Despite several cryptocurrencies showing a recovery to start the weekend, the peak was short-lived, as the majority of cryptos corrected to around the same levels with which they ended last week. Over the past week, news out of China continued to impact markets, while Bitcoin reclaimed some of its notoriety with a surprise announcement from Anonymous. This coming week, central bank chiefs may also impact markets, as they outline some of their future financial plans.

Today’s Highlights

- China Changes Tune

- Anonymous for Anonymity

- The Week Ahead

China’s Keeps Crypto in Focus

It seems that the overall attitude in China towards crypto has been shifting. After a severe crackdown on cryptos in the past, including a total ban on crypto mining, the authorities seem to be gearing up for a change. Last Tuesday, Chinese state media newspaper Xinhua News published a front-page article on Bitcoin. Coupled with President Xi’s recent comments on taking advantage of blockchain, and reports that China’s digital currency will permit anonymous transactions, it seems more likely that the official government policy towards cryptocurrencies will soon be very different.

Anonymous for Anonymity

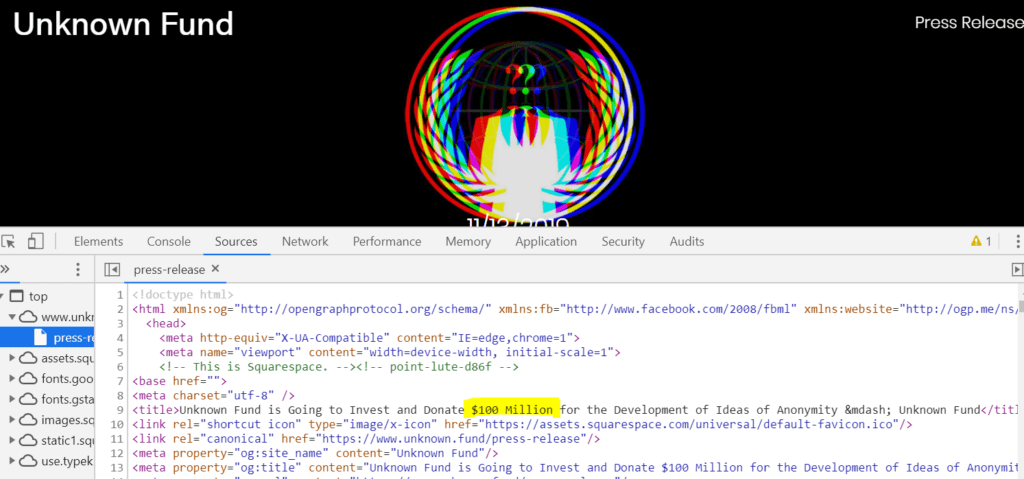

After staying relatively below the radar recently, international faceless hacker organization Anonymous has resurfaced, this time pointing a finger at major corporations and big banks. On Wednesday, the Guy-Fawkes-mask-yielding organization pledged $75 million in Bitcoin to fight against what they describe as corporations using users’ data against them. However, some diligent readers took a look at the source code and it seems that the original pledge was higher:

Apparently, they changed the sum last-minute. According to their press release, the Unknown Fund will invest in startups that promote anonymity. It is no surprise, then, that the organization decided to use crypto for their investment.

The Week Ahead

The coming week could prove to be volatile for international markets, as central banks take center stage. If in the past, mainstream banking was the exact opposite of the crypto market, the two are increasingly becoming more intertwined. This will most likely manifest itself on Friday, when new ECB President Christine Lagarde will speak at the European Banking Congress, in Frankfurt. Lagarde is a long-term advocate of crypto and could talk of her plans for the future of digital currencies in Europe. Earlier in the week, minutes from the latest FOMC meeting will be released on Wednesday, impacting mainstream markets, currencies and perhaps crypto, and on Thursday, Bank of Canada Governor Stephen Poloz will be talking about the future of the economy, so there’s a good chance he will also discuss crypto or blockchain.

eToro USA LLC; Virtual currencies are highly volatile. Your capital is at risk.