A watchlist is a refined selection of assets that an investor might want to keep an eye on at any one time, making market monitoring and portfolio management quicker and easier. This article will explore how to build and use a watchlist effectively as part of an overall investment strategy that matches an individual’s goals.

A watchlist refers to a personal selection of financial assets, instruments or markets that an investor might want to monitor with ease. This article will provide an in-depth understanding of what a watchlist is, how to create one and how investors might use it effectively to follow their strategy and achieve their investment goals.

What is a watchlist?

A watchlist allows investors to handpick a selection of assets to monitor at a glance, minimising the time and effort needed to regularly search for information about individual assets.

A personalised watchlist gives investors a better chance of identifying potential market opportunities. A specific focus on just a handful of relevant assets helps investors to drown out the noise of the rest of the market, to better assess and compare the assets they are most interested in.

How to build an effective watchlist

An effective watchlist should offer investors quick and easy access to refined, relevant and well-focused information about their assets, or those they are interested in.

Personalise categories

Creating different watchlists for different categories of investment or interest can be a helpful tool for investors looking to monitor vast sections of the market. By personalising these categories in line with their own investment strategy, an investor can track how different assets and sectors are performing, individually, overall and relative to one another.

For instance, someone who is considering investing in the pharmaceutical and biotech sector might create a watchlist of popular biotech stocks, name it “Biotech Consideration,” and include Johnson & Johnson, Pfizer Inc., Novartis, Merck & Co. and Abbott Laboratories.

They could use this information to track the price of each stock over a set period of time, compare and contrast how each changes in line with wider market trends, and use these insights to help determine their strategy for investing in the sector.

Get technical

There are more technical methods for creating a watchlist, such as using the Global Industry Classification Standard (GICS). This categorises stocks first into sectors, then industry groups, then industry, and finally, sub-industry.

Tip: Within the GICS, there are 11 sectors, 24 industry groups, 69 industries and 158 sub-industries.

How to build a watchlist on eToro

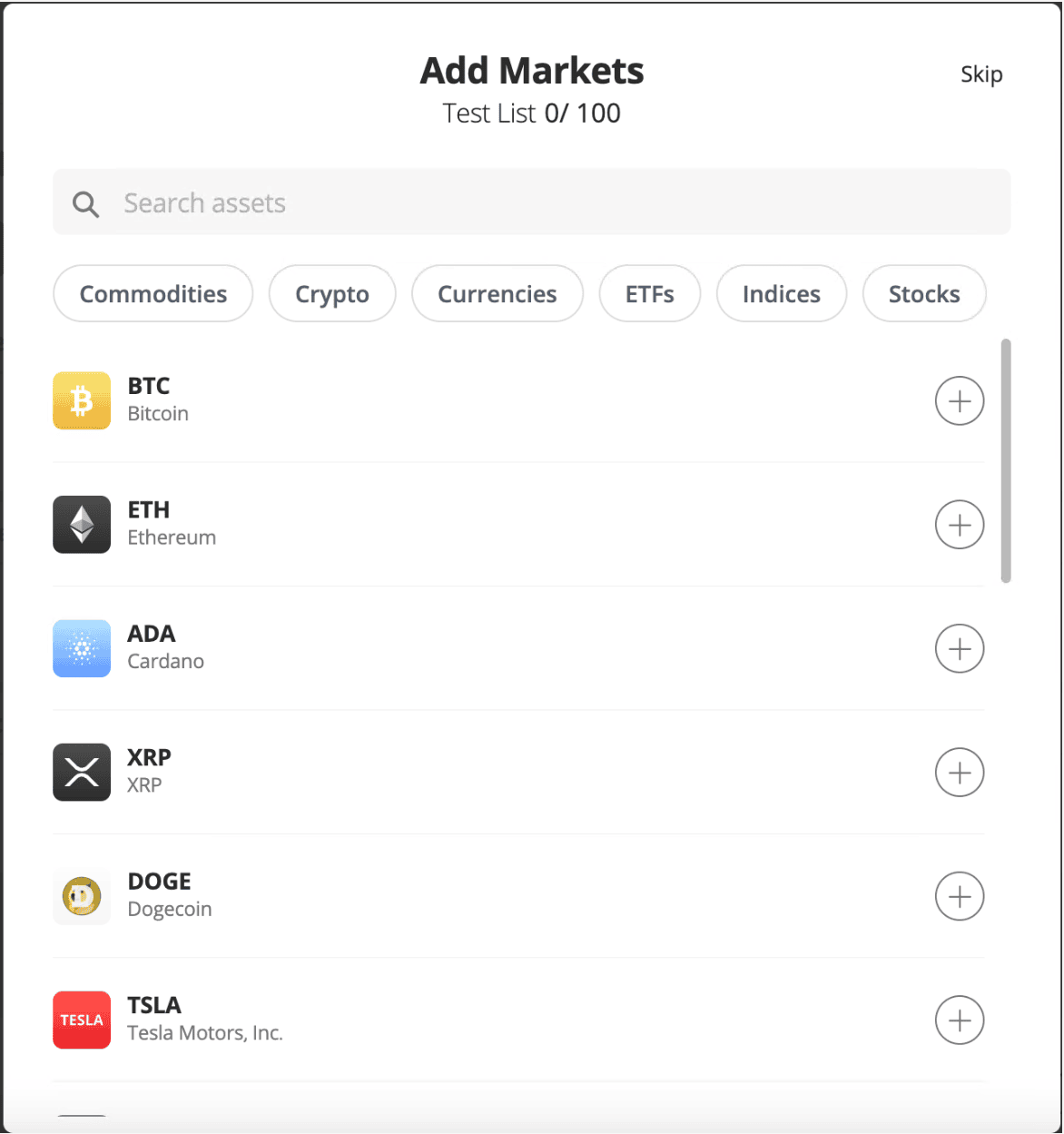

eToro offers a straightforward way of keeping track of investments. Users are able to create up to 25 personalised watchlists, including up to 100 items in each. To create a new watchlist on eToro:

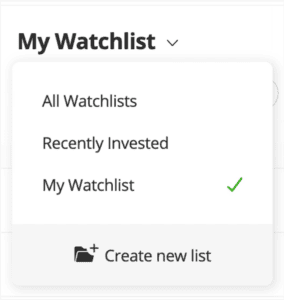

- Navigate to “Watchlist” from the homepage.

- Select the “My Watchlist” dropdown.

- Select “Create New List” from the dropdown.

- Name your new watchlist.

How to use a watchlist effectively

Watchlists can be used to help investors follow their investment strategy and achieve their investment goals. They provide an essential tool for investors to monitor a personalised and refined view of the market, and better focus their time on the effective analysis of only a highly relevant selection of assets.

Limit numbers

Limiting the number of assets included in any one watchlist will help investors to make better sense of the data it shows. A sensible number of assets for any watchlist lies somewhere between 5 and 10.

Refine regularly

It is also recommended that investors regularly refine their watchlist to show only their most active investments. They might do this by removing old assets or closed positions from view, or limiting any long-term investments from view, as in general, investors will seek to hold these assets regardless of their day-to-day price movement.

Use price alerts

Investors might choose to use price alerts to get notifications whenever an asset on a watchlist displays volatility, or to stay alert on notable activity in the markets in general.

Final thoughts

A watchlist is a helpful tool that investors can use to make well-informed investment decisions. Practically, it reduces the amount of time needed to sift through market data, allowing investors to concentrate exclusively on a refined selection of assets and easily monitor the market to manage their investment strategies in line with their personal goals.

Build your investment knowledge further with the eToro Academy.

FAQs

- What are some ways I can categorise my stock investments?

-

Stocks, bonds, and money market instruments have traditionally been regarded as the three main asset classes. Many investors today might view commodities, futures, derivatives, real estate, and even crypto as separate asset classes.

- How do I decide what to invest in?

-

Be sure to understand how much money you are willing to invest and potentially lose. Choose the investment types that suit your level of risk tolerance. Then, research dividends, P/E ratio, beta, earnings per share, and historical returns.

- What is the difference between trading and investing?

-

Trading and investing are phrases that are sometimes used synonymously. However, there are significant distinctions between the two financial approaches. Generally, the aim of investing is to increase wealth over the medium to long term. The aim of trading, on the other hand, is to make money quickly.

This information is for educational purposes only and should not be taken as investment advice, personal recommendation, or an offer of, or solicitation to, buy or sell any financial instruments.

This material has been prepared without regard to any particular investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Not all of the financial instruments and services referred to are offered by eToro and any references to past performance of a financial instrument, index, or a packaged investment product are not, and should not be taken as, a reliable indicator of future results.

eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this guide. Make sure you understand the risks involved in trading before committing any capital. Never risk more than you are prepared to lose.