Summary

Focus: Asia in the spotlight

Asia is 60% of the worlds population, near 40% of GDP, and with GDP growth rates 2-4x those of western markets. It is as diverse as 1.4 billion person consumer giants China and India across to tech titans Taiwan and Korea, and the world’s 2nd largest equity market Japan. Despite this it has significantly underperformed global equities this year, especially hit by the covid virus 3rd wave and China’s tech crackdown. Whilst we are cautious short term, the long term opportunity is clear and available via broad ETF’s like AAXJ and portfolios like @AsiaDragons or more thematic @ChinaTech and @ChinaCar.

Ready to return to school

It was a resilient week for global markets given the Fed’s Jackson Hole get-together and weaker than-expected global PMI growth data. Markets are up 7% over the summer, bucking traditional weak seasonality, and have now not seen even a 5% pullback since November. This is the 8th longest winning market streak in history. Whilst a pullback of some magnitude is well-overdue we see markets as well-supported and to keep successfully climbing the ‘wall of worry’ over the virus third wave, Fed policy tightening, and ongoing China tech crackdown.

The Fed tightening two-step focus

The Fed’s Jackson Hole get-together continued the long march towards the Fed starting the unprecedented process of reducing its $8.3 trillion balance sheet and raising interest rates off 0%. They will move slowly, and markets can take it, but expect some volatility.

Not all tech is created equal

Big Tech (FAANG) performance has left peers in the dust. This may accelerate as slowing GDP growth and higher interest rates sap demand for tech disruptors with few earnings and high financing needs. We also analysed the reassuring history of tech founders handing over control. This is key for Amazon (AMZN) today.

Crypto eases but adoption builds

Bitcoin (BTC) briefly regained its $50,000 price milestone, but crypto asset strength was led by Cardano (ADA), Binance Coin (BNB), and Tezos (XTZ). Adoption was further boosted by Paypal’s (PYPL) crypto offering expansion to the UK, and payments giant Visa (V) non-fungible token (NFT) buy and bullish outlook on their use.

Oil leads commodity relief

Brent crude jumped 10% as global growth fears eased and the USD retreated. Investors remain likely too cautious, with crude oil futures prices backwardated (lower than current), whilst new drilling activity is 40% below pre-crisis levels, all supporting medium term oil upside.

The week ahead: Jobs and China

1) US monthly jobs data (Fri) in focus as Fed considers timing of its policy tightening. 2) China’ forward-looking purchasing managers (PMI) data as world’s no.2 economy slowed. 3) Q2 earnings from semiconductor Broadcom, Crowdstrike, Veeva, Chewy, and Netease.

Our key views: Staying the course

We see a positive outlook of 1) vaccine rollout and economic re-opening, and 2) still huge policy support, offsetting virus third wave and Fed tightening risks. We favour assets most helped by this growth rebound: equities, commodities, crypto, and value, and are cautious fixed income, USD, defensive equities and China.

Top Index Performance

| 1 Week | 1 Month | YTD | |

| DJ30 | 0.96% | 1.49% | 15.84% |

| NASDAQ | 1.52% | 2.60% | 20.06% |

| SPX500 | 2.82% | 3.11% | 17.39% |

| UK100 | 0.85% | 1.65% | 10.64% |

| GER30 | 0.28% | 1.98% | 15.55% |

| JPN225 | 2.32% | 1.31% | 0.72% |

| HKG50 | 2.25% | -2.13% | -6.70% |

*Data accurate as of 30/08/2021

Market Views

Back to school

- As kids ready to return to school, and investors to their desks, it has been a strong summer. US and European equities are up 6-7% since June, dodging weak seasonality. S&P 500 saw a good week, up 1.5%, and now 20% this year, resilient to the Fed’s Jackson Hole discussion on starting to tighten monetary policy by year-end, and a set of weaker-than-expected global purchasing manager (PMI) growth data. Commodities saw a rebound, and the USD weakened. Equities were led up by Value, energy and financials, with defensives, utilities and staples, weaker. See our global markets summary presentation here.

- The S&P 500 has been in a remorseless rally, without even a 5% pullback, let alone a 10% ‘correction’, since November. This is the eighth longest winning streak (200 trading days) in history, along with one of the strongest returns (30%). We have only seen three years the last fifty with no pullback. An normal year has three.

- A pullback is overdue, but we continue to see markets as well-supported and successfully climbing the ‘wall of worry’ of the third virus wave, Fed policy tightening talk, and China’s tech crackdown. Forward S&P 500 returns from the seven even-longer rallies were positive.

The Fed tightening two-step ahead

- The Fed balance sheet has ballooned to $8.3 trillion, double its size before the pandemic. Similarly, the Fed funds rate is at zero, for only the second time. This has worried investors.

- The Fed ‘two-step’ is to 1) cut (‘taper’) its $120 billion a month bond buys to zero by late 2022. This will end its balance sheet growth, which then falls as bonds mature. They are unlikely to sell anything. 2) Fed then slowly raises the 0% Fed interest rate, starting end 2022/early 2023, depending on inflation and the growth outlook.

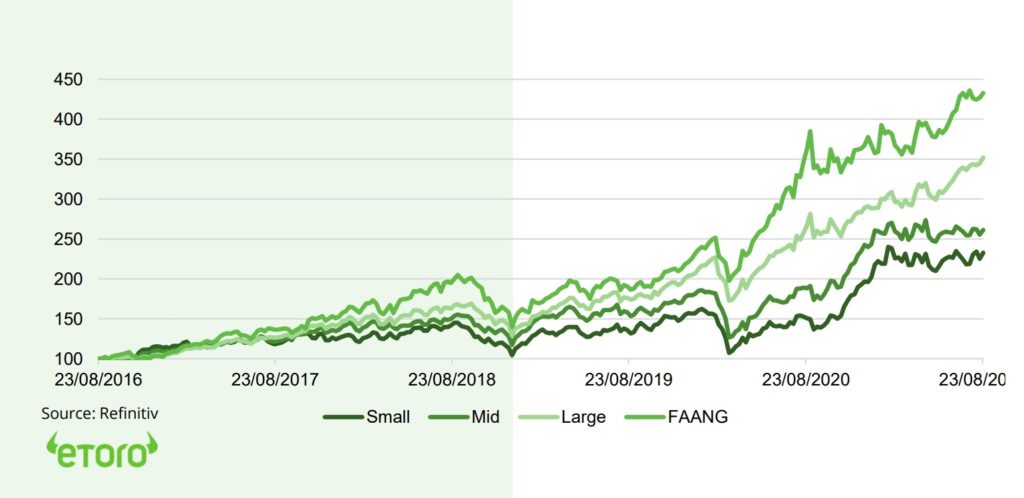

FAANG’s vs Large, Mid, and Small Cap US Tech Stock Performance (5 Years, Rebased to 100)

Not all tech is created equal

- Large cap US tech has outperformed smaller peers (see chart), by 200% in five years, despite the same positive trends of faster tech adoption and software ‘eating the world’. The disruptive innovators proxied by ARK Innovation (ARKK) have underperformed the FAANGS near 20% recently as Tesla (TSLA) to Palantir (PLTR) lagged.

- As the business cycle ages and Fed hikes rates, we see an even greater premium on big tech’s growth visibility, cash flow and valuation, and caution the innovators growth premium without earnings. Big tech are the new defensive stocks.

Apple and founder transitions

- It was 10th anniversary of Steve Jobs stepping down as Apple CEO, after a prior decade 3,100% outperformance of NASDAQ. But his successor, Tim Cook, has also managed a huge 2,600% outperformance the past 10 years, taking Apple to a $2.4 trillion value, the largest of any stock.

- Tech founder transitions can be risky, but our analysis shows a surprisingly good track record, with the stocks big enough and industry trends strong enough to keep prospering. This is good news for those transitioning founders today, like Amazon (AMZN), Alphabet (GOOG), Netflix (NFLX), Alibaba (BABA), and Pinduoduo (PDD).

Pause in the crypto bounce-back

- Bitcoin (BTC) briefly regained the symbolic $50,000 level last week, before crypto-assets saw broad but modest weakness. Among the rare exceptions were Cardano (ADA), Binance Coin (BNB), and $4 billion market cap ‘next gen’ decentralized smart contract Tezos (XTZ).

- Paypal (PYPL) is to introduce its crypto offering in UK, a further step to mainstream adoption. Elsewhere, NFT (non-fungible token) interest builds as payments giant Visa (V) paid $150,000 for a ‘CryptoPunk’ NFT and said it see’ a big NFT role in the future of retail and entertainment.

Commodities see some relief. Focus on oil

- Commodities had a better week, with the broad Bloomberg commodity index +6%, led by oil and copper, as growth fears eased and USD fell. We are positive commodities, with a rare ‘sweet spot’ of recovering demand and tight supply.

- Investors remain overly cautious the oil price outlook. The oil futures market is in backwardation, with futures prices much lower than current spot levels. This is counter intuitively bullish, disincentivising investment in new production and boosting inventory sales.

- Additionally, the traditional supply response to current relatively high oil prices is very slow, mainly for environmental reasons. Oil prices are back above pre-pandemic levels whilst US oil drilling rig activity is still 40% lower.

US Equity Sectors, Themes, Crypto assets

| 1 Week | 1 Month | YTD | |

| IT | 2.29% | 3.37% | 22.57% |

| Healthcare | -0.24% | 2.65% | 16.14% |

| C Cyclicals | 2.55% | -0.55% | 11.95% |

| Small Caps | 5.05% | 3.89% | 15.31% |

| Value | 1.18% | 2.17% | 18.52% |

| Bitcoin | -0.40% | 27.30% | 68.46% |

| Ethereum | -0.42% | 44.42% | 331.49% |

Source: Refinitiv

The week ahead: US jobs and Chinese growth

1.Focus on US jobs (Fri). Non-farm payrolls (est. +760,000) growth to see a slowdown from very strong 900,000+ levels but unemployment rate to fall to 5.2%. The Fed considers regaining the 5.7 million jobs still lost to the pandemic as key to the timing and pace of its policy tightening.

2.Also China GDP growth (Mon, Wed) as see forward-looking purchasing manager (PMI) data. Doubts built on recovery of world’s no. 2 economy and largest commodity user as its manufacturing PMI fell to only 50 last month.

3. Q2 earnings are due from $200bn market cap. semiconductor stock Broadcom (AVGO), cyber security Crowdstrike (CRWD), cloud services Veeva (VEEV), online pet-supplier Chewy (CHWY), and Chinese gamer Netease (NTES).

Our key views: Staying the course

- We see a positive scenario of 1) global vaccine rollout and economic re-opening, 2) still large policy support of low interest rates and fiscal expansion. This is resilient to current volatility.

- The main risk is Fed monetary policy tightening, which we see as gradual and well-flagged, alongside growth risks from the third virus wave, which we see as peaking soon.

- We focus on reflation and cyclical assets benefitting most from the growth rebound: commodities, crypto, small cap, value equity. Relative caution on fixed income, USD, defensive equities and China.

Fixed Income, Commodities, Currencies

| 1 Week | 1 Month | YTD | |

| Commod* | 5.69% | 0.08% | 23.44% |

| Brent Oil | 11.43% | -1.68% | 40.21% |

| Gold Spot | 2.10% | 0.63% | -4.12% |

| DXY USD | -0.87% | 0.55% | 3.06% |

| EUR/USD | 0.82% | -0.61% | -3.43% |

| US 10Yr Yld | 5.29% | 8.56% | 39.48% |

| VIX Vol. | -11.69% | -10.14% | 27.96% |

Source: Refinitiv. * Broad based Bloomberg commodity index

Focus of Week: Asia in the spotlight

The world’s economic engine: now and especially in the future

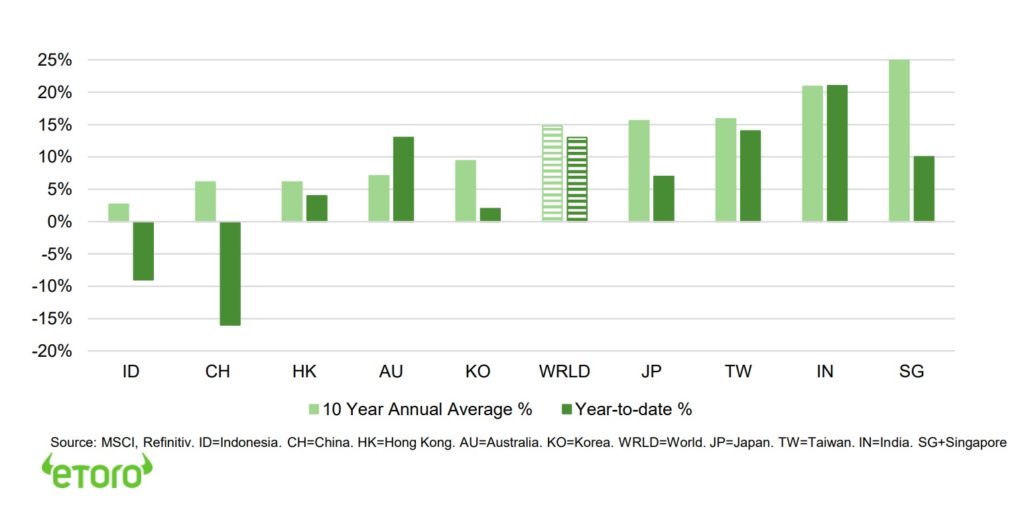

Asia has 60% the world’s population, 37% of it’s GDP, and has grown this GDP 2-4 times as fast as western developed economies in the past decade. It has some of the world’s largest and fastest growing companies and dominates sectors from luxury to semis. It is incredibly diverse, from fast growing and 1.4 billion population India and China, to smaller, richer, and slower growing Japan, Korea, and Taiwan. Yet, its equity markets have underperformed recently (see chart), struggling with the covid 3rd wave and China’s tech sector crackdown. Whilst we are cautious in the short term, the long-term investment opportunity is clear.

The developed tech-led titans of Korea, Taiwan, and Japan

Korea and Taiwan dominate global tech supply chains, led by Taiwan Semi (TSM) and Samsung (SMSN.L). They are open, export-oriented, tech-heavy, relatively cheap and still classified as emerging markets. Japan is the world’s no. 2 equity market but has been a ‘value-trap’: cheap but hurt by low GDP growth, poor demographics, and high debt, despite many globally leading companies like Toyota (TM) and Sony (SONY).

The China (and Hong Kong) economic juggernaut and changing stock market

China transitioned from commodity and manufacturing-heavy state-owned companies to one dominated – even more than US – by consumer internet, led by Alibaba (BABA), Tencent (0700.HK), and JD.COM (JD.US). It is the world’s second largest economy, largest commodity importer, and is hugely under-represented in global equity markets. We are cautious short term given its tech regulatory crackdown and economic growth slow down, but cheap valuations, strong growth, and policy flexibility make it attractive long term.

The large up-and-comers in south Asia – India, Indonesia, and ASEAN

South Asian economies have large, growing and urbanising populations, off a low economic base. India GDP per capita is only $2,000 and Indonesia $4,000. Their equity markets are domestic focused on banks, consumer and tech, and traditionally expensive, reflecting the consumer growth. They have innovative ‘unicorn’ start-ups, from Indonesia’s Bukalapak and GoTo to Singapore gamer Sea (SE) and ride hailer Grab.

How to invest in such a diverse region – breadth or depth

Shorter term we are more focused on the investment opportunities in US and Europe, but the long-term Asia potential remains huge. Broad exposure is possible via Asia ETF’s such as AAXJ or @AsiaDragons, or specific country ETFs like Korea (EWJ) or India (INDA). Thematic exposure via @ChinaTech, and @ChinaCar

Asian country equity performance vs world (10-year annual average and Year-to-date %)

Key Views

| The eToro Market Strategy View | |

| Global Overview | Positive scenario of 1) global vaccine rollout and economic re-opening, 2) support from low interest rates and government spending. Main risk is from US Fed monetary policy tightening, but will be well-signalled and very gradual. Economies are increasingly resilient new virus case ‘waves’. Focus on most growth sensitive assets: equities, commodities, crypto, small cap and value. Relative caution on fixed income, USD, defensive equities and China. |

| Traffic lights* | Equity Market Outlook |

| United States | World’s largest equity market (55% of total) seeing strongest GDP recovery in 30-years driving earnings upside ‘surprise’, and a rare third consecutive year of 10%+ equity market returns. Valuations at 21x P/E are 25% above historic levels but supported by still low bond yields and strong earnings growth outlook. See further cyclicals and value catch-up, after a decade of underperformance, whilst tech is well supported by its structural growth outlook. |

| Europe & UK | A big beneficiary of the global growth rebound. Helped by 1) a greater weight of sectors most sensitive to the growth rebound, and lack of tech, 2) 25% cheaper valuations than the US, 3) a decade of under performance has made under-owned by global investors. Combination of lower-for-longer ECB plus multi-year €750bn ‘Next Generation’ government spending to drive European GDP and earnings growth more than the US, for the first time in a decade. |

| Emerging Markets (EM) | China, Korea, Taiwan dominate EM, with 60% weight, and is more tech-centric than US. China has world’s strongest GDP growth, and benefitted from being ‘first in, first out’ of crisis, but its tech sector crackdown is hurting the market. LatAm and Eastern Europe have more upside to vaccine rollouts, global growth recovery and higher commodities. |

| Other International (JP, AUS, CN) |

Canada and Australia benefit from strong equity market weight in commodities and financials, as global growth rebounds and bond yields set to rise. Japanese equities among cheapest of any major market and vaccination rates accelerating, but has structural headwinds of low GDP growth, an ageing population, and world’s highest debt. |

| Traffic lights* | Equity Sector & Themes Outlook |

| Tech | The broad ‘tech’ sector of IT, communications, and parts of consumer discretionary (Amazon, Tesla), dominates US and Chinese markets. Expect a more subdued 2021 after dramatic 2020 rally. But are structural stories with good growth, high profitability, and clean balance sheets that justify high valuations, and should continue to rise. |

| Defensives | Healthcare, consumer staples, utilities, and real estate sectors traditionally offer more defensive cash flows, less exposed to changes in economic growth. This has also made them more sensitive to rising bond yields. We expect them to relatively underperform in the current cyclicals focused environment with growth and earnings strong. |

| Cyclicals | We expect cyclicals – consumer discretionary (autos, apparel, restaurants), industrials, energy, and materials, to lead market performance. They are most sensitive to the sharp economic recovery and higher bond yield outlook, with more sensitive businesses, depressed earnings, cheaper valuations, and have been out-of-favour for many years. |

| Financials | Financials will benefit from the GDP growth recovery, with higher loan demand and lower defaults. Similarly, they benefit from higher bond yields outlook, charging more for loans than they pay for deposits. Sector has cheapest P/E valuation of any, and regulators recently giving flexibility to pay large 8-10% dividend and buyback yields. |

| Themes | We favour small cap vs large, on more GDP growth exposure, earnings upside, and domestic focus. Similarly, value over growth on GDP recovery, lower valuations, under-ownership after decade under-performance. Dividends and buybacks recovering with cash flows. Power of dividends under-estimated, at up to 1/2 of total long term return. |

| Traffic lights* | Other Assets |

| Currencies | We see modest USD weakness as the rest-of-world GDP growth recovery accelerates, and fears over a virus ‘third wave’ ease. A stable or weaker USD traditionally supports Emerging Markets, commodities, and large US foreign earners, such as the tech sector, and could be a modest headwind to large exporters, such as Europe. |

| Fixed Income | US 10-year bond yields to rise modestly as inflation above 2% average Fed target, ‘real’ inflation-adjusted yields negative, Fed to gradually tighten policy. Will be modest as inflation expectations already high, wide spread to other market bond yields, and structural headwinds of all-time high debt, poor demographics, and low productivity. |

| Commodities | Commodities supported by record-breaking GDP growth rebound, ‘green’ industry demand, years of supply underinvestment, and a stable or weaker USD. Industrial metals (copper) and battery materials seem best positioned, whilst oil price supported by only slow return of OPEC+ supply. Gold hurt by outlook for higher bond yields. |

| Crypto | Institutionalization of bitcoin market barely begun, as asset class benefits from very strong risk-adjusted returns and low correlations with other assets. Altcoins have outperformed as see broader interest and use cases. Clear supply rules a benefit as inflation rises. Volatility remains very high, with the 15th -50% pullback of the last decade. |

| *Methodology: | Our guide to where we see better risk-adjusted outlook. Not investment advice. |

| Positive | Overall positive view, and expected to outperform the asset class on a 12-month view. |

| Neutral | Overall neutral view, with elements of strength and weakness on a 12-month view |

| Cautious | Overall cautious view, and expected to underperform the asset class on a 12-month view |

Source: eToro

Analyst Team

| Global Analyst Team | |

| CIO | Gil Shapira |

| Global Markets Strategist | Ben Laidler |

| United Kingdom | Adam Vettese Mark Crouch Simon Peters |

| France | Antoine Fraysse Soulier David Derhy |

| Iberia/LatAm | Javier Molina |

| Italy | Edoardo Fusco Femiano |

| Poland | Pawel Majtkowski |

| Romania | Bogdan Maioreanu |

| Asia | Nemo Qin Marco Ma |

| Australia | Josh Gilbert |

COMPLIANCE DISCLAIMER

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.