The Daily Breakdown takes a closer look at the start of earnings season as volatility remains elevated amid increased uncertainty.

Friday’s TLDR

- Investors look for clarity

- Banks kick off earnings

- LULU looks for support

What’s happening?

There’s no reason to sugarcoat it, so let’s just be honest: This has been a really tough stretch for investors. There’s been immense volatility, plenty of worry, and painful losses in US stocks.

But let’s remember something, too.

There have been past periods of immense difficulty before. The 2022 bear market wasn’t an easy ride. Stocks like Meta and Netflix lost more than 75% of their value, while others like Nvidia and AMD shed roughly two-thirds of their value.

The Covid days were not easy and 2018 had plenty of difficulties. We’ve seen flash crashes, financial crises (like 2008-09) and bubbles burst (like in 2000-02). Now you may not have been involved in all (or even one) of these markets. But we — the retail investor — get through them each time, and this time should be no different. It’s just a matter of how long it will take and how much pain the markets will endure.

While we know that the long-term stats favor those who buy these dips, we can also acknowledge that it takes a short-term toll on investors’ emotions and psyche. In other words, buying the dip was only easy in hindsight.

Whether this is your first rodeo or not, we know that each correction brings lessons along with it — and they will be a little bit different for everyone. Maybe some investors had too much concentration this time around and failed to diversify. Perhaps others were over-leveraged or panicked at the recent lows rather than having cash on hand to take advantage of an opportunity.

Whatever that lesson is for you, try to learn from it!

Earnings Season

JPMorgan, Morgan Stanley, BlackRock, and Wells Fargo will report earnings this morning as the banks officially kick off earnings season. It surely will be an interesting quarter, too.

Guidance from many firms may be temporarily suspended as they refrain from providing longer term outlooks amid a sea of uncertainty — remember, markets hate uncertainty, so this isn’t too surprising. (In fact, Delta Air Lines did exactly this earlier this week).

While there will likely be plenty of short-term disruptions, the key will be making sure that long-term expectations remain intact. For now, that’s what Wall Street expects. Analysts polled by Bloomberg only expect earnings growth of about 6% this quarter and next quarter. However, growth expectations jump to 11% in Q3 and 10.3% in Q4.

Let’s take it one step at a time and see what the banks have to say today.

Want to receive these insights straight to your inbox?

The setup — Lululemon Athletica

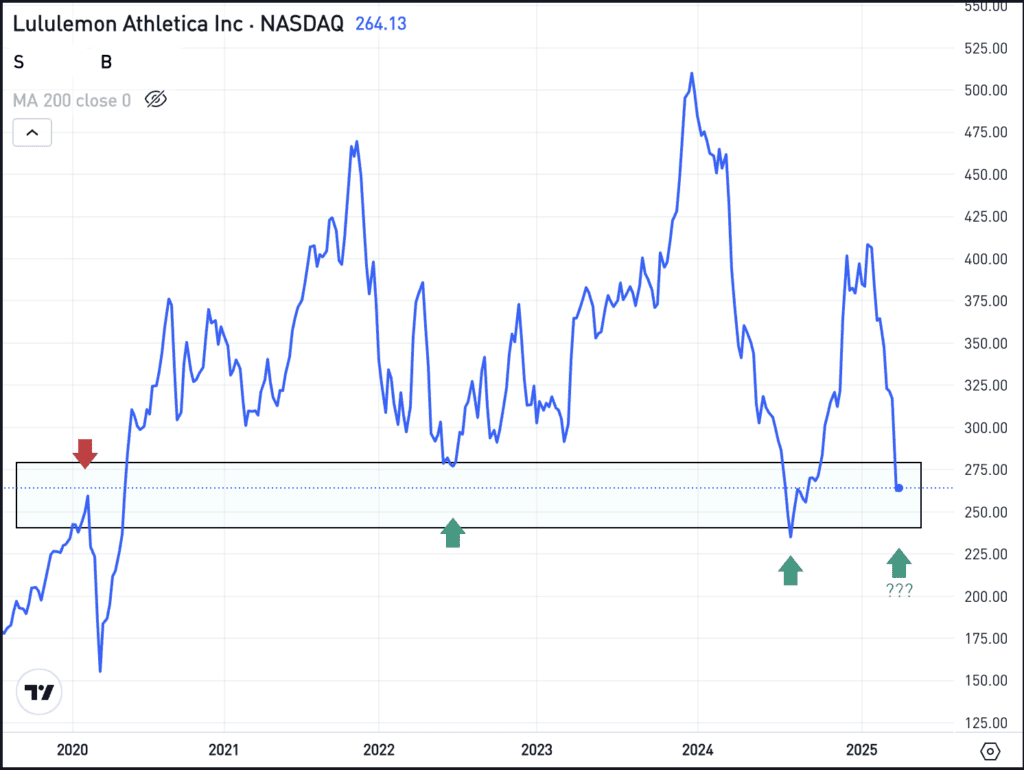

Lululemon Athletica surged 85% from its summer lows to the recent highs, but have been hit hard amid trade-war worries. Shares have fallen more than 40% from peak-to-trough, and even after Wednesday’s rebound, they are still down about 35%.

However, many fundamental investors believe the company is hitting a major turnaround in its business, while the longer-term technical setup is drawing interest from other investors.

It’s a wide zone down here — roughly $240 to $270 — but this area has proved pivotal for LULU shares over the last five years. It has been resistance, like it was in early 2020, and it’s been support, like it was in 2022 and 2024. The question now is, will it act as support again?

If so, long term buyers who utilize some form of technical analysis may consider the recent pullback an attractive risk/reward. If this level holds, a larger rebound could take shape. Remember, shares were recently trading for about $425 apiece.

However, if this area breaks as support and LULU fails to regain it, then more downside could be in store.

For what it’s worth, analysts currently expect revenue to grow about 10% in fiscal 2025, alongside nearly 15% earnings growth. After the recent pullback, shares trade at roughly 18 times forward earnings. Over the last 5 years, LULU has traded with an average forward P/E ratio of about 33, putting the current valuation at the low end of that range.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.