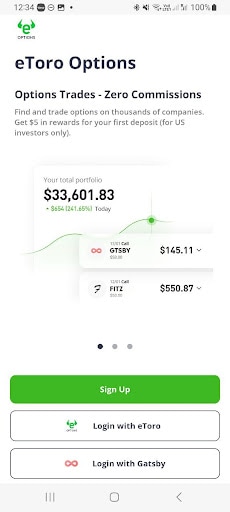

Ready to start your options trading journey? This walkthrough will take you through the process on the eToro Options platform, step by step.

Log in to your account

To get started, log in to your account using your eToro credentials and make sure your eToro Options account is verified. If you’re new to trading options, you may need to answer a few questions to make sure you fit the profile for an options trader.

Fund your account

Once your account is registered and verified, the next step is to put funds into your account. Hit the “Fund my account” button, and you’ll be presented with a couple of different funding methods. The simplest way is to transfer money from your eToro investment account, but you can also send a wire transfer from your bank. For more information on all these methods, click here.

One important fact to remember: The funds you have in your eToro account are different from the ones in your eToro Options account.

Choose your option

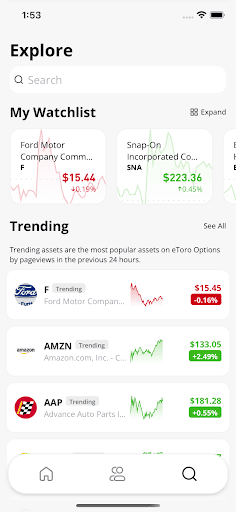

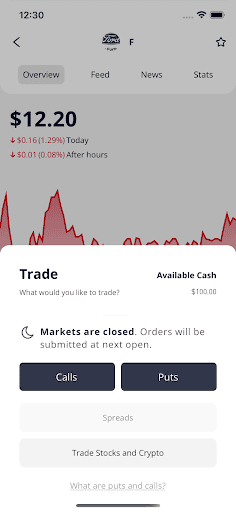

Next, you’ll have to choose an option to trade. You can search for your favorite companies that offer stock, and find one that you like. Then, hit “Trade.”

You can choose between a put, a call, or a spread.

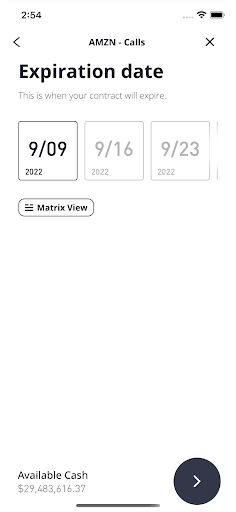

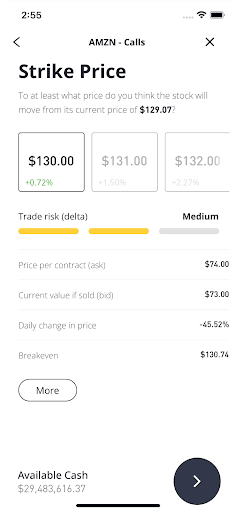

Once you pick the type of option, it’s time to get into the details. Pick the date you expect the option to move by (the expiry date) and the price past which you expect it to move (the strike price). You’ll be presented with the prices of the options available on the page you select your strike price, under the “Price per contract (ask)” section. You’ll also be able to view the option’s trade risk, bid price (current value if sold), daily change in price, and breakeven point.

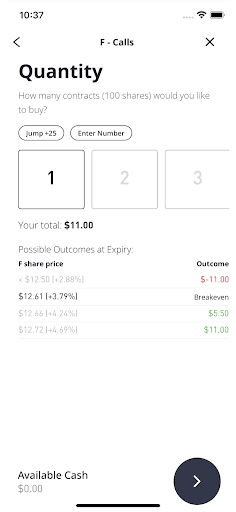

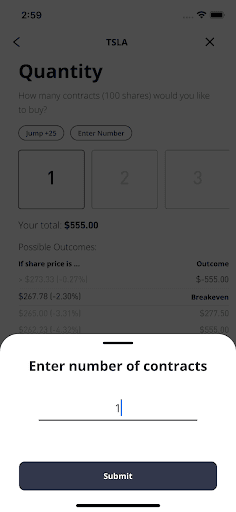

Finally, select the number of 100-share contracts you’d like to purchase.

Purchase your option

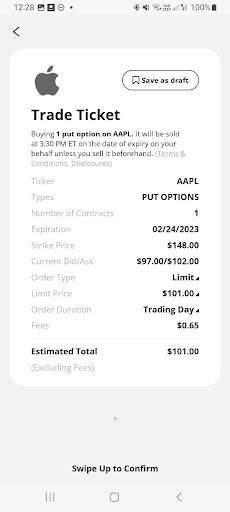

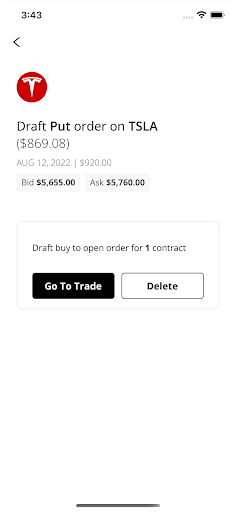

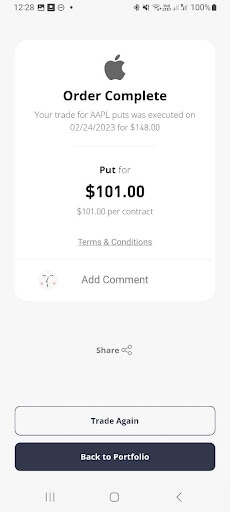

When you’re ready to purchase your option, simply review all the relevant metrics, and swipe up on your screen. If you’re not ready to commit, you’ll also have the choice to save your contract as a draft trade.

Once you’ve purchased your option, you have some choices to make. One choice is to wait until the expiry date to see what happens. If the stock moves enough in the expected direction, you could make a profit. eToro Options will close your option at 3:30 PM EST / 20:30 GMT on its expiry date*, and you’ll see your pending profit in your account at that time.

If the stock does not move in the expected direction, or does not move enough, it will either be closed at a partial loss or expire worthless.

Trade your option

If you decide you don’t want to wait for your option to expire and cash out, you can sell it to someone else in the market.

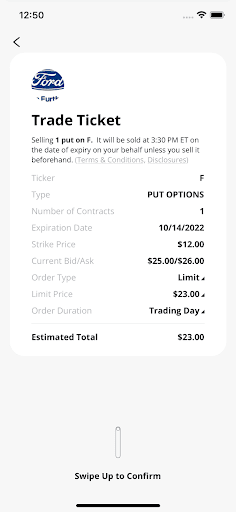

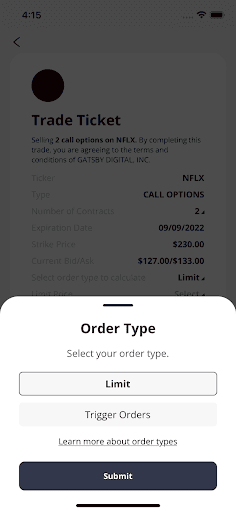

You’ll have to go to your existing ticket, and decide what order type you’d like to pursue: market, limit, or trigger. To learn more about these, you can simply press the link on the screen.

If you choose a limit order, simply set your ask price (we’ll display choices for you, based on what the current bid prices are for similar options), a time limit, and wait to see if someone takes you up on your offer.

Other ways to trade

Not ready to commit to options yet? You can use the draft trading function to see how options trading on eToro Options works before actually investing your money. If you need inspiration, you can also see what other users are trading on the eToro Options newsfeed, and read some of their comments.

Conclusion

Options are one more way that you can engage with the market and play a more active role in the management of your portfolio. They can be a powerful tool, when used in ways that fit your strategy.

To get started trading options, download the eToro Options app.

*In rare instances, we’re unable to sell expiring positions at 3:30pm EST. In these instances, clients are responsible for losses due to assignment or expiry.

Options are complex products, involve risk and are not appropriate for all investors. You may lose all your invested capital. Please review Characteristics and Risks of Standardized Options prior to engaging in options trading.

eToro Options offers listed US equity options trading via eToro USA Securities Inc., which is registered with the Securities and Exchange Commission and a FINRA member. Visit our Disclosure Library for additional important disclosures including our Customer Relationship Summary and Privacy Policy. FINRA Brokercheck© 2023

eToro UK clients should review Terms and Conditions in respect of this service.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.