Advanced Micro Devices is trying to clear a painful level of downtrend resistance. The Daily Breakdown takes a closer look at the charts.

Tuesday’s TLDR

- Nasdaq climbs more than 2%

- Tesla looks to snap losing streak

- AMD clears resistance

What’s happening?

Monday was one of the strongest days for US stocks so far this year, with the S&P 500 gaining 1.8%, the Nasdaq 100 climbing more than 2% and the Russell 2000 jumping more than 2.5%.

The rally was fueled by reports that the tariffs planned for April 2nd will be more narrow than previously expected. In other words, investors are hoping for a de-escalation in the trade war.

This goes to show just how much the markets crave certainty.

As the tariff war has escalated and flip-flopped with on-again off-again import duties, stocks tumbled into one of the fastest 10% corrections we’ve seen since 1950. Now even just the hint of having a “better-than-feared” tariff situation on April 2nd sent US stock indices higher by about 2%.

I don’t like to stick my head in the sand and rely on “hope,” because it’s not a very reliable investing strategy. But imagine what happens if — and hopefully when — this trade war comes to an end.

Yesterday was a preview of how quickly investors could re-enter the market. However, it’s also a reminder of how quickly markets can move lower should things escalate further.

Want to receive these insights straight to your inbox?

The setup — Advanced Micro Devices

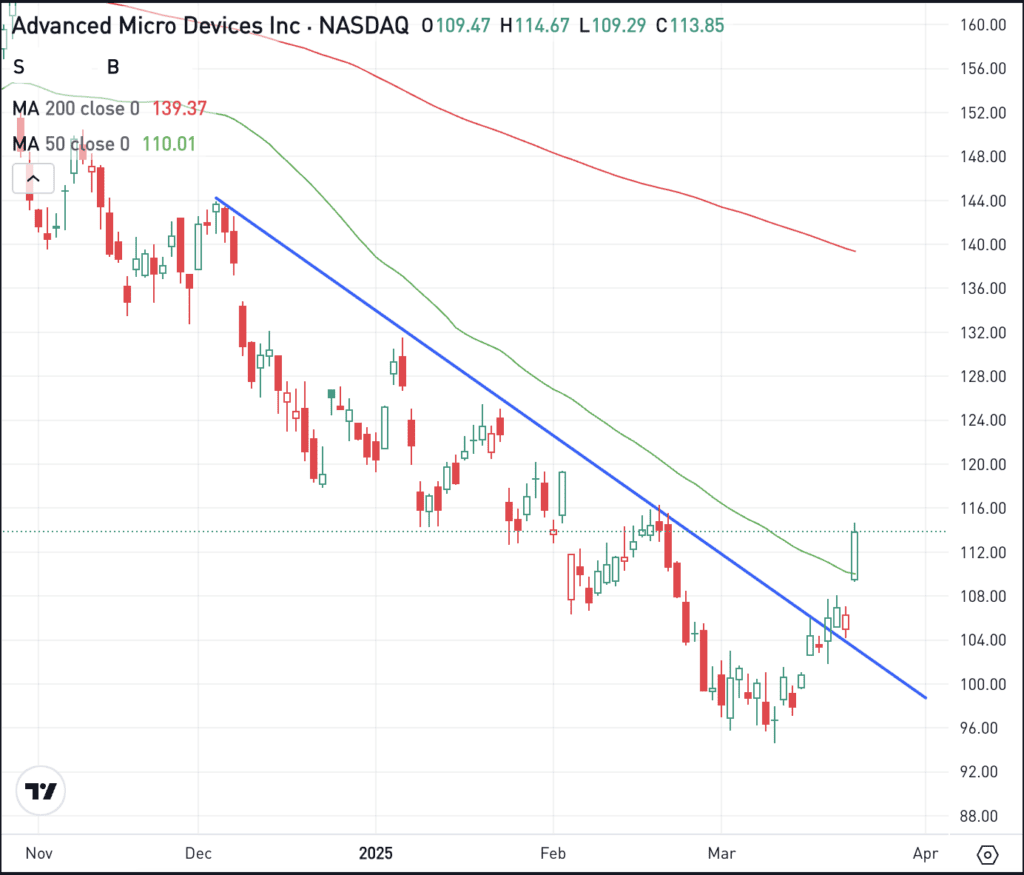

Advanced Micro Devices has had a horrific run. While there’s been some bumpiness in the chip space, AMD has been crushed from its highs. Despite the recent rally, shares are still down 50% from all-time highs and are down more than 35% over the past year.

However, the stock has found some recent momentum, gaining more than 7% on Monday. It was enough to vault shares over downtrend resistance (blue line), as well as the 50-day moving average — regaining this measure for the first time since late October.

After yesterday’s burst, AMD may need a little time to cool off — remember, this stock was trading below $100 just a few days ago. From here though, investors will want to see the stock maintain bullish momentum, potentially continuing to rebound higher.

Options

This is one area where options can come into play, as the risk is tied to the premium paid when buying options or option spreads.

Bulls can utilize calls or call spreads to speculate on a rebound, while bears can use puts or puts spread to speculate on more downside should support break.

For those looking to learn more about options, consider visiting the eToro Academy.

What Wall Street is watching

TSLA – Tesla has come roaring back to life in recent trading. Shares gained almost 12% yesterday and are riding a four-day win streak. After such a strong start to the week, bulls are hoping that Tesla can snap its 9-week losing streak. Check out Tesla’s chart.

OKLO – Shares of Oklo are down about 6% in pre-market trading after reporting its Q4 results. Earnings slightly missed analysts’ expectations, which is weighing on the stock this morning. While the stock is down notably from its recent highs, shares were still up about 45% in 2025 coming into yesterday’s report.

Disclaimer:

Please note that due to market volatility, some of the prices may have already been reached and scenarios played out.