If you’re feeling blue about the stock market, it might seem that the best thing to do is walk away, wait for it to recover, and hope your stocks rebound. But what if there were actually assets you might want to consider investing in when you think the stock price is going to drop?

There’s more than one way to engage with the stock market, and depending on how you feel about the future, there are different assets that could — in theory — help you make a profit on your investment. We’ll discuss two of the many factors that you can use to decide what kind of stock-related asset is right for you.

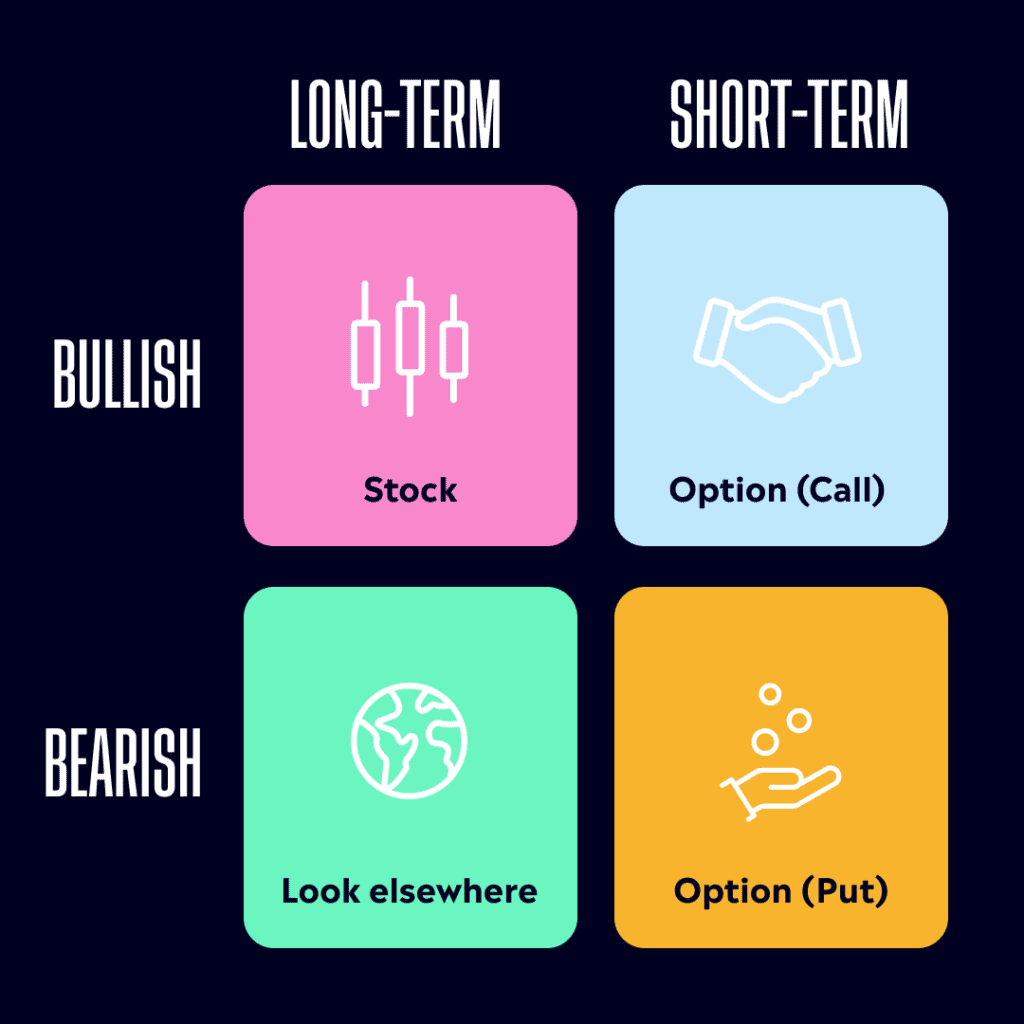

The first factor is whether you’re bullish (optimistic) or bearish (pessimistic) about a stock. Bullish means you think the stock is going to go up, bearish means you think it’s going to go down.

The second factor is your time frame: Are you picking investments based on your short-term or long-term feelings about the company?

By combining these two axes, you could get a better idea of what investments might be the most beneficial to your portfolio.

Bullish investors

Common knowledge says that if you’re bullish on a company, you might consider investing in its stock. However, that might not always be your best option.

For example, let’s pretend your favorite company is Toastr. You think that Toastr — a manufacturer of smart toasters — is a real up-and-comer, and that in 10-15 years, they’re going to build their way up from small, insignificant appliance maker to big-time tech giant. You’d be long-term bullish, and in that case, investing in Toastr stock might make sense for you.

However, let’s say Toastr is dropping its new SmartBread 3000 in three weeks, and you’re confident it’s going to take the world by storm — causing a big jump in its price within the next month. You could invest in stock, but instead, you might want to consider purchasing an option — specifically, a call option.

Why? By purchasing an option that expires in one month, you would have access to more potential gain. If you’re right, the SmartBread 3000 does take the world by storm and the stock price rises, you could make more profit (as a percentage of your initial investment) than if you had just bought the stock (see why here).

The downside? If you’re wrong, you lose the entirety of your initial investment* — though that investment is usually less than it would have been, had you bought the same amount of stock.

Bearish investors

Those sound like two great options for bulls. But what about bears?

Well, if you’re pessimistic in the short-term, and you think SmartBread 3000 is going to be a total failure that burns the stock to the ground… you still might want to buy an option. This time, however, you may want to look into buying a put option. Buying a put option would reserve your right to sell shares in the future, at the price you choose as your strike price. If the stock price drops, you have the potential to make a profit on the put option depending on the strike price you choose and how much the stock dropped. (For more details, check out this article).

And if it went up, you’d once again be limiting your loss to your initial investment (in most cases)*.

Of course, this is just for short-term bears. If you’re a long-term bear, and you think that the company as a whole is simply on the decline — well, you might want to find another company to invest in. You could always look into a competitor, or just another sector, entirely.

Not every investment is for everyone, and that’s okay. Just make sure you’re diversifying — in whatever way is best for you.

*There are certain edge cases in which you may be exposed to greater loss than your initial investment. Although these instances are rare, they can occur.

Options are complex products, involve risk and are not appropriate for all investors. You may lose all your invested capital. Please review Characteristics and Risks of Standardized Options prior to engaging in options trading.

eToro Options offers listed US equity options trading via eToro USA Securities Inc., which is registered with the Securities and Exchange Commission and a FINRA member. Visit our Disclosure Library for additional important disclosures including our Customer Relationship Summary and Privacy Policy. FINRA Brokercheck© 2023

eToro UK clients should review Terms and Conditions in respect of this service.

This communication is for information and education purposes only and should not be taken as investment advice, a personal recommendation, or an offer of, or solicitation to buy or sell, any financial instruments. This material has been prepared without taking into account any particular recipient’s investment objectives or financial situation, and has not been prepared in accordance with the legal and regulatory requirements to promote independent research. Any references to past or future performance of a financial instrument, index or a packaged investment product are not, and should not be taken as, a reliable indicator of future results. eToro makes no representation and assumes no liability as to the accuracy or completeness of the content of this publication.