The Daily Breakdown takes a closer look at leveraged ETFs, which have been incredibly volatile in the current market environment.

Friday’s TLDR

- Leverage can hurt

- Breaking down Berkshire stock

The Bottom Line + Daily Breakdown

Leverage can come in many forms these days. For instance, it can come from options, margin, and leveraged ETFs*. While leverage can turn into an addictive use of capital when times are good, the situation can get pretty dark when volatility increases.

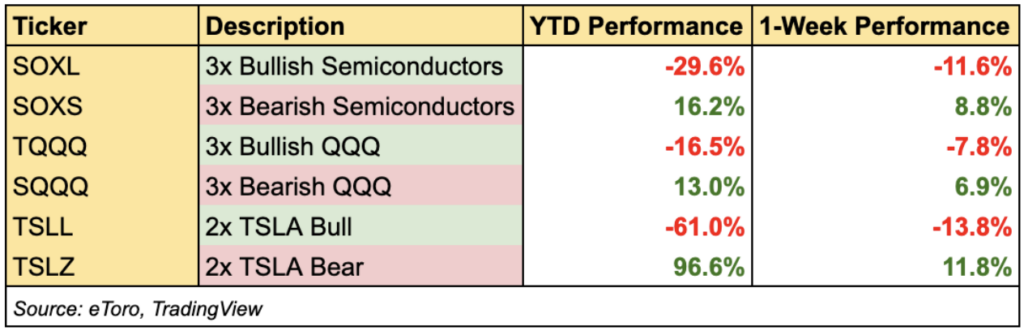

Observe the recent performance of some popular leveraged ETFs (based trading volumes):

Investors using leveraged-bull ETFs may be struggling this year. For instance, while the QQQ ETF is down 4.5% for the year, the 3x leveraged long ETF (TQQQ) is down more than 16%. Or notice how the semiconductor ETF — the SMH — is down 9.3% for the year, while the 3x leveraged ETF (SOXL) is down almost 30% this year!

You might see “3x leveraged ETFs” but then wonder why these vehicles aren’t exact multiples of the underlying asset. For example, why the TQQQ ETF is down 16.4% instead of down 13.5% (a -4.5% loss for QQQ multiplied by 3). This is known as “decay.”

Leveraged ETFs lose value over time due to daily rebalancing to maintain their leverage ratio. This process can erode returns over time, and particularly in volatile markets. For instance, even if the underlying index were to remain flat, the value of the leveraged ETF can decrease due to this daily rebalancing mechanism.

On the table above, you’ll notice that the leveraged-bear ETFs are up on the year — which is expected given the recent price action — but perhaps not up quite as much as investors would have hoped in some cases.

Again, that’s “decay” at work.

There Are Positives, Too

Despite some of the pitfalls of leveraged ETFs, they can be beneficial too.

Long-term investors in these assets can suffer from decay — even when they’re right on the direction of the underlying index or asset. However, short-term investors using these vehicles trying to take advantage of current market conditions or as a hedge on their portfolio can profit from them when timed correctly.

The Bottom Line

Ultimately, volatile environments like this highlight the dangers and the opportunities that can come from using leveraged ETFs. They can be profitable in some cases, but they can also be dangerous when investors have too much exposure to them — especially when the underlying direction turns out to be wrong.

Generally speaking, the more leverage that’s involved, the better timing investors will need.

On the flip side, some ETFs exist — like the SPLV, which follows the 100 least volatile stocks in the S&P 500 — that aren’t designed to capture volatility, but avoid it.

Whatever investors decide — be it with or without leveraged ETFs, using options to hedge, raising cash to buffer increased volatility, or standing firm and doing nothing — it should be based on what’s best for their own risk tolerance, investment goals, and portfolio.

*Leveraged ETFs track assets and try to multiply their returns. For example, if a 2x leveraged ETF were to increase in value, that increase would be double an identical, non-leveraged ETF. However, if that 2x leveraged ETF decreases in value, that decrease will double, too. They’re typically short-term products and are not appropriate for all investors.

Want to receive these insights straight to your inbox?

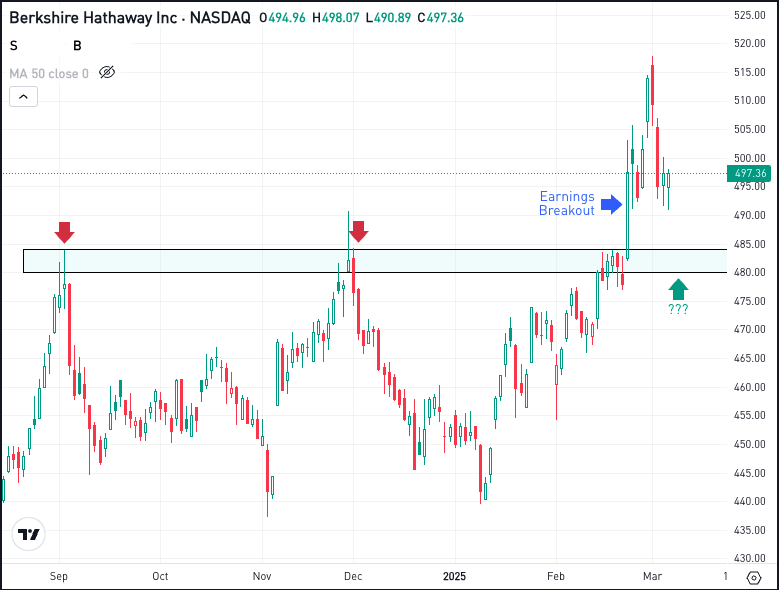

The setup — Berkshire Hathaway

Thursday was a tough day in markets, but Berkshire Hathaway actually held up pretty well. Despite the 1.8% fall for the S&P 500, BRK.B fell just 0.1%.

Not to mention, shares are up almost 10% on the year, whereas the S&P 500 is actually down about 2.5% so far in 2025. In other words, Warren Buffett’s firm has been doing pretty well lately.

That’s why some investors may be watching this one in case of a dip.

Keep an eye on the $480 to $485 area. Should BRK.B pull back that far, it would represent a dip of about 7% from the recent record highs.

If Berkshire pulls back and holds this area as support, we could see a rebound. If support fails, then more bearish momentum could ensue.

Options

One downside to BRK.B is its share price. Because the stock price is so high, the options prices are incredibly high, too. This can make it difficult for investors to approach these companies with options.

In that case, many traders may opt to just trade a few shares of the common stock — and that’s fine. However, one alternative is spreads.

Call spreads and put spreads allow traders to take options trades with a much lower premium than buying the calls outright. In these cases, the maximum risk is the premium paid.

Options aren’t for everyone — especially in these scenarios — but spreads make them more accessible. For those looking to learn more about options, consider visiting the eToro Academy.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.