Energy commodities trading can enable portfolio diversification, while potentially generating a return through one of the world economy’s pivotal components. Learn how energy trading works and uncover the factors that influence prices.

The macroeconomic factors that drive energy commodity prices are fairly intuitive, at least for the most part. Global aggregate demand for fuels is based on economic cycles, which can be easily tracked through readily available news reports.

Gaining entry to the energy commodities market is relatively straightforward, with most brokers allowing investors to buy or sell assets linked to the oil, natural gas, petroleum, coal and nuclear sectors.

What are energy commodities?

Energy commodities include products such as oil, petroleum and coal. They are used to transport goods, heat homes and offices, and produce electricity. As a sub-sector within the wider commodity market, they play a crucial role in everyday economic operations.

Oil and petroleum commodities

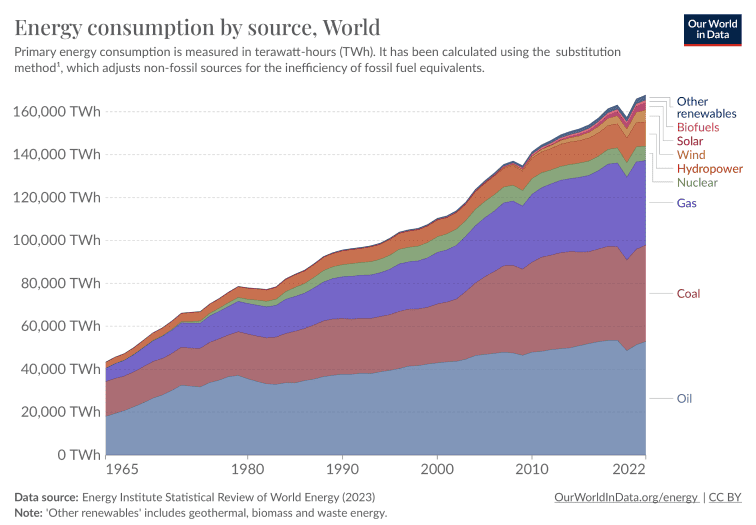

Because petroleum is produced from crude oil, the pricing dynamics of the two commodities are closely linked. The total annual global consumption of oil commodities is well over 4.39 billion metric tons, and despite the shift to renewable energy, oil production levels continue to grow. Currently, oil accounts for approximately 30% of global energy consumption.

Tip: Oil differs from other energy commodities because it is also used to produce goods such as plastics and fertilisers.

Natural gas commodities

Natural gas is the world’s third most widely used energy commodity. It is regarded as one of the “cleaner” fossil fuels, which is why some investors will watch its price closely, especially during the current shift from carbon-based to renewable energy sources.

Coal commodities

Coal is primarily used for electricity generation, but it also plays an important role in the production of cement, steel and iron ore. China accounts for more than 50% of global coal consumption, followed by India at approximately 12%.

Coal is currently used to a great extent around the world, although the significant carbon footprint associated with the commodity makes it the largest contributor to rising global temperatures. It is, therefore, likely that coal usage will decline in the future.

Tip: Non-renewable fossil fuels currently account for 85% of annual global energy consumption.

Nuclear energy commodities

Nuclear energy sparks a number of different opinions. It essentially offers a carbon-free method of generating a reliable base level power supply, complementing the generation of electricity through renewables. While renewable energy production is notoriously weather dependent, the radioactive nature of nuclear power generation can make it difficult to establish new supply sources.

Source: Our World in Data

Ways to invest and trade in energy commodities

Energy trading involves buying and selling financial instruments that mirror the prices of energy commodities on international exchanges. Some of these instruments have a more direct correlation to the underlying commodity than others.

Energy futures & CFDs

Futures trading determines the value of oil, gas, petroleum and coal. These commodities are traded on global energy exchanges such as the Chicago Mercantile Exchange.

Buying energy futures is a good way of getting involved in the energy market, although the operational features of futures trading can make it a difficult option for beginners.

On the other hand, energy CFDs effectively represent a contractual agreement between you and your broker. Most energy CFDs track the price of energy futures in the underlying markets.

Tip: Uranium cannot be traded as a future. Investors can gain exposure to the nuclear power sector through uranium stocks.

Energy ETFs

Exchange-traded funds (ETFs) are passive investment vehicles that track the price of a group of assets. Some ETFs can be traded to track the futures price of a commodity, while others, like the Energy Select Sector SPDR Fund, are made up of a basket of energy company stocks.

Tip: Investing in an energy ETF can help investors to quickly gain diversified exposure to the energy commodity sector.

Energy equities/stocks & shares

Stocks are a convenient and relatively cost-effective avenue for investing. Buying shares in firms that extract or process energy commodities is an indirect way of gaining exposure to the energy commodities market.

Although the correlation with underlying energy prices may be less direct than if you were to buy futures or CFDs, other features of stocks, such as the dividends they pay, generally appeal to investors.

Are energy commodities a good investment?

Investing in energy commodities is a relatively straightforward venture. However, accurately predicting price directions can be challenging. Investing in energy commodities requires the development of a coherent strategy, a profound understanding of how commodity markets work and thoughtful consideration of the variables that influence commodity prices.

Risks of trading energy commodities

All forms of investment involve an element of risk, but energy commodity markets are known for having a higher risk profile than many other asset classes, including bonds and blue-chip stocks.

Energy commodity markets also have relatively high price volatility. This volatility implies short-term price movements, which could result in emotional investing and the closing of positions that might eventually have proven to be profitable.

Energy supplies and prices are also heavily influenced by geopolitical events, which can be difficult to predict. Countries that act as net energy commodity exporters tend to work together to optimise their returns, while net importers implement policies designed to ensure energy security.

Developing an effective trading psychology that factors in these risks is an important part of any strategy aimed at attaining financial freedom.

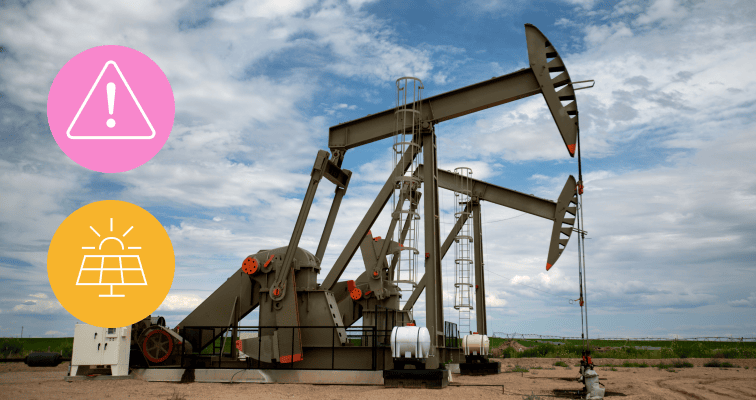

Alternative energy investments

Successful investing is highly dependent on the ability to spot market trends, and so the shift towards renewable energy should not be ignored. The introduction of renewables poses a potential risk to investors bought into traditional energy sources, but represents an opportunity for those who are new to the sector.

ETFs such as the iShares Global Clean Energy ETF can offer a convenient and cost-effective way of investing in commodities while also supporting a societal transition.

Final thoughts

The energy market is going through a transitional period that is likely to result in a further increase in price volatility. Depending on your risk profile and investment time horizon, this volatility can represent both a risk and an opportunity.

If you are thinking of trading energy commodities, gaining a better understanding of how the markets work, as well as the prospects associated with each energy commodity, will play a critical role in helping you to achieve your investment goals.

Visit the eToro Academy to learn more about energy commodities.

Quiz

FAQs

- What do higher energy commodity prices mean for stock prices?

-

Higher energy costs can impact share price valuations by squeezing the profit margins of firms that are unable to pass additional costs onto consumers in the form of higher prices.

Rising fuel prices can also trigger a rise in the Consumer Price Index (CPI), which is used to measure inflation in the wider economy. If a rising CPI results in central banks raising interest rates, this can also be detrimental to stock valuations. Typically speaking, higher interest rates are correlated with reduced levels of aggregate demand in an economy.

- What is energy security and how is it managed?

-

The International Energy Agency (IEA) defines energy security as “the uninterrupted availability of energy sources at an affordable price.” The IEA is an independent intergovernmental organisation, consisting of 31 member nations, that provides policy recommendations, analysis and data on the entire global energy sector.

On a national level, countries have set up bodies, such as the US Department of Energy, which directly intervene in markets and influence government policies to ensure a reliable supply of energy.

- What is the difference between the “spot price” and the “futures price”?

-

The spot price is the price quoted for the immediate payment and delivery of a commodity such as oil. On the other hand, the futures price is the agreed-upon price for delivery and payment to be made at a future date.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments.

This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Not all of the financial instruments and services referred to are offered by eToro and any references to past performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.