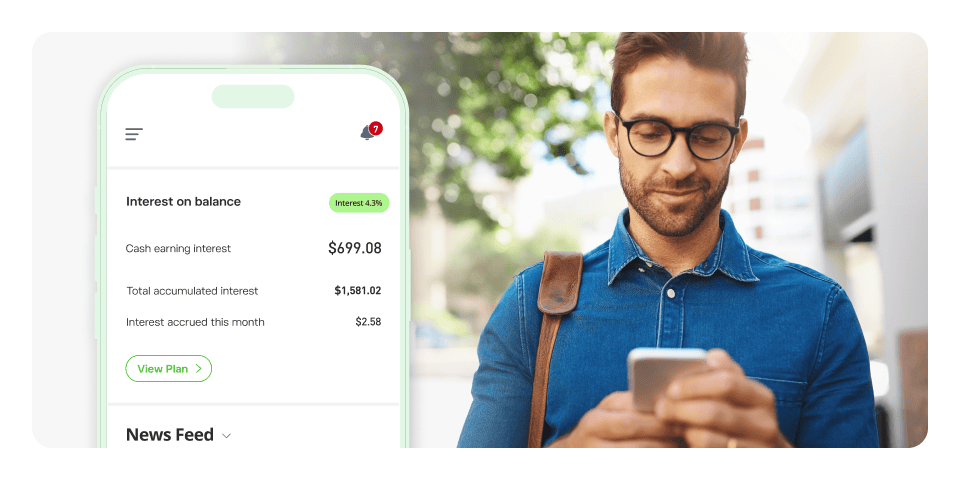

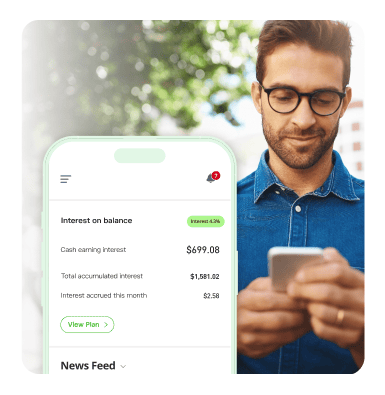

Earn up to 4.05% annual interest

Get more from your money with eToro’s interest on USD cash balance

Please refer to our Terms and Conditions

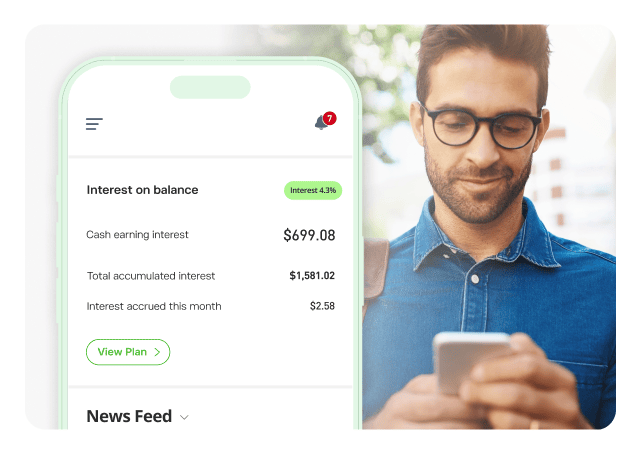

How to start earning interest

Could your money be doing more?

Activate eToro’s interest on USD cash balance and start receiving interest payments straight to your account.

Earn more on your uninvested funds with highly competitive interest rates

Interest earned is automatically paid into your eToro balance each month

Your funds remain fully accessible to withdraw at any time you wish

eToro’s interest rates

Activate eToro’s interest on USD cash balance and start receiving interest payments straight to your account.

Interest rates for eligible residents of the European Union, United Kingdom, Jersey, Gibraltar, Guernsey and the Isle of Man:

| Total balance required | $1-$50,000 | $50,000+ |

|---|---|---|

| Annual interest rate | 3.25% | 4.05% |

Interest rates for eligible users in all other regions:

| Total balance required | $10,000 | $25,000 | $50,000 | $250,000 |

|---|---|---|---|---|

| Annual interest rate | 0.75% | 2.75% | 3.75% | 4.05% |

Start earning annual interest

Please refer to our Terms and Conditions

FAQ

- What is the total balance required?

-

The total balance required is what determines the interest rate that you will receive. It is the total realised equity in your account, including invested funds and available cash balance.

Note that the rate which you will receive is determined by your total balance required. This rate is applied to the available USD cash balance only.

- What is the available USD cash balance?

-

The available USD cash balance consists of non-invested funds currently in a user’s trading account, and is the amount entitled for interest payment.

Compound interest is not paid, i.e., users do not earn interest on funds from previous interest payments.

- How do I qualify?

-

You will be entitled to the interest in accordance with your Club tier, as per the available cash balance, calculated daily and paid monthly.

- How do I activate the interest on USD cash balance in my eToro account?

-

1. Log in to your eToro account. (Don’t have an account yet? Sign up here.)

2. Make sure that you have the total balance required in your account.

3. Go to the eToro Club dashboard. Scroll down to “Interest on Balance,” then switch from “Disabled” to “Active.”

- How and when is the interest calculated?

-

Although the interest rate is annual, it is calculated daily and paid monthly. Each day, the balance entitled for interest payment is calculated (minus any interest and/or any fees due to us). This amount is multiplied by the daily interest rate. At the end of each month, the cumulative amount of interest is totalled and then paid automatically no later than the 5th business day of the following month.

– The 1st determination is according to the amount in the balance, with $10,000 earning 2% yearly, non-compounded.

– $10,000 balance over a full calendar year earning 2% = earning $200 interest per annum

– 2% yearly when divided by 365 gives the daily rate of 0.005479%.

– 0.005479% x $10,000* = the daily interest earned at $0.5479

– Cumulative Interest for 1 month (30 days) is $0.5479 x 30 days = $16.44

– Cumulative Interest for 1 Year (365 Days) is $0.5479 x 365 days = $200* Assuming balance is kept at that same level for the full period.

- When is the interest added to my account?

-

Payment is made automatically no later than the 5th business day of the following month, early morning GMT time.

- What is the minimum amount for payment?

-

The minimum amount of interest to earn for payment is $0.01.

- If I activate interest on USD cash balance sometime mid-month, will I earn interest for that entire month?

-

No. Interest is earned from the day that the user actually opts in, provided they continue to be eligible and have the total balance required to earn the interest payment.

- Will I have to pay taxes on the interest received?

-

Taxes due will depend on regulations in your country of residence. You are responsible for all applicable taxes related to accepting interest payments from eToro. In some jurisdictions, eToro will be required to withhold taxes payable on your behalf and remit them directly to the relevant tax authority.

- Do I have to pay any fees?

-

No additional charges apply in relation to interest payments.

- Are my funds safeguarded?

-

As a regulated company we are required to safeguard your funds in accordance with specific client money rules. eToro (Europe) Ltd is a member of the Investor Compensation Fund (ICF), which compensates investors only up to twenty thousand EUR. Additionally, in certain cases your funds deposited in eligible European banks are backed by the Deposit Guaranteed Scheme (DGS). The DGS has a maximum payout limit of up to EUR 100.000 / GBP 85.000 per depositor, per bank.

eToro (UK) Ltd is covered by the Financial Services Compensation Scheme, which provides compensation of up to £85,000 per eligible person, if the firm is unable to meet its financial obligations. This protection applies in the unlikely event of eToro (UK) Ltd’s insolvency and any shortfall in client assets

- Other important information

-

eToro holds the right to refuse to allow any client to enter the Interest on Balance program and/or remove any client from participation in the program, if found in violation of any applicable policies, rules and/or regulations. The program may be renewed at a lower interest rate.

eToro retains a variable portion of the interest it earns on eligible uninvested cash (i.e., the difference between interest received and any interest paid) to cover cash-management, operational and platform costs associated with this service.