With every new asset class comes new opportunities, but there can also be a learning curve. But don’t worry — we’ve put together a number of resources to help you get the hang of this latest addition to the eToro investing ecosystem.

An options analogy

Ever go to book a plane ticket, but you’re not 100% sure you’re going to be able to take that trip? Prices look good, and you don’t want to risk them going up, but you’re not quite ready to put $500 down to reserve your seat to Bogotá, yet.

Some airlines will offer you something called a “flight hold,” which reserves your right to purchase your ticket at its current price, no matter how much the price increases in the future. Some of these holds last up to two weeks, and they cost a fraction of the price of a ticket.

Flight holds offer customers a choice: a small amount of money now to lock in a purchase price for later. Options do something similar.

For options, it’s the same concept but with stock. Buying an option gives you the right to buy or sell stock (typically 100 shares at a time) at a particular price — even if that price changes for the general public.

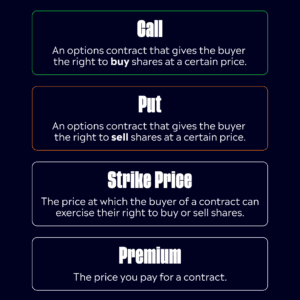

Your price — the price you lock in for the stocks — is called the strike price, and the money you put down to reserve that price, or buy the option, is called the premium.

So really, options are more like contracts than stocks. They lock in a price to buy or sell a specific stock at a specific price. The only thing you need to know is that they are typically time-sensitive, meaning they reserve the price only for a specified amount of time.

Trading options

So, how does one actually make — or lose — money, using options?

Well, there are two main ways you can interact with options on eToro.

The first is by buying a call. A call is the right to buy shares at a particular price. When you purchase a call, you are expecting the price of the shares to go up.

For example, you might buy a call with a $100 premium that reserves your right to buy shares at $10. If the price then goes up to $15, you’d make about $5 for each of your 100 shares — $500 — minus the original cost of the option ($400 profit).

The second way is by buying a put, which functions on the other side of the spectrum. A put is when you reserve the right to sell shares at a particular price. When you buy a put, you often think that the price of the underlying stock is going to go down. Let’s go back to our previous example. If you reserve the right to sell your shares at $10, and the price goes down to $5, you’re once again making about $5 per share — $500 — minus the original cost of the option (again, a $400 profit for a $100 option).

But let’s say the price swings the other direction: You buy a call, and the price goes down, or you buy a put and the price goes up — or in either case, the price doesn’t move at all. The only money you lose — typically — is your premium*.

That’s what makes options such an interesting investment: Unlike with stocks, your loss is (usually) limited to the amount of the premium*, which is often a fraction of the full price of the stocks.

Trading options on eToro

eToro has an easy-to-use interface, meant to make options trading more accessible. For example, all options are generally cashed out at 3:30 PM on the day of expiration**. That means that if your option gained value, you’ll simply see the cash in your account after the day of expiration, rather than the shares.

This means that you’re not responsible for turning those shares around and selling them yourself — further streamlining your experience and minimizing missed opportunities.

Get started

Want more resources on options? Head over to the eToro Academy to get a more in-depth look at how options work and other strategies you can use. Or, head over to eToro to start exploring your options today.

*There are certain edge cases in which you may be exposed to greater loss than your initial investment. Although these instances are rare, they can occur.

**In rare instances, we’re unable to sell expiring positions at 3:30pm EST. In these instances, clients are responsible for losses due to assignment or expiry.

Options involve risk and are not suitable for all investors. Please review Characteristics and Risks of Standardized Options prior to engaging in options trading.