2023 saw big changes in the world of investing, especially in areas such as oil, Bitcoin, and various types of ETFs. Let’s dive into what’s been happening and what we might expect in 2024.

2023: a year of dynamic shifts

It was a year of big winners and notable trends. AI and major tech stocks, led by companies like Tesla, NVIDIA, and Apple, bounced back impressively. Surprisingly, cryptocurrencies also rose as a leading asset class.

On the trend front, investors focused on fixed income and dealt with higher interest rates, while commodities experienced a lot of ups and downs. Dividend stocks provided a sense of security in these fluctuating times. However, not all was smooth sailing; banking and real estate sectors didn’t perform as well, and global political issues significantly impacted commodities.

2024: Navigating the Financial Landscape

Midsize UK stocks’ performance: growth despite challenges

It’s looking like 2024 could potentially be a strong year for the stocks contained in the UK100 index tracking large-cap UK stocks, thanks to UK tax cut plans and better-than- expected inflation rates, with a wide gap in valuation relative to the SPX500.

The UK100 provides investors with exposure to major UK stocks which represent a balanced blend of growth and value across various sectors in UK industry.

76% of retail CFD accounts lose money.

Oil market: riding the waves of uncertainty

The ups and downs of the oil markets caught the attention of both long-term investors like Warren Buffett, as well as that of day traders who favour volatility. With ongoing political tensions, there’s a good chance for more action in this unpredictable market.

Whichever investment strategy you subscribe to, oil is undeniably a crucial global commodity, playing a pivotal role in the energy sector and significantly influencing economic dynamics due to its impact on fuel prices and industrial production.

76% of retail CFD accounts lose money.

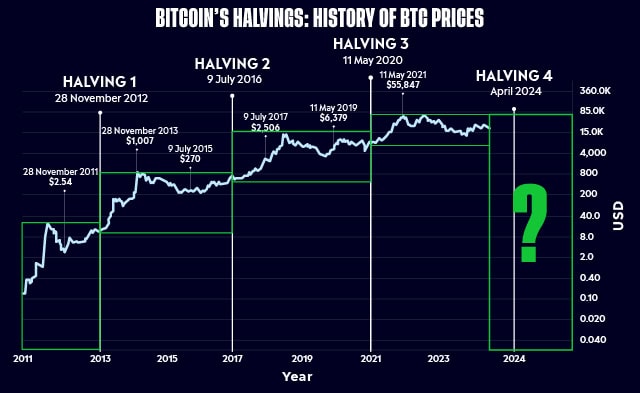

Bitcoin’s comeback: what’s next?

Bitcoin seems to be gearing up for a big 2024, with new products such as BlackRock’s Crypto ETF as well as the much-anticipated Bitcoin halving event which takes place once every four years. Everyone’s watching to see how these developments might shape the future of this digital currency.

Past performance is not an indication of future results.

Bitcoin, the pioneering cryptocurrency, is known for its decentralized nature and has become a prominent digital asset, influencing the financial landscape with its potential for high returns and volatility.

Cryptoasset investing is highly volatile and unregulated in some EU countries. No consumer protection. Tax on profits may apply.

It is important to read and understand the risks of this investment which are explained in detail at this link.

Crypto investing is offered by eToro (Europe) Ltd as a DASP, registered with the AMF. Cryptoasset investing is highly volatile. No consumer protection.

Don’t invest unless you’re prepared to lose all the money you invest. This is a high-risk investment and you should not expect to be protected if something goes wrong. Take 2 mins to learn more

Treasury bond ETFs: A smart move with US rate cuts?

Expecting lower interest rates in the US, could Treasury Bond ETFs be a smart pick? The answer will depend on actual rate cuts in the US. Should they happen, investors can expect to see yield increases.

The iShares 20+ Year Treasury Bond ETF (TLT), a popular choice for investors, tracks long-term US Treasury bonds, offering a way to invest in fixed-income securities with the potential for steady returns and risk mitigation. Since it is a long duration ETF, it is sensitive to rate changes and as such, can also benefit from rate cuts.

76% of retail CFD accounts lose money.

Tech stocks: the power of AI and the Magnificent 7

Tech stocks had a great run in 2023, thanks to breakthroughs in AI and the performance of seven major tech companies. The Vanguard Mega Cap Growth ETF (MGK), highly exposed to these “Magnificent 7,” is known for its focus on mega-cap growth stocks, offering investors diversified exposure to some of the largest and most influential companies in the market.

76% of retail CFD accounts lose money.

Something for everyone

As we step into 2024, investors have many interesting options to consider — ranging from UK stocks bolstered by economic policies, to the dynamic oil market, Bitcoin’s potential comeback, opportunities in Treasury bond ETFs, and the ever-evolving tech landscape. Staying informed as we progress into the next quarter and beyond is key to navigating these diverse investment paths.

76% of retail CFD accounts lose money.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.