Commodities are the building blocks of industrial activity. Investors can trade markets in raw materials, such as oil, gold, copper or wheat, based on whether they think their prices will rise or fall. Investing in commodities is also an effective way to diversify an investment portfolio.

Commodity market prices are largely driven by “real world” buyers and sellers, such as multinational companies, that trade raw materials as part of their day-to-day business activity.

Investors can also take a view on whether the price of a commodity will go up or down, without necessarily owning a physical barrel of oil or a bushel of wheat.

Tip: Commodities can be traded like any other asset using a standard brokerage account.

What are commodities?

A commodity is a natural resource or agricultural product that is mined, grown, reared or processed, and then used to produce more complex goods. The way in which commodities are standardised and interchangeable has resulted in the formation of dedicated commodity

Types of commodities

There are a wide range of commodities available, all grouped into one of several categories depending on the nature of the raw material and its use.

Why trade commodities?

Most investors decide to buy and sell commodities because they believe their price will change. Trading in commodities is very similar to buying other

“Commodity markets tend to zig, when the equity markets zag.”

Jim Rogers

If you decide to open a

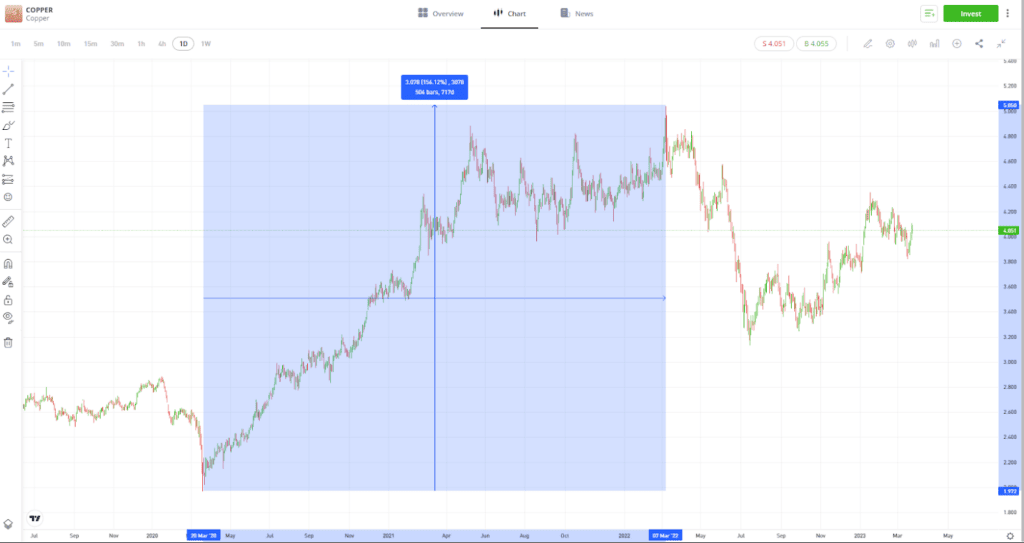

Price moves in commodity markets can be long-term in nature. For example, the price of copper rose 156% between March 2020 and 2022, as demand outstripped supply for a prolonged period of time.

Past performance is not an indication of future results

Alternatively, price moves can occur as a short-term reaction to market events. In 2024 the price of cocoa nearly tripled due to poor harvests limiting supply, whereas the price of wheat fell by +40% thanks to robust harvests and easing geo-political tensions.

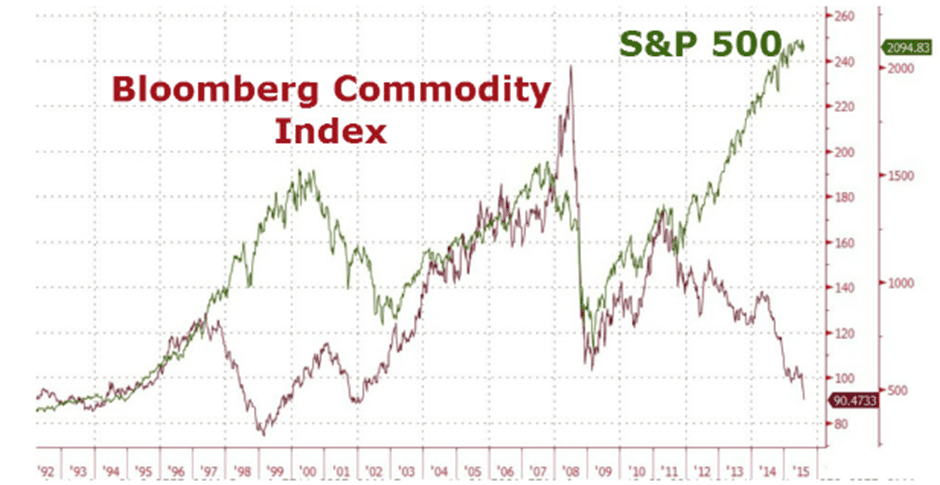

There are other features of the commodity markets that make them popular with investors. Historical price charts demonstrate a low

Past performance is not an indication of future results

Source: Mikes Money Talks

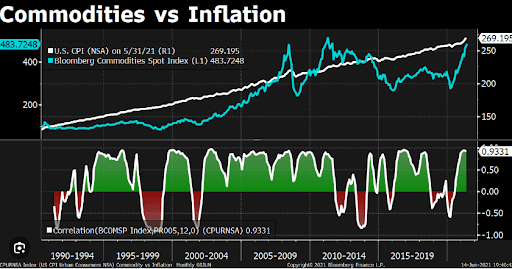

Commodities are also popular because of their correlation with

Past performance is not an indication of future results

Source: X

How to trade commodities

One way of trading commodities is to use

Alternatively, investors can buy the stocks of firms that are heavily linked to the commodity markets. For example, shares in oil and gas giant Shell Plc (SHEL) will closely track the price of energy sector commodities. A firm’s profits are driven by the value of the commodity assets it holds, processes and sells, and some investors prefer to gain indirect exposure to the commodity sector by investing in

Tip:

What drives commodity prices?

Supply and demand help to drive the price of commodities. Interest rates, inflation levels and consumer confidence and other macroeconomic factors can all influence commodity prices.

Supply “shocks” can also trigger commodity price moves. Geopolitical events, such as wars, can disrupt supply lines, and bad weather can impact a harvest.

Commodities investing also requires gaining an understanding of how the supply of commodities is difficult to change drastically — it is hard for suppliers to scale up production, even if price and demand increase. For example, it can take years for a new mine to start operating fully and the natural growing cycle of soft commodities will determine how quickly farmers can respond to price changes.

Final thoughts

Many investors are interested in commodities because the assets themselves, as well as the factors that influence their price, are relatively easy to understand.

As an asset class, they can offer a degree of diversification, a hedge against inflation and have a low correlation to stock prices. For those reasons, experienced investors will often include commodities in their investment portfolios.

Head to the eToro Academy to learn more about investing in commodities.

FAQs

- Who invests in commodities?

-

Speculators, or retail investors, make up a large percentage of commodity investors. Between 2012 and 2022, it is estimated that there was a 100% increase in the volume of oil trades carried out by investors looking to make a return on their investment, rather than actually wanting to own and utilise crude oil. Often, the greater the number of speculators in a market, the higher the price volatility.

- How much does it cost to invest in CFD commodities?

-

Most brokers offer commission-free CFD trading. Instead, brokers make their money on the difference between the buy and sell price — the spread. CFDs do incur daily financing fees, however, which will need to be factored in by potential investors.

- What is the easiest commodity to trade?

-

Opening a CFD commodity trade is the same as it is for other CFD markets, and the process of investing in one commodity is no easier than investing in another. Instead, investors should consider the underlying features of the market. For example, the price of oil and copper will fluctuate in line with the wider economy, whereas soft commodity prices are more likely to be influenced by the weather.

- How does commodity trading differ from stock trading?

-

One important difference between these two markets is the nature of the factors which drive price changes. The price of raw materials might be influenced by macroeconimic cycles, geopolitical events, or even the weather. Stock prices are to a larger extent based on how investors predict a particular company, or the stock market in general will perform.

- Can commodities be used to hedge against inflation?

-

Yes, this is a common characteristic of commodity markets. Gold in particular has a strong reputation for being a hedge against inflation but other commodities also come into scope.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments.

This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Not all of the financial instruments and services referred to are offered by eToro and any references to past performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments.This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

Past performance is not an indication of future results.

CFDs are complex instruments and come with a high risk of losing money rapidly due to leverage. 77% of retail investor accounts lose money when trading CFDs with this provider. You should consider whether you understand how CFDs work and whether you can afford to take the high risk of losing your money.

eToro AUS Capital Ltd ACN 612 791 803 AFSL 491139. OTC Derivatives are speculative and leveraged. Not suitable for all investors. Capital at risk. See PDS and TMD

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.