Fundamental analysis helps to predict long-term trends in single assets and sectors, as well as in the wider financial market. It can also help you to develop a strategy that rides out market “noise” and focuses on making long-term returns.

Learn what fundamental analysis is and why it is important, and discover the difference between quantitative and qualitative fundamental analysis and how both can be applied to the financial markets.

Fundamental analysis helps to predict long-term trends in single assets and sectors, as well as in the wider financial market. Whether you are trading stocks, indices, commodities, forex or any other financial instrument, fundamental analysis can help you to identify points at which an asset is undervalued, and the price that it could potentially reach in the future.

What is fundamental analysis?

Fundamental analysis involves studying the factors that determine an asset’s fair market value and comparing that number to the asset’s current market price. Fundamental analysis can also incorporate important macroeconomic factors, such as inflation and unemployment, that can influence economic activity and asset prices at a structural level.

Why is fundamental analysis important for investors?

Fundamental analysis helps an investor to establish whether it is a good time to buy, hold or sell a position.

In terms of stock investing, fundamental analysis allows you to determine the current financial health of a company. It is then possible to use this information to better understand the company’s future prospects. The principles of fundamental analysis can be applied to all asset classes.

Fundamental analysis provides tools to help you to calculate an asset’s intrinsic value. These tools can also highlight instances of an asset being mispriced, or reasons for its price to start trending in one direction or another.

The stock market is filled with individuals who know the price of everything, but the value of nothing.

Phillip Fisher

Quantitative and qualitative fundamental analysis

Fundamental analysis can be used to consider a wide range of factors. As a result, some analysts break the approach down into two sub-categories: quantitative fundamental analysis and qualitative fundamental analysis.

Quantitative fundamental analysis

Stock investors use quantitative fundamental analysis to analyse hard data. This can include financial statements, such as balance sheets, income statements and firms’ cash flow reports. This technique helps you to evaluate trends in a company’s revenue, profitability and cash flow patterns.

Quantitative analysis uses data that is more exact, but company reports are a lagging indicator — they detail what has happened, rather than what might happen.

Tip: Quarterly earnings reports often include forecasts that predict the company’s future performance.

Qualitative fundamental analysis

Qualitative fundamental analysis involves using subjective analysis to decide whether to buy a stock. For example, an investor might notice that a firm is benefitting from increased customer demand or has just announced a new, innovative product that might help it to develop market share.

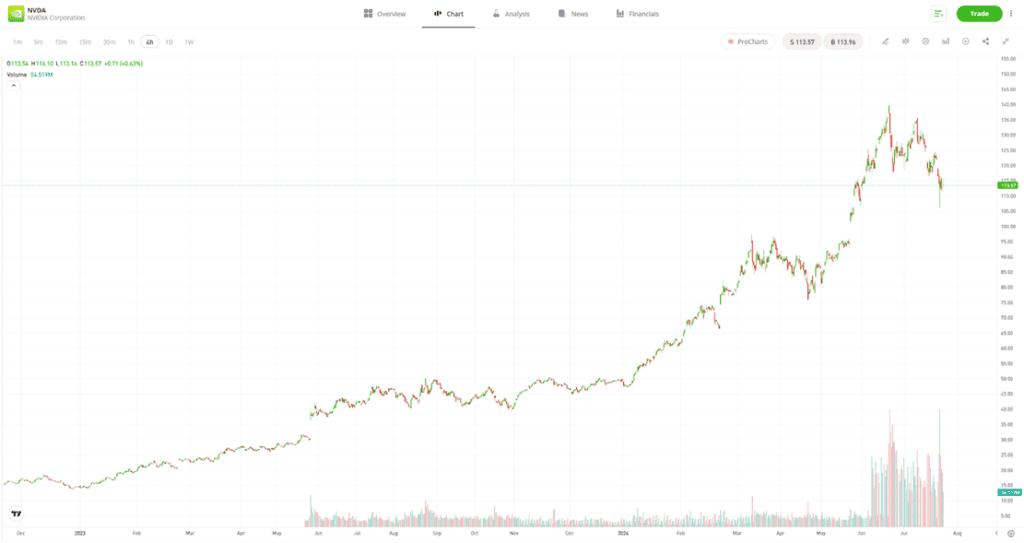

In the below chart, you can see that the price of Nvidia (NVDA) stock grew substantially throughout 2023. This is due, in part, to the company becoming the market leader in the creation of artificial intelligence (AI) chips.

Past performance is not an indication of future results

Source: eToro

Changes to a company’s prospects that are identified using qualitative fundamental analysis should, in theory, ultimately feed into the company’s statements as changes in revenue. Qualitative analysis helps investors to spot opportunities early, rather than waiting for these changes to be reported.

Fundamental analysis of the stock market

Fundamental analysis of stocks is made easier by the fact that companies listed on official stock exchanges tend to offer clear and transparent reports on a regular basis. These reports include easy-to-read summary statements as well as granular details that can offer clues as to whether a stock should potentially be bought or sold.

Fundamental analysis of stocks

Fundamental analysis can be used to gain a clear understanding of a company’s potential, regardless of whether you are considering investing in a market giant such as Apple or a gold mining and exploration company such as Zijin Mining Group.

The financial statements released by these companies will include key data points such as total revenue, dividend payments, capital investment and the debt-to-equity ratio (D/E).

Comparing data found on a company’s balance sheet to a stock’s current market price allows you to establish if the stock is under or overvalued by calculating the price-to-earnings ratio (P/E) and price-to-book ratio (P/B).

Fundamental analysis of indices

Stock indices are made up of a basket of different, individual stocks. Aggregating the data of each company can provide a varied insight into the core prospects of the entire index. It is also possible to compare indices against one another. For example, comparing the P/E ratio of the S&P 500 Index against the FTSE 100 Index could help you to determine whether to invest in US or UK listed stocks.

Tip: Good trading platforms will allow you to easily view a company’s key metrics, such as the P/E ratio.

Fundamental analysis in other markets

Some instruments, such as forex, commodities and crypto, do not provide investors with balance sheets and income statements. However, other key data points can be analysed when making investment decisions.

Fundamental analysis in forex

Fundamental analysis can be used within forex as the price of a currency pair is typically driven by supply and demand, which is, in turn, driven by a variety of macroeconomic factors. For example, investors might be interested in a currency because it offers a higher rate of return on cash balances, thanks to the country’s higher interest rates.

International money flows also occur when a country’s economy is growing and attracting foreign investment. Some currencies, such as the Swiss franc (CHF), become more attractive during times of heightened geopolitical risk because of the security they offer.

Fundamental analysis in commodities

Commodities are the raw materials that make up the building blocks of global economic activity. Fundamental analysis of commodity markets, therefore, tends to focus on macro-level trends. More specifically, this analysis looks at economic cycles, which detail how different countries go through natural phases of expansion and contraction.

Price trends in commodity markets can last for extended periods of time. This is because demand can change in an instant, but supply is inelastic. For example, bringing new mines into production or planting and harvesting seasonal crops, such as soybeans, is a time-consuming endeavour, meaning that it is not possible to immediately meet new demands.

Final thoughts

Having a clear strategy is a key part of investing and achieving your financial aims. Fundamental analysis is, therefore, a useful tool as it can help you to identify good trading opportunities and provide you with the confidence to hold them until they reach their target price.

Visit the eToro Academy to learn how to start investing using fundamental analysis.

Quiz

FAQs

- How can I find the right information for fundamental analysis?

-

Most of the information relating to fundamental analysis is available publicly. Good brokers will collate and share the data relating to earnings reports, and more detailed analysis can be done by accessing the “Investor Relations” area of a company’s homepage.

- What are the drawbacks of fundamental analysis?

-

A lot of the data used in fundamental analysis details historical events. Using this data to establish future trends involves a degree of subjectivity, and so, it is, therefore, possible for two analysts using the same data sources to draw different conclusions.

- What are the alternatives to fundamental analysis?

-

Technical analysis is an alternative to fundamental analysis. Technical analysis uses historical market data to predict future price moves. Alternatively, if you are looking to gain broad exposure to certain asset groups, rather than to beat the market, then, an ETF fund that tracks a sector or index could offer a low-maintenance and cost-effective alternative.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments.

This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Not all of the financial instruments and services referred to are offered by eToro and any references to past performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.