Summary

Focus: Our sector investment playbook

Under the hood of the US equity strength this year we have seen a lot of movement between sectors. We see the current opportunity in those benefiting most from strong GDP growth – namely industrials, commodities, and financials. They are also cheap and under-owned. But Tech remains the foundation of any portfolio, with still strong growth, high profit margins, and fortress balance sheets. Defensives, like utilities and consumer staples, are on the radar for later in this economic cycle rather than now.

Markets shaken not stirred

US equities rose 2% last week, recovering from sharp weakness early in the week driven by a continued growth ‘scare’, as global new virus cases have risen over 40% in the past month. Markets helped by Q2 earnings strength, more dovishness from European Central Bank (ECB) meeting, and strength from forward-looking July purchasing managers indices (PMI’s). Tech related sectors led gains, whilst utilities and energy were the only fallers.

A record for retail investors

US household equity investments are at an all time record given strong markets and more retail investors. But they over-invest in their home equity market, given its familiarity, and overseas country and currency risks. This home bias often leads to poor country and sector diversification, at a time when this diversification has never been easier or cheaper.

Earnings even better than expected

Strong Q2 earnings reports are providing an antidote to concerns on new virus cases and lockdowns. With over a fifth of the S&P 500 reported, 85% of stocks have beaten already high analysts forecasts, led by cyclical sectors. Big tech is next week’s test with the so-called FAANGM’s representing 25% weight in the S&P 500. We look for more earnings beats, to support their valuations, and the market.

Stablecoin boom continues to $115 billion size

Bitcoin (BTC) rebounded after briefly dipping below $30,000. We look at the surging popularity of stablecoins like tether (USDT) and USD Coin (USDC), that has taken overall market cap to $115 billion, as use cases have built, even as crypto markets have weakened.

Natural gas leading commodities to highs

The broad-based Bloomberg commodity index made new highs, brushing off renewed USD strength, and led up by surging natural gas prices (+53% YTD) as economies re-open boosting liquid natgas (LNG) demand, whilst drilling activity only half prior highs.

The week ahead: big tech earnings week

1) Q2 ‘big tech’ earnings week with Facebook (FB), Apple (APPL), Amazon (AMZN), and Alphabet (GOOG). 2) US Federal Reserve meets Wednesday, with the market focused on both the growth and inflation outlook. 3) International Monetary Fund (IMF) releases latest, likely higher, global GDP forecasts on Tuesday.

Our key views: Stay focused on growth

We see a positive outlook of 1) accelerating vaccine rollout and economic re-opening, and 2) unprecedented policy support. Current growth ‘scare’ gives new opportunities in our favoured reflation assets: equities, commodities, crypto, and value. Relative caution on fixed income, USD, defensive equity and China

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | 1.08% | 1.82% | 14.56% |

| NASDAQ | 1.96% | 3.06% | 17.46% |

| SPX500 | 2.84% | 3.32% | 15.12% |

| UK100 | 0.28% | -1.52% | 8.76% |

| GER30 | 0.83% | 0.39% | 14.22% |

| JPN225 | -3.71% | -4.60% | 0.38% |

| HKG50 | -2.44% | -6.71% | 0.33% |

*Data accurate as of 05/07/2021

Market Views

Markets shaken not stirred

- US equities rose 2% last week to a new all-time high (see chart), recovering from some sharp weakness early in the week, on a continued growth ‘scare’, as global new virus cases have risen over 40% in the past month. Markets were helped higher by US Q2 earnings strength, more dovishness from the European Central Bank (ECB) meeting, and broad strength from the forward-looking July purchasing managers indices (PMI’s). Tech related sectors led gainers, whilst utilities and energy were the only losers.

- We see the growth outlook as secure, and still positively surprising. Any market weakness is a ‘second opportunity’ to buy lagged growth sensitive cyclical sectors like financials (XLF), commodities (XLE, XLB), and re-opening areas like airlines, hotels, cruise lines and apparel.

- Some more volatility should be expected given the VIX volatility index post-crisis low and strong investor sentiment –both contrarian negatives – alongside the summer’s poor seasonality.

Spotlight on retail investors

- US household equity investments are a record given strong markets and increased numbers of retail investors. At first glance this is worrying, with prior peaks leading to low equity returns, but we see support from structural increase in retail participation, continued low bond yields, and very strong US household finances.

- But investors do disproportionately invest in their home equity market, given its familiarity, and their aversion to overseas country and currency risks. This home bias often leads to poor country and sector diversification and hurts returns. Paradoxically, diversification has never been cheaper or easier, with ETF’s like ACWI and EFA or @GlobalMarketETF’s.

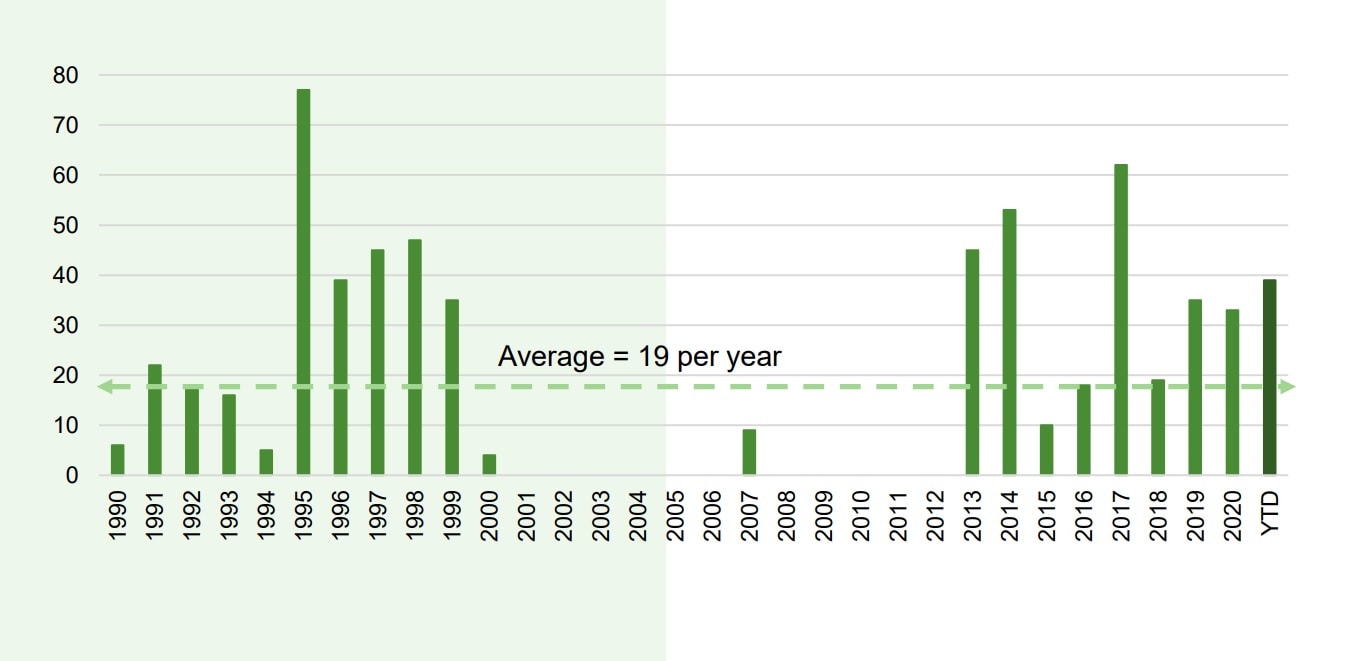

S&P 500 Jan-June Performance (Last 50 years)

Source: S&P Dow Jones Indices

Global earnings even better than expected

- The second week of earnings season has seen a total of 24% of the S&P 500 now report. Over 85% of those have beaten analysts already high expectations, by an average of 16%. This has taken earnings growth to +78% versus the same period last year. Further increases to earnings is the key upside driver to the equity market.

- Earnings surprises have been led by the cyclical sectors – industrials, consumer discretionary, and financials – the most sensitive to the GDP rebound. This is our investment focus (page 5).

Big tech Q2 reports key to the outlook

- Most of the so-called FAANGM stocks report earnings this week. They have a combined market capitalization of $9 trillion, a 25% weight in the S&P 500 index, and have been a key driver of US equity outperformance this year.

- We expect overall strong results to continue justifying the group’s premium valuation, at 37x price/earnings ratio vs the S&P 500 on 21.5x.

- We see them on track to meet their strong +25% revenue and +40% earnings growth forecasts for the year, with profit margins double the S&P 500 average, and ‘fortress’ balance sheets allowing more dividends and share buybacks.

Stablecoin boom takes market cap to $115bn

- Bitcoin (BTC) fell briefly below key $30,000 level, before recovering, helped by the latest Elon Musk tweeted support for the asset class. Average bitcoin trading volumes also rebounded from a yearly $200 million daily low.

- We highlight the surging popularity of stablecoins, such as tether (USDT) and USD Coin (USDC), that has taken overall market cap to $115 billion, as use cases have built, even as broader crypto markets have weakened.

- Jack Dorsey, CEO of Twitter (TWTR) and Square (SQ) , reiterated his commitment to make bitcoin a ‘big part’ of their future, supporting products.

Natural gas leads commodities to new highs

- The broad Bloomberg commodities index is at a new high, helped by natural gas +53% YTD. Gas demand has been boosted by reopening economies and seasonality (US summer air – con demand), whilst supply has been slow to recover, with shale drilling low. When gas prices were last at this level in 2018 gas drilling rig activity was twice as high as current levels.

- USD Index (DXY) of six major FX pairs (Euro, Yen, Pound, Canadian Dollar, Swedish Krona, Swiss Franc) rallied 3% the last two months. A stronger USD is often a problem for commodity demand, making more expensive for foreign buyers, But we see limited impact given the magnitude of this demand rebound and the supply shortages.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | 3.43% | 6.09% | 19.88% |

| Healthcare | 2.42% | 4.57% | 13.80% |

| C Cyclicals | 2.79% | 3.06% | 12.90% |

| Small Caps | 2.15% | -4.07% | 11.89% |

| Value | 0.91% | 1.61% | 15.68% |

| Bitcoin | 0.73% | -3.26% | 12.10% |

| Ethereum | 5.45% | 3.71% | 169.35% |

Source: Refinitiv

The week ahead: What’s the Fed thinking?

- 3rd week of global Q2 earnings, with tech giant FAANGM’s reporting. Facebook (FB), Apple (APPL), Amazon (AMZN), Alphabet (GOOG), and Microsoft (MSFT) all due. NFLX was last week.

- International Monetary Fund (IMF) to likely raise its global GDP outlook (Tue) from prior 2021 +6.0%, and 2022 +4.4% in a further antidote to the recent market growth ‘scare’.

- US Federal Reserve meets (Wed). Markets will focus on growth and inflation talk after the recent collapse in 10-year bond yields to 1.2%. Risks are to the upside from these very low expectation levels and could raise volatility.

- US second quarter GDP growth (Fri) seen at +8.2%. Strong vs the +6.4% of last quarter, and a further boost to the GDP and earnings view.

Our key views: Growth outlook is secure

- We see a positive scenario of 1) accelerating global vaccine rollout and economic re-opening, 2) still large economic policy support of low interest rates and fiscal expansion.

- The main, but well signalled, risk is of gradual Fed monetary policy tightening.

- We focus on reflation and cyclical assets benefitting most from the growth rebound: commodities, crypto, small cap, value equity.

- Relative caution on fixed income, USD, defensive equities and China.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | 1.33% | 3.18% | 22.09% |

| Brent Oil | 1.21% | -1.49% | 43.45% |

| Gold Spot | -0.57% | 1.14% | -5.23% |

| DXY USD | 0.24% | 1.15% | 3.31% |

| EUR/USD | -0.29% | -1.39% | -3.63% |

| US 10Yr Yld | -1.74% | -25.12% | 35.74% |

| VIX Vol. | -6.78% | -10.12% | -24.40% |

Source: Refinitiv. * Broad based Bloomberg commodity index

Focus of Week: Big tech in the spotlight

Strong markets, but a lot going on under the surface

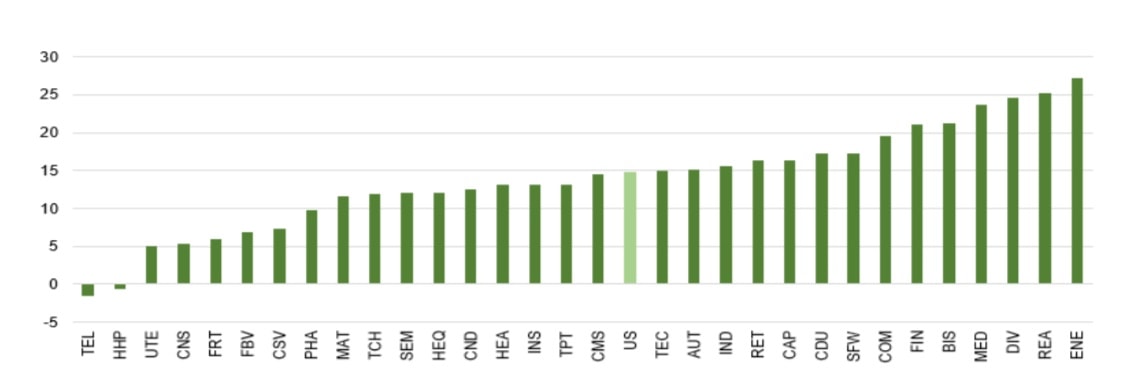

Equity markets have risen strongly and seemingly inexorably this year. Beneath the surface though we have seen strong rotations between sectors, and almost all industries posting good gains (see chart). This improved market breadth is healthy, and in sharp contrast to last year. We outline our sector investment playbook, with a tech foundation, a near term cyclicals opportunity, and defensives in reserve for later.

A tale of two quarters – cyclicals lead in Q1, and tech rebounds in Q2

The sectors most sensitive to the re-opening economy and growth rebound led in the first three months of the year. Energy, financials, industrials, and retail (so-called Value). From April, tech (and so-called Growth) and real estate (XLRE) saw a significant rebound, helped by lower bond yields and higher growth concerns. This saw a significant bunching of returns, with the early year cyclicals lead now sharply cut back.

Cyclicals is the current opportunity as the growth ‘scare’ will fade

We see this Value again leading markets higher, as 1) the current growth ‘scare’ eases as delta variant cases peak and vaccination rates accelerate, whilst 2) US bond yields increase after under-estimating the inflation risks and as the US Federal Reserve moves to start tightening policy later this year. Value sectors benefit the most from this, with more depressed earnings, much cheaper valuations, and being less well-owned after underperforming recently. We focus on financials (XLF), commodities (XLE, XLB), and ‘reopeners’.

Tech is the foundation of any portfolio given its good growth, margins, and strong balance sheets

We see growth stocks, such as tech (XLK), lagging cyclicals but remaining as core holdings. Earnings growth remains strong (and most FAANGM’s reporting this week), even after the 2020 lockdown acceleration. Profitability is high. Balance sheets very strong, enabling capex and increasing dividends and share buybacks. This combo of growth, profitability, and cash returns justifies high valuations. Regulatory risks in the US are overdone, and tech sector to keep growing if venture capital trends are a future guide.

Defensives like utilities and staples are on the radar for later, when the growth rebound ends

The laggards have been defensives sectors – with least earnings sensitivity to GDP – like telecoms, utilities (XLU), consumer staples (XLP). They are also hurt by rising bond yields, as highly valued and their long-term cash flows sensitive to yields. We see GDP growth as still under-estimated and little room for bond yields to fall more. They do have strong dividends and their defensive nature attractive later in cycle.

US industry price performance year-to-date (%)

Source: MSCI, Refinitiv. Refinitiv. UT=Autos. BIS=Banks. CAP=Capital Goods. CDU=Consumer Durables. CND=Consumer Discretionary. COM=Communications. CMS=Commercial Services. CNS=Consumer Staples. CSV=Consumer Services. DIV=Diversified Financials. ENE=Energy. FBV=Food & Beverage. FIN=Financials. FRT=Food Retail & Tobacco. HEA=Healthcare. HEQ=Healthcare Equipment. HHP=Household Products. IND=Industrials. INS=Insurance. MAT=Materials. MED=Media. PHA=Pharmaceuticals. REA=Real Estate. RET=Retail. SEM=Semiconductors. SFW=Software. TCH=Tech Hardware. TEC=Information Technology. TEL=Telecoms. TPT=Transport. US=S&P 500. UTE=Utilities.

Key Views

| The eToro Market Strategy View | |

| Global Overview | Positive scenario of 1) accelerating global vaccine rollout and economic re-opening, 2) large economic policy support of low interest rates and fiscal expansion, and 3) low base of 2020 recession and deflation. Main, but well signalled, risk of gradual Fed monetary policy tightening. Focus on reflation and cyclical assets: equities, commodities, crypto, small cap and value. Relative caution fixed income, USD, defensive equities and China. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (55% of total) seeing strongest GDP recovery in 30-years driving earnings upside ‘surprise’, and a rare third consecutive year of 10%+ equity market returns. Valuations at 22x P/E are 30% above historic levels but supported by still low bond yields and strong earnings growth outlook. See further cyclicals and value catch-up, after a decade of underperformance, whilst tech is supported by its structural growth outlook. |

| Europe & UK | Latest to benefit from vaccination surge and much more economic re-opening to go. Equity markets helped by 1) a greater weight of cyclical sectors, and lack of tech, 2) 25% cheaper valuations vs US, 3) decade of underperformance made under-owned by global investors. Combo of lower-for-longer ECB plus multi-year €750bn ‘Next Generation’ fiscal support is set to drive European GDP and earnings growth more than the US, for the first time in a decade. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM, with 60% weight, and is more tech-centric than US. China has world’s strongest GDP growth, and benefitted from being ‘first in, first out’ of crisis, but its tech sector crackdown has hurt the market. LatAm and Eastern Europe have more upside to vaccine rollouts, global growth recovery and higher commodities. |

| Other International (JP, AUS, CN) |

Canada and Australia benefit from strong equity market weight in commodities and financials, as global growth rebounds and bond yields set to rise. Japanese equities among cheapest of any major market and vaccination rates accelerating, but has structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | The broad ‘tech’ sector of IT, communications, and parts of consumer discretionary (Amazon, Tesla), dominates US and Chinese markets. Expect a more subdued 2021 after dramatic 2020 rally. But are structural stories with good growth, high profitability, and clean balance sheets that justify high valuations, and should continue to rise. |

| Defensives | Healthcare, consumer staples, utilities, and real estate sectors traditionally offer more defensive cash flows, less exposed to changes in economic growth. This has also made them more sensitive to rising bond yields. We expect them to relatively underperform in the current cyclicals focused environment with growth strong. . |

| Cyclicals | We expect cyclicals – consumer discretionary (autos, apparel, restaurants), industrials, energy, and materials, to lead market performance. They are most sensitive to the sharp economic recovery and higher bond yield outlook, with more sensitive businesses, depressed earnings, cheaper valuations, and have been out-of-favour for many years. |

| Financials | Financials will benefit from the GDP growth recovery, with higher loan demand and lower defaults. Similarly, they benefit from higher bond yields outlook, charging more for loans than they pay for deposits. Sector has cheapest P/E valuation of any, and regulators recently giving flexibility to pay large 8-10% dividend and buyback yields. |

| Themes | We favour small cap vs large, on more GDP growth exposure, earnings upside, and domestic focus. Similarly, value over growth on GDP recovery, lower valuations, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. |

| Traffic lights* | Other Assets |

| Currencies | We see modest USD weakness as the rest-of-world GDP growth recovery accelerates, with investor positioning now less crowded around expecting USD weakness, and Fed only gradually tightening policy. A stable or weaker USD traditionally supports EM, commodities, and US foreign earners, such as the tech sector. |

| Fixed Income | US 10-year bond yields to rise modestly as inflation above 2% average Fed target, ‘real’ inflation-adjusted yields negative, Fed to gradually tighten policy. Will be modest as inflation expectations already high, wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, and low productivity |

| Commodities | Commodities supported by record-breaking GDP growth rebound, ‘green’ industry demand, years of supply underinvestment, and a stable or weaker USD. Industrial metals (copper) and battery materials seem best positioned, whilst oil price supported by only slow return of OPEC+ supply. Gold hurt by outlook for rising bond yields. |

| Crypto | Institutionalization of bitcoin market barely begun, as asset class benefits from very strong risk-adjusted returns and low correlations with other assets. Altcoins have outperformed as see broader interest and use cases. Clear supply rules a benefit as inflation rises. Volatility remains very high, with the 15th -50% pullback of the last decade. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Iberia/LatAm | Javier Molina |

| Italy | Edoardo Fusco Femiano |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.