The Daily Breakdown takes a look at Monday’s selloff in stocks, gold’s run to record highs, and the notable strength in shares of Spotify.

Tuesday’s TLDR

- Trump’s issue with the Fed

- Spotify sings a strong tune

- GE, VZ earnings in focus

What’s Happening?

Before we dive in, let’s make sure you’re set to receive The Daily Breakdown each morning. To keep getting our daily insights, all you need to do is log in to your eToro account.

Monday was another tough session as the S&P 500 and Nasdaq 100 tumbled more than 2%. At yesterday’s lows, the SPY and QQQ were down more than 3%.

On the bright side, both indices are up close to 1% in pre-market trading, while Bitcoin has been putting up some serious gains this week, up about 4%. That said, nothing has been able to hold a light to gold, which just cleared $3,500/oz.

Remember, it wasn’t too long ago that we talked about it crossing $3,000/oz for the first time, showing just how much demand there has been. Gold is now up more than 30% so far this year and is up almost 50% over the past 12 months. This has given an obvious boost to the GLD ETF as well.

Yesterday’s weakness in stocks and strength in gold — a notable flight-to-safety asset — came on the back of President Trump’s tirade against Fed Chair Powell. This spooked investors and has many worrying about the current independence of the Federal Reserve.

Bulls are hoping today’s conversation will be about earnings and a positive trade deal rather than more pressure on the Fed.

Want to receive these insights straight to your inbox?

The Setup — Spotify

Shares of Spotify are holding up pretty well in 2025, up 23.7% so far this year. Over the past year, SPOT has rallied more than 100%.

While some investors may take issue with the stock’s valuation, it’s hard to argue about Spotify’s success. Revenue, earnings and user growth continue to trend higher, with analysts expecting about 75% earnings growth this year.

The fact that shares are holding up so well despite the market’s volatility is also encouraging.

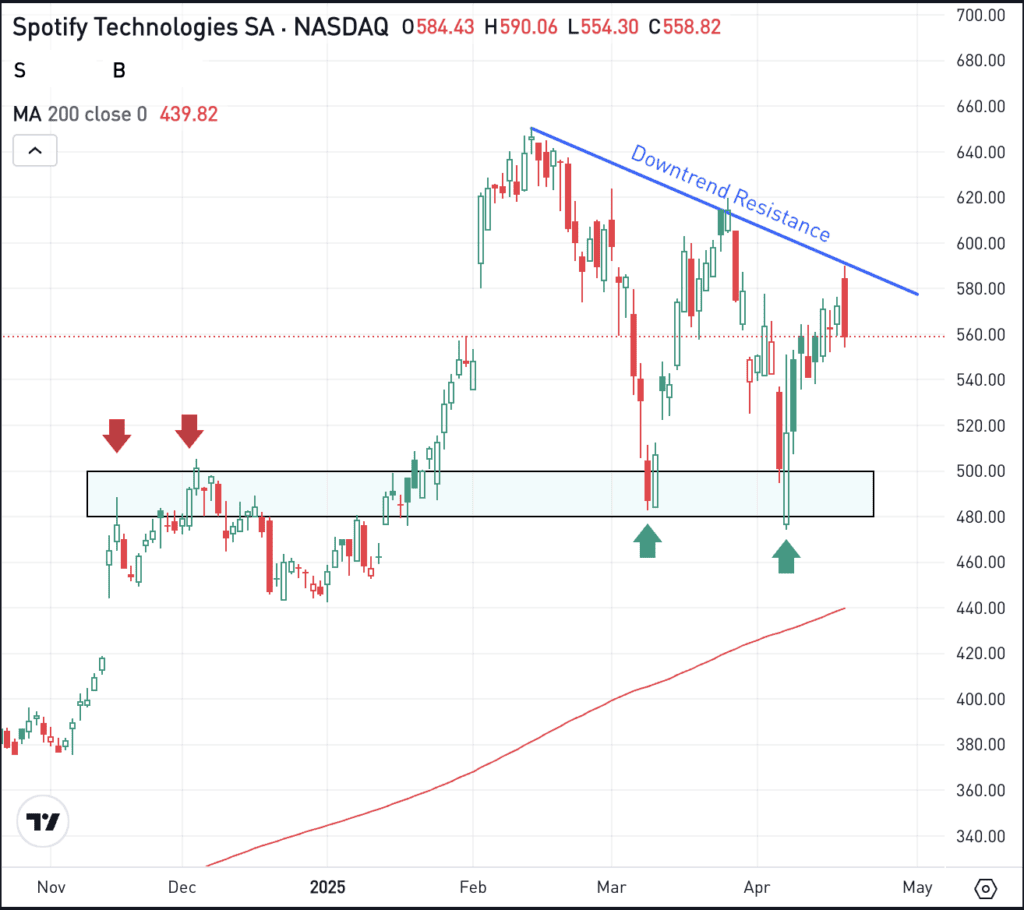

Some may point out that Spotify shares are trading below downtrend resistance. Yes, this is true. However, many technical traders would consider this a form of consolidation, or healthy price action, particularly after SPOT’s big rally.

From here, more conservative investors may put a price alert on Spotify and wait for a potential retest of the $475 to $500 area, which has been support over the past few months. Others may consider current prices attractive enough to enter with shares down about 13% from the highs. Finally, some investors may avoid SPOT due to the current volatility and/or the stock’s valuation.

What Wall Street is Watching

GE – Shares of General Electric are moving higher this morning after the firm beat on earnings and revenue expectations. Further, guidance came in strong, giving investors some reassurance about the business. Check out the charts for GE.

VZ – On the other hand, shares of Verizon are moving lower this morning despite the firm beating on earnings and revenue expectations. Although management reaffirmed its full-year outlook, a larger-than-expected decline in phone subscribers outweighed the strong Q1 headline results.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.