Why ETFs?

An ETF, or exchange-traded fund, is a type of investment fund that aims to track the performance of a specific stock market index, industry sector, or asset.

Through one ETF, you can potentially gain exposure to hundreds of assets

ETFs are ready-made and don’t require you to choose assets individually

ETFs are more cost-effective than actively-managed funds

Choose the ETF that’s right for you

seek to track performance of a benchmark index.

hold stocks with a strong history of paying dividends

can be an excellent lower risk investment option.

offer exposure to the price changes of raw materials.

How to buy ETFs on eToro

Select the ETF that you wish to trade, then click the Trade button

Enter the amount of money (or number of units) you wish to invest

Once you have set the position’s parameters, click Open Trade

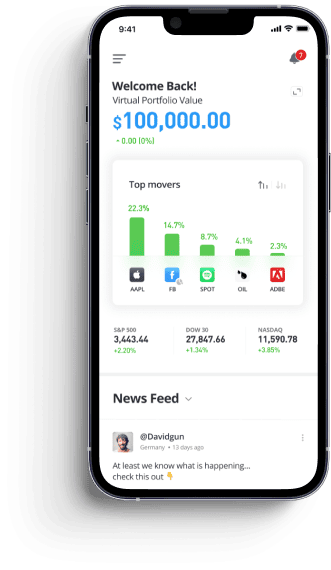

Get the confidence to trade ETFs

Want to hone your trading skills at your own pace, with zero risk? Use the free demo portfolio with $100,000 in virtual funds to practise investing in ETFs, as well as everything else eToro has to offer.

- What is an ETF?

-

An ETF, or exchange-traded fund, is a type of investment fund that aims to track the performance of a specific stock market index, industry sector, or asset.

- Are ETFs suitable for beginners?

-

ETFs provide a simple and direct way to get exposure to a broad spectrum of financial assets, spanning commodities, bonds, stocks, and even real estate. ETF trading is preferred to the use of mutual funds, as they don’t incur the same trading fees and expense ratios, whilst providing the accessibility of being able to open and close positions multiple times daily like stock trading.

If you are keen to learn more about trading ETFs, click here to read our full guide to investing in ETFs for beginners.

- What fees will I pay for trading ETFs?

-

For fees associated with ETFs, please see our Fees page.

- Do ETFs pay dividends?

-

Dividends are cash payments that some companies pay to their investors out of their profits. Not all companies pay dividends but many well-established companies do. If you hold an ETF that invests in dividend-paying companies, you will receive dividends. For more information on dividends, see our guide.

- Are ETFs suitable for long term investment?

-

Like most investments, adopting a long-term strategy with ETFs is a good idea, and can help reduce your risk. Take for example, stock index ETFs. In the short term, stocks can be highly volatile. However, in the long run, the stock market tends to rise. So, generally speaking, the longer you invest, the less chance you have of losing money.

- Are ETFs traded 24 hours a day?

-

ETFs are traded in the markets during regular hours just like stocks are. You can continue trading ETFs throughout the day and in the after-hours market, but the order will be executed at market open. See the Market Hours page here.

- What’s the difference between ETFs and mutual funds?

-

ETFs and mutual funds both represent clusters or “baskets” of individual bonds or stocks. But there are some key differences.

Mutual funds are typically actively managed, while ETFs are a more passive investment vehicle, tracking an existing market index autonomously. With mutual funds requiring active management, mutual fund investors will pay management fees and often require much bigger levels of an initial investment than an ETF.

ETFs also offer more hands-on control over the price you buy and sell than a mutual fund. You can buy and sell ETFs at fluctuating prices throughout a trading session. However, those who buy into a mutual fund will pay the same price as anyone else that’s invested that day. With mutual funds, the values are not calculated until the end of each trading day.