The Daily Breakdown looks at the Fed’s latest economic outlook, and sizes up Uber stock as shares try to breakout over recent resistance.

Thursday’s TLDR

- Fed highlights strong economy

- And an uncertain outlook

- Nike, Micron report earnings

What’s happening?

Yesterday’s Fed update had a few highlights worth mentioning. There was no change in interest rates (as expected) but Chair Powell spoke optimistically, saying things like the “economy is strong overall” and “it’s a solid picture.” However, he emphasized that uncertainty is “unusually high” right now as well.

There are eight Fed meetings per year roughly every six weeks (the next one is in early May). Four times a year, the Fed updates and releases what’s called the “Summary of Economic Projections” — or the “SEP” for short.

The SEP is the Fed’s outlook for GDP, inflation, interest rates, and unemployment, and accessing them is free from the Federal Reserve website.

The Fed’s latest outlook? They expect 2025 inflation (via Core PCE) to be 2.8% now vs. prior expectations of 2.5% and now forecast GDP growth of 1.7% vs. 2.1% previously.

Tariffs and economic uncertainty were the big culprits of this altered view, although Fed members still expect two rate cuts this year.

The Bottom Line: The Fed seems confident in the economy, which has been a big worry for investors lately. Stocks rallied after yesterday’s event. Let’s see if they continue to do so today and if the S&P 500 can finish in positive territory this week.

Want to receive these insights straight to your inbox?

The setup — UBER

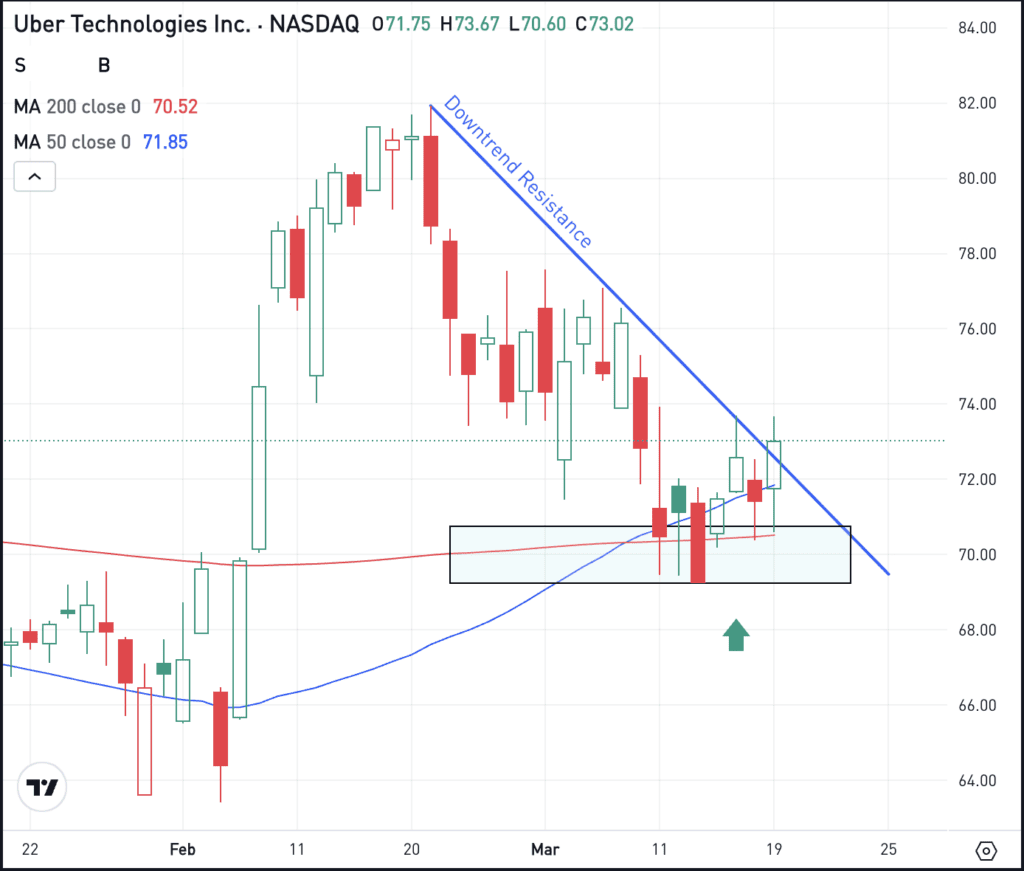

Uber stock initially rallied in early February due to strong earnings, but a decline in US stocks paired with disappointing profitability outlooks from companies like Delta Air Lines and American Airlines has weighed on Uber stock.

From the post-earnings high last month, shares are down about 11%. However, Uber is holding above several major moving averages, like 50-day and 200-day. It’s also trying to clear downtrend resistance. Have a look:

Conservative bulls may wait to see if Uber stock can close above downtrend resistance and the $74 level. Aggressive bulls might consider taking a position as long as the stock can stay above the recent lows near $69.

In either scenario, bulls want to see Uber clear resistance near $74 to make a larger rebound to the upside. If it cannot and shares break below $69, bearish momentum could accelerate.

Options

This is one area where options can come into play, as the risk is tied to the premium paid when buying options or option spreads.

Bulls can utilize calls or call spreads to speculate on a rebound, while bears can use puts or puts spread to speculate on more downside should support break.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

GOLD – Gold rallied again on Wednesday, notching another record high as it gains altitude above the $3,000 level. The GLD ETF has now rallied in seven straight sessions and is up more than 16% so far this year. Check out the chart for GLD.

NKE – While we’re well out of earnings season for most firms, Nike will report earnings after the close. It will do so alongside other notable companies too, like Micron and FedEx. Each company offers its own glimpse into a different part of the economy (Nike into the global consumer, FedEx into shipping activity for consumers and businesses, and Micron into the semiconductor world).

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.