As George Soros once said: “When a long-term trend loses its momentum, short-term volatility tends to rise. It is easy to see why that should be so: the trend-following crowd is disoriented.” And right now, that’s exactly where global markets are, between narrative and noise, squinting at earnings and central bank signals for direction.

Gold’s glow-up

Gold pushed past $3,350/oz supported by global uncertainty, a weaker USD, and strong central bank demand. It’s also being seen as a hedge against sticky inflation, with Fed rate cuts likely pushed further out. Investor takeaway: Gold’s rally reflects a shift in positioning, not panic. It’s a reminder that diversification, into commodities or short-duration bonds, can help manage volatility.

China’s GDP “beat” isn’t the full story

Yes, China’s economy grew 5.4% in Q1, beating expectations, but markets barely flinched. Why? Because export frontloading ahead of US tariffs juiced the numbers, while investors are waiting for more concrete signs of domestic demand strength or policy stimulus (think: rate cuts, infrastructure cash). Investor takeaway: Chinese equities like Alibaba and BYD saw modest gains, but broad upside may depend on upcoming fiscal or monetary support (or a yuan policy shift). Any stimulus announcement could be a near-term catalyst. Conversely, if trade tensions escalate with new rounds of tit-for-tat tariffs, markets could react with another risk-off bout, making China’s next moves all the more crucial.

UK: Inflation cools, but maybe not for long

Inflation came in softer at 2.6%, below expectations, and traders jumped on hopes that the BoE might cut rates in May. FTSE 100 stocks in housing and retail (think: Taylor Wimpey, Tesco) liked that news, and the pound held steady. Lower rates could support domestic stocks and ease borrowing costs but watch out: April energy price hikes could push CPI back up. Investor takeaway: If you’re in FTSE 100 ETFs, near-term upside may hinge on confirmation of a rate cut. A cut could boost small caps too, which are still lagging large caps. Watch for BOE messaging in early May.

Big Tech: High expectations, cautious setup

Netflix delivered a solid beat (earnings up 25%, sales up 13%, operating margin 31.7%) , but upcoming earnings from Alphabet, Microsoft, Amazon and others are being watched closely. Analysts have trimmed forecasts slightly, reflecting concern over margin compression and cautious corporate guidance. Investor takeaway: Valuations remain elevated in tech. If guidance underwhelms, there could be room for further consolidation. However, pullbacks may offer long-term entry points into quality names.

Japan’s stock rally = trade vibes + yen weakness

The Nikkei 225 gained over 3%, lifted by a weaker yen and progress in US-Japan trade talks, and exporters like Toyota and Sony outperformed. Inflation remains above target, but the BOJ is expected to keep policy unchanged. Investor takeaway: Don’t sleep on Japan. It’s the best-performing major equity market YTD and if the yen stays soft, exporters still have room to run. Currency-sensitive sectors remain in focus.

Wave of earnings: Lower expectations as an opportunity?

In the midst of heightened market volatility, triggered by the US administration’s tariff drama, investors should not overlook the upcoming earnings reports in the U.S. The major banks have already reported, but this week the earnings season picks up speed – including companies like Verizon, Boeing, IBM, PepsiCo, and Intel.

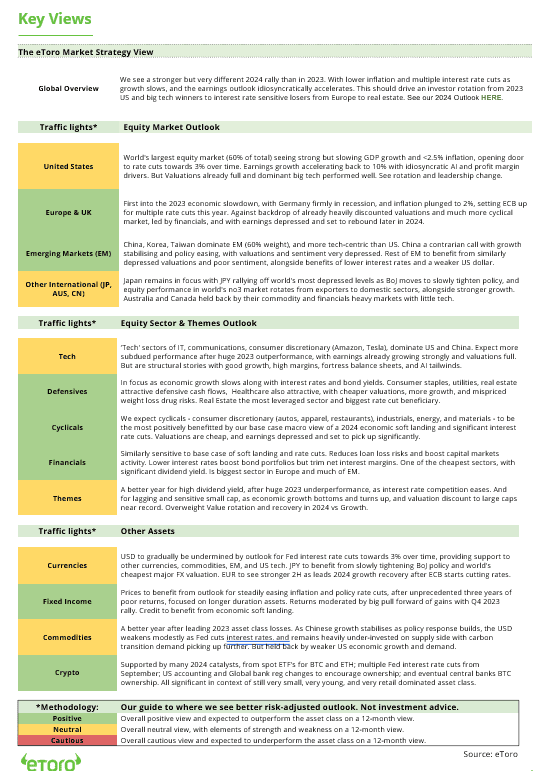

Tariffs threaten global stability more than expected: Still, the U.S. economy is far from a recession. At least that’s what the current earnings expectations for the S&P 500 suggest.

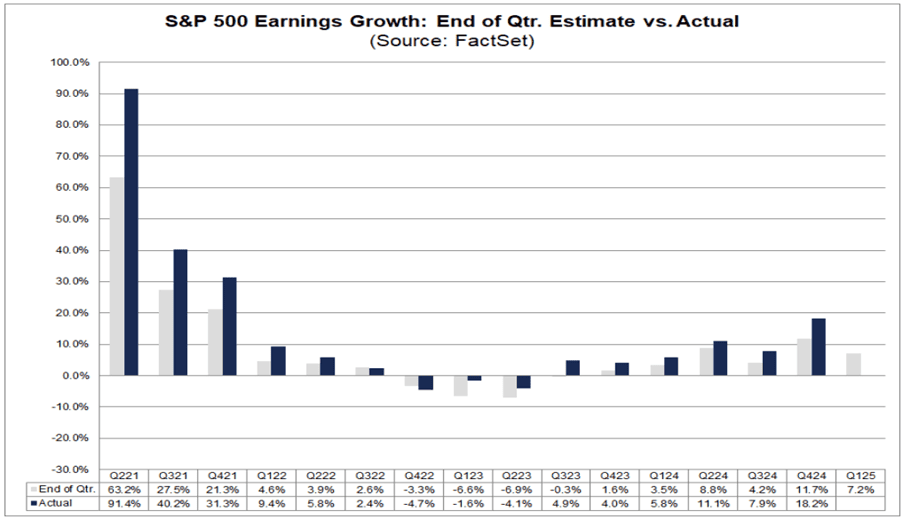

Momentum fading: However, profit growth is expected to have slowed significantly in the first quarter – from 18.2% to 7.2%. According to forecasts (see chart), the sectors healthcare, technology, and utilities are the main growth drivers. On the negative side, consumer goods, materials, and energy are weighing down results.

Corporate profits rise, stock prices do not: The situation is complex. Nine out of eleven sectors are in negative territory year-to-date. Leading the losses are consumer discretionary (-19.7%) and technology (-18.3%). Consumer staples (+3.2%) and utilities (+1.9%) are the only sectors showing positive performance, followed closely by healthcare and real estate.

Investors are returning to defensive stocks: These are less dependent on the economic cycle and offer more stability in uncertain markets. How quickly the broader market can recover largely depends on the US administration. The world needs clarity in trade policy. Every sign of easing reduces inflation expectations and creates room for interest rate cuts. Investors could then become more willing to take on risk again.

Economic damage hard to measure: Past macroeconomic data has lost significance. What matters more now is how often companies address tariffs and recession risks in their guidance over the coming weeks. That makes this earnings season more important than ever.

Bottom line: Earnings expectations have already been revised downward in recent months. The bar for this earnings season is therefore lower. In addition, expectations have been exceeded in each of the past eight quarters. That could provide real opportunities for positive market momentum.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.