Options are a derivative asset, which means that their value is derived from an underlying asset (in this case, a stock). However, that derivative structure also means there are different options strategies you can use, depending on what your goals are or how you think the market will move.

Let’s get started.

What are calls?

Calls may be the most well-known type of option. They offer the chance to purchase shares of a stock (usually 100 at a time) at a price that is, hopefully, lower than the price the stock is trading at (when the option expires).

This means the best time to buy a call option would be when you expect the price of the stock to go up before the expiry date.

There are four potential outcomes once you purchase your call option.

- Profit

- Breakeven

- Partial loss

- Total loss

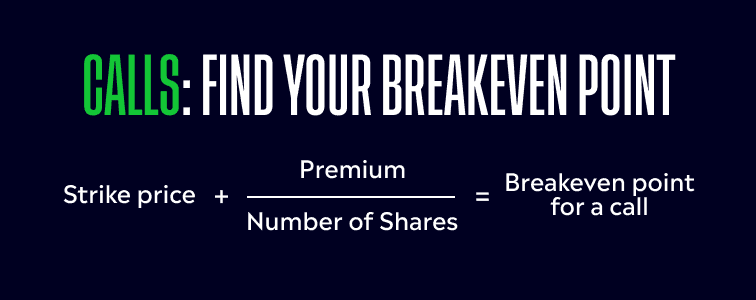

We’ll start with breakeven, since that acts as the baseline for the rest of the outcomes. Essentially, breakeven is the point where the money you put in is the same as the money that comes out — you’re left with net zero on your investment.

Let’s look at a hypothetical scenario of an option approaching its expiration date:

You buy a call option for 100 shares of your favorite stock.

Strike price: $10/share

Option cost (premium): $100

The stock price then rises to $11 — past your $10 strike price!

As exciting as the news is, you haven’t quite reached the profit point yet. Why? Because $11 is your breakeven point. You made $100 ($1 for each of your $100 shares), but you spent $100 to buy the option in the first place. That leaves you with net zero. Not the best, not the worst.

Of course, it’s rare for a stock to land exactly on your breakeven point at the time your option expires. That leads us to the other three scenarios.

Let’s continue with the most favorable outcome: profit.

In order to profit off of a call, the price of the underlying stock needs to move above your breakeven point.

For every $1 above the breakeven point the stock moves, in theory, you’d get $1 for every share in profit! If we go back to our previous scenario, that means a $12 stock makes you $100. If it goes up to $15, you’ll make $400. At $21, you’d make a whopping $1,000! You can see how small changes in share price can add up to large amounts of value — once you pass that profit point.

But what about the other side? Well, if the stock never reaches your strike price, you lose the whole investment — that’s considered a total loss. Bummer. But, you can rest easy knowing that in almost all situations, your initial investment is usually the most you’ll lose*. So breathe a sigh of relief, rethink your strategy, and see what investment you might want to make next.

And what about the space between your strike price and your breakeven point? In our previous scenario, that would be the price between $10 and $11 — let’s say it lands on $10.50. In this case, you’d experience a partial loss. You made $50, but you originally put in $100 — so you’d still be losing $50, overall. Again, not great, but not nearly as bad as what you would have lost, had you shelled out thousands of dollars on 100 shares of stock.

You might also hear the terms “in the money” or “out of the money” when referring to options and profitability. Put simply, “in the money” means that the stock price has passed an the strike price — meaning that you are in partial loss, breakeven, or profit territory. Out of the money means the stock price has not met the strike and you have had a total loss at expiration.

What are puts?

Puts work on the other end of the spectrum. When you buy a put, you’re reserving the right to sell shares at, hopefully, a higher price than they are trading at (when the option expires).

There are two main times that you might want to buy a put. The first is when you expect the price of the stock to go down. The second would be as a hedge — if you invest in a lot of stock, but aren’t confident that it’s going to go up, you could buy a put as a way to lower your risk, since you’ll make some money back if the price drops enough.

Just like calls, puts have four outcomes:

- Profit

- Breakeven

- Partial loss

- Total loss

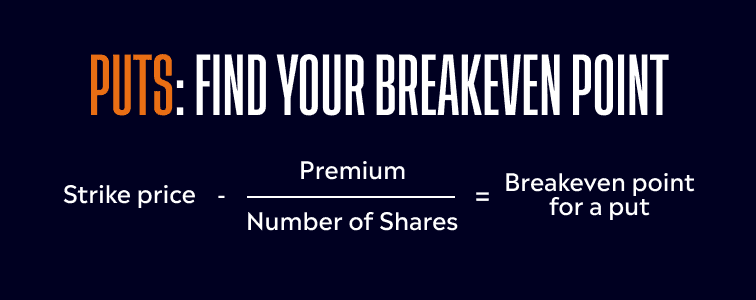

But in this case, the profit begins when the stock goes below your breakeven point, rather than above it at expiration.

Let’s go back to our previous example, except, this time, you think the stock price is going to drop to $10:

You buy a put option for 100 shares of your favorite stock.

Strike price: $10/share

Option cost (premium): $100

Let’s say the stock then drops to $9. You would make $100 ($1 for each of your $100 shares), but you spent $100 on the put in the first place, once again putting you at net zero. Again — not great, not bad, just okay.

Now, let’s say that stock dropped to $8. At this point, you’ve made $200 — minus the original $100 cost — meaning you’ve made $100 profit. Sweet!

At $7, that grows to $200 of profit. At $1, you’d make $800 in profit. The lower the stock goes, the more money you would make — and how many other assets is that true for? (Hint: Not a lot.)

That means that between $9 and $10 puts you at the partial loss scenario, and anything above $10 will create a total loss situation. But just like a call, this total loss is (usually) limited to your original investment in the option* — your $100 — because you can simply choose to let the option expire.

For a put, “in the money” and “out of the money” mean the same thing as they do for a call. If you’re “in the money,” you’ve passed your strike price (partial loss, breakeven, or profit); if you’re “out of the money,” you’ve had a total loss.

Conclusion

Different options can help you build out your portfolio in different ways, but all of them require some kind of opinion about the market and some hands-on activity. Not sure if options trading is right for you? Check out our article on the subject. Or, explore options on eToro Options today.

*There are certain edge cases in which you may be exposed to greater loss than your initial investment. Although these instances are rare, they can occur.

Options are complex products, involve risk and are not appropriate for all investors. You may lose all your invested capital. Please review Characteristics and Risks of Standardized Options prior to engaging in options trading.

eToro Options offers listed US equity options trading via eToro USA Securities Inc., which is registered with the Securities and Exchange Commission and a FINRA member. Visit our Disclosure Library for additional important disclosures including our Customer Relationship Summary and Privacy Policy. FINRA Brokercheck© 2023

eToro UK clients should review Terms and Conditions in respect of this service.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.