Microsoft backing out some leases is creating a scare among AI investors. The Daily Breakdown looks at the impact rippling through tech.

Thursday’s TDLR

- Trade war worries hit stocks

- LULU reports earnings

- Microsoft news hits AI stocks

What’s happening?

Escalating tariff concerns helped fuel yesterday’s decline in US stocks, with the auto industry being the latest to come under fire.

The Trump Administration announced a round of 25% import tariffs initially targeting fully assembled vehicles. These are set to go into effect on April 3rd, but will expand to include major automobile parts by May 3rd.

It didn’t help that Microsoft is reportedly backing out several US and European data center projects, which sparked fear about supply outstripping demand when it comes to AI infrastructure. While Microsoft only fell 1.3% on the day, Nvidia, Broadcom, and other chipmakers fell much further due to this concern.

Want some good news, though?

Five of the eleven S&P 500 sectors finished higher on the day, while more than half of the stocks in the index finished in positive territory. However, mega-cap tech still remains a problem.

Five of the Magnificent Seven stocks fell more than 2% yesterday, with Tesla and Nvidia each dropping more than 5%. With these companies’ market caps totaling $15.6 trillion, these declines impact the entire market, even if other stocks and sectors are rallying.

Want to receive these insights straight to your inbox?

The setup — Procter & Gamble

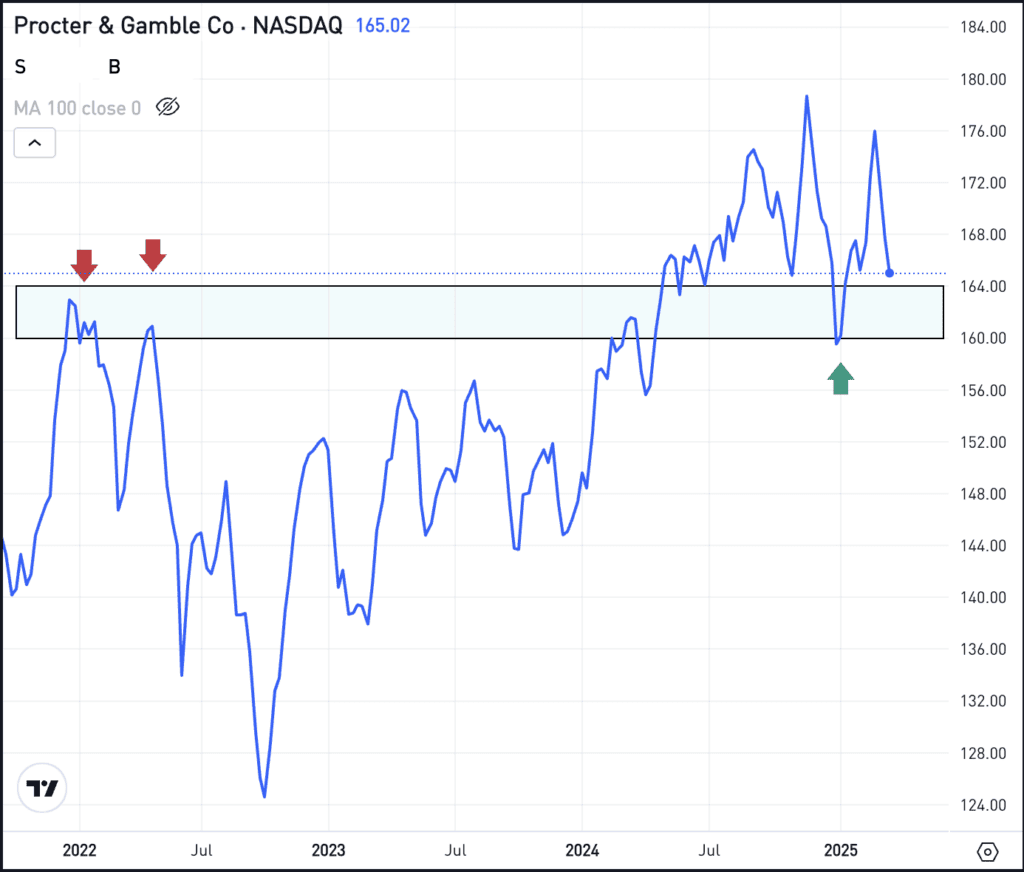

The $160 to $165 area had marked the prior bull market highs for Procter & Gamble in 2022, but the stock is now pulling back to this area after recently hitting new record highs.

P&G currently sports a dividend yield of 2.4% and has raised its dividend for 68 consecutive years.

While that long-term streak is great, more active investors are keeping an eye on the charts to see if this prior $160 to $165 resistance zone can now act as support.

If the stock is able to find support in this area, it’s possible that P&G shares could enjoy a rebound, potentially back toward its recent highs near $180. However, if this area fails to hold as support, more selling pressure could ensue.

Options

Buying calls or call spreads may be one way to take advantage of a pullback. For call buyers, it may be advantageous to have adequate time until the option’s expiration.

For those that aren’t feeling so bullish or who are looking for a deeper pullback, puts or put spreads could be one way to take advantage.

To learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

DLTR – Dollar Tree popped after selling its Family Dollar brand for $1 billion. Investors cheered the move, seeing it as a chance to streamline operations and focus on higher-performing segments.

LULU – While earnings season is just about over, Lululemon Athletica will report earnings after the close. Analysts expect roughly 12% revenue growth and earnings of $5.85 a share (representing growth of about 17%). Can the firm deliver? Check out the charts for Lululemon.

GM – Shares of General Motors are under pressure this morning, down over 5% in pre-market trading. That’s as news of the auto tariffs weighs on the stock price. However, Ford stock is actually up about 1% in pre-market trading due to relatively lower import exposure compared to its competitors.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.