The Daily Breakdown looks at how stock markets in other parts of the world — like China and Europe — are performing relative to the US.

Tuesday’s TLDR

- International stocks are ripping

- GM stock is holding up

- Gold hits record highs (again)

What’s happening?

We’ve had back-to-back rallies in US stocks, which has been a welcomed reprieve given the selloff over the past weeks. However, other international markets have done quite well despite the recent volatility.

For instance, Alibaba, PDD Holdings, JD.com, Baidu and others continue to lift Chinese equities higher.

That’s as the FXI and KWEB ETFs continue to surge, up 26.5% and 31% so far year to date, respectively.

European stocks are also outperforming relative to the S&P 500. For instance, the German ETF — EWG — is up more than 22% so far this year, while the FTSE ETF — VGK — (which measures stocks in the UK) is up more than 15% so far in 2025.

In general, European stocks are doing well, considering an ETF like EZU is up nearly 20% this year.

What’s my point?

Despite years of underperformance, China equities are roaring back to life at a time where hometown favorites remain under pressure. Equities from across the pond are doing well too. That’s not to say these trends will last forever, but it’s where the momentum is right now and highlights how a little diversification can go a long way.

Want to receive these insights straight to your inbox?

The setup — General Motors

It’s been quite some time since we’ve looked at General Motors, and perhaps now is a surprising time, given all the tariff talk impacting the auto industry. For many investors, that will make GM, Ford, and others a “no touch.”

However, GM stock has actually traded pretty well despite the tariff news. Shares are up about 1% over the past month vs. a decline of 7.2% for the S&P 500.

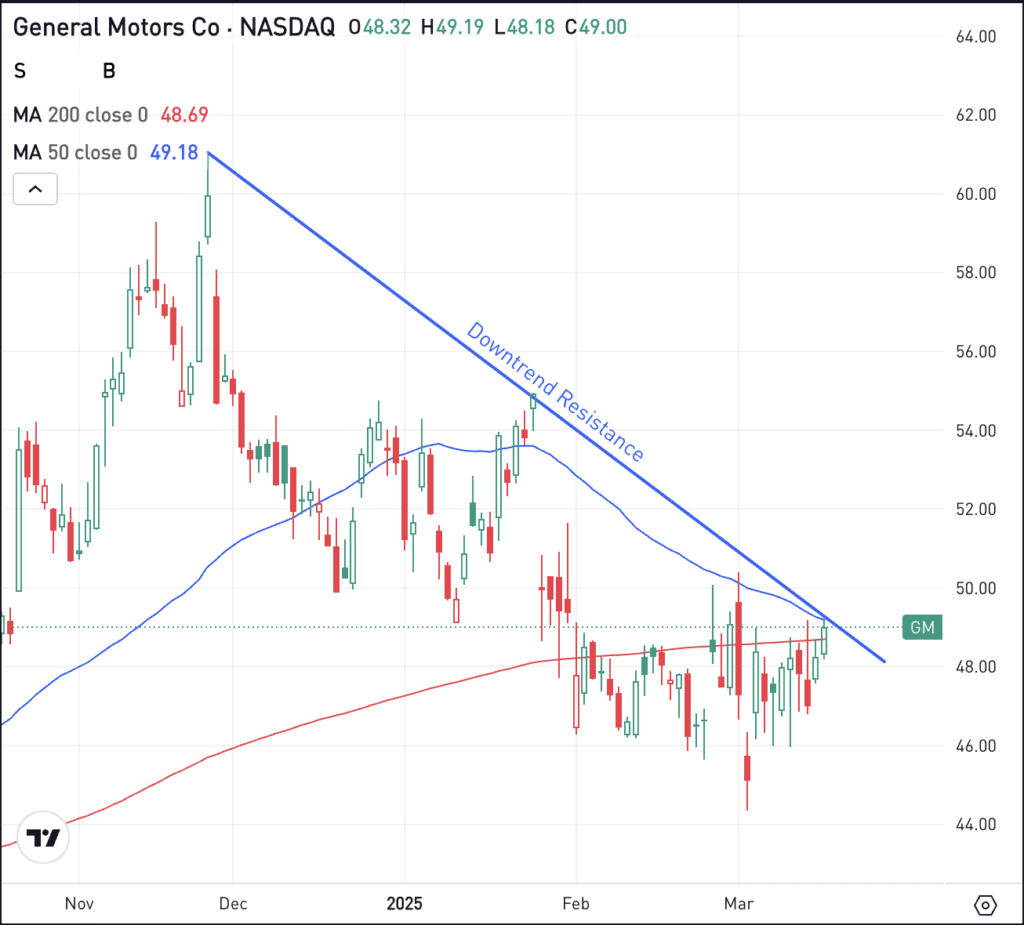

GM stock closed above its 200-day moving average yesterday. However, for bulls to gain confidence, they’ll want to see shares close above downtrend resistance (blue line), as well as the declining 50-day moving average.

If the stock can do so, a larger upside rally could take place. However, if it’s unable to clear these measures, more bearish momentum could ensue.

Options

Investors who believe shares will break out — or those who are waiting for the potential breakout to happen first — can participate with calls or call spreads. If speculating on the breakout rather than waiting for it to happen first, investors might consider using adequate time until expiration.

For investors who would rather speculate on resistance holding, they could use puts or put spreads.

To learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

GOOG – Shares of Alphabet are in focus today as it has reportedly agreed to acquire Wiz for more than $30 billion. If this sounds familiar, it’s because Alphabet previously tried to purchase Wiz (for about $23 billion) but could not due to antitrust worries.

NIO – Nio stock is up about 4% in pre-market trading after the company announced a strategic partnership with CATL, which is the largest battery manufacturer in China. Bulls are hoping for the stock to add to its 15% year-to-date gains. Check out the charts for NIO.

GOLD – Gold prices recently topped $3,000 an ounce and that hasn’t slowed down the price one bit. Gold bugs are hoping for a sixth straight day of gains in gold, which has helped drive the GLD and SLV ETFs higher in recent trading, with both up more than 10% so far in 2025.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.