Tesla and Alphabet headline a busy week of earnings. The Daily Breakdown digs in as volatility remains heavy.

Monday’s TLDR

- It’s a big week of earnings

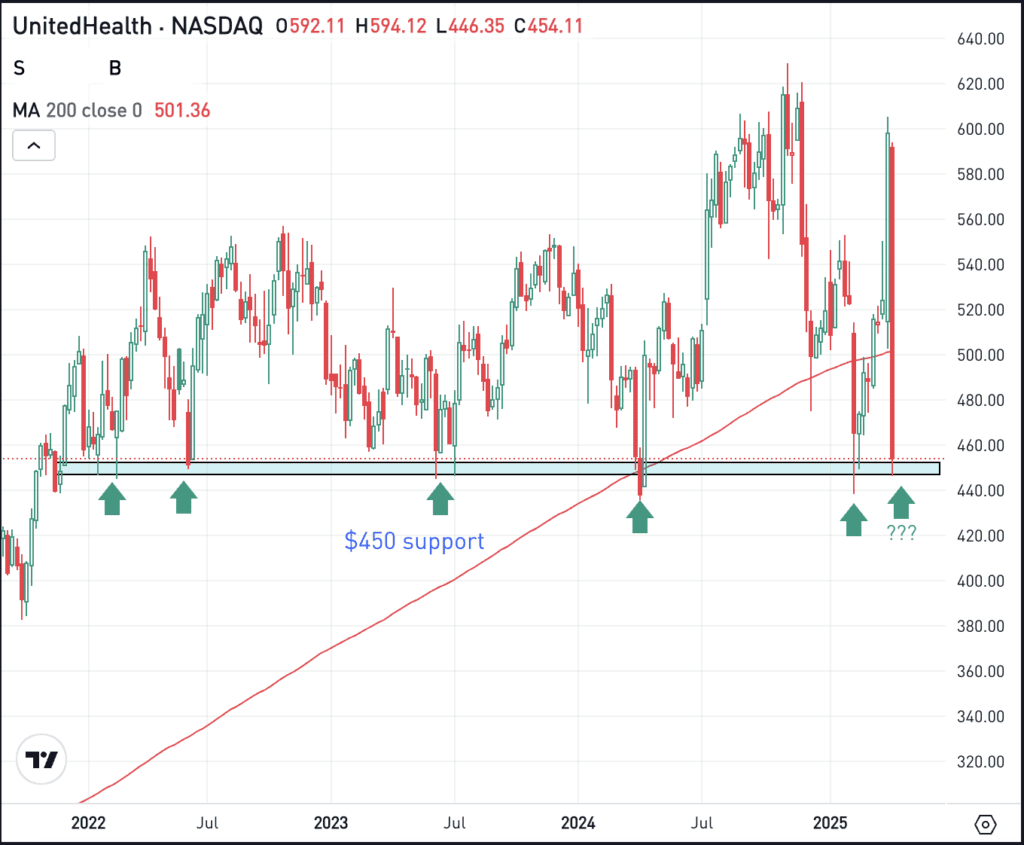

- UNH looks for potential support

- BTC at highest level since April 2

What’s Happening

When it comes to major economic reports, this week should be pretty quiet. Pay attention to Thursday’s jobless claims number, which has yet to show a sustained spike in unemployment. Until that changes, the labor market can hold up despite the deafening roar of trade-war rhetoric and economic worries.

That leaves earnings — and more headlines — as the main drivers for the week.

On Tuesday, Verizon, General Electric, and Tesla will report earnings, with Tesla the first of the Magnificent 7 to report.

On Wednesday, we’ll hear from Boeing, AT&T, IBM, and Chipotle.

Thursday features earnings reports from American Airlines, Intel, and Alphabet as the latter continues to fight through ongoing regulatory issues. The latest? An issue with its ad-tech business, which was recently ruled a monopoly.

On Friday, companies like AbbVie, Colgate Palmolive, and Phillips 66 will report before the open.

Want to receive these insights straight to your inbox?

The setup — UnitedHealth Group

You know how we often say: “It’s not about what a company does, it’s about what it’s going to do?”

Well, that logic was on display with UnitedHealth last week, as shares plunged more than 20% on Thursday due to the company’s quarterly results. While the firm’s fiscal Q1 results slightly missed expectations, it represented big growth from the prior year. However, management slashed its full-year earnings outlook.

That sent shares tumbling to a key area on the charts. As always, feel free to check out the chart for UNH, mark your own levels, and set alerts.

If the $450 level is stirring up some distant memories from some long-time readers, that’s because we discussed this level just over a year ago.

From a technical perspective, it’s pretty simple: Bulls want to see UNH stock hold this area as support. If it does, a larger bounce could take hold. If it doesn’t hold and $450 turns into resistance, bearish momentum can persist.

For options traders, calls or bull call spreads could be one way to speculate on support holding. In this scenario, options buyers limit their risk to the price paid for the calls or call spreads, while trying to capitalize on a bounce in the stock.

Conversely, investors who expect support to fail could speculate with puts or put spreads.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is Watching

NFLX – Shares of Netflix are tip-toeing higher in pre-market trading, up about 2% after reporting earnings after the close on Thursday — the most recent trading session for US stocks. The firm beat on earnings and revenue estimates, and said its business is not being disrupted by the current trade war situation. Check out the charts for NFLX.

SPY – The S&P 500 ETF — SPY — and the QQQ ETF are starting the day off under pressure, as investors continue to worry about fallout from the global trade war and as volatility remains elevated. Both are down more than 1% in pre-market trading.

BTC – Bitcoin found a bit of traction over the weekend, inching higher on Saturday and Sunday before climbing about 2.5% so far on Monday morning. The rally has BTC to its highest level since April 2nd, as bulls look for renewed momentum.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.